Florida has second highest resetting home equity lines of credit, RealtyTrac

Florida had the second highest number of resetting HELOCs over the next four years, with 513,229. Seriously underwater homes, those with a combined balance of all outstanding loans secured by the property of 125 percent or more of the property’s estimated market value as of December, backed 71 percent of the resetting HELOCs over the next four years in Florida, according to the report.

“Low rates, rising prices and an improving economy have taken the steam out of the HELOC reset pressure cooker,” Mike Pappas, CEO and president of the Keyes Company, said in a statement. “In 2014, 1 percent of our South Florida housing stock saw their HELOCs begin to amortize and paid — on average — a $162 per month increase in their monthly payments. Over the next four years 7 percent of our property owners will see a similar increase, and as long as interest rates stay low and we continue to experience rising prices there should be no major impact on the market.”

The report also found that 56 percent of the 3.3 million home equity lines of credit in the U.S. are on properties that are seriously underwater. Nevada had the highest percentage of HELOC resets over the next four years on homes that are still seriously underwater with 84 percent, followed by Arizona, Florida and Illinois.

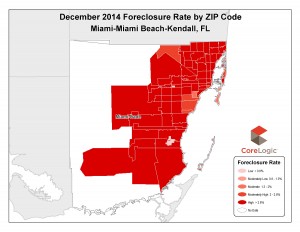

Miami-Dade foreclosure rates

Foreclosure rates in Miami-Dade are down, CoreLogic

Foreclosure rates in Miami-Miami Beach-Kendall in December saw a decrease from December of 2013. The foreclosure rate among outstanding mortgage loans was 4.62 percent for December, a decrease of 4.24 percentage points compared to December of 2013 when the rate was 8.86 percent. Foreclosure activity in the area was higher than the national foreclosure rate, which was 1.47 percent for December.

The mortgage delinquency rate decreased in Miami-Dade — more than 10 percent of mortgage loans were 90 days or more delinquent compared to 15.05 percent for the same period last year.