Knowledge is power in real estate, especially when brokerages and research firms are pointing toward a slowdown. Check out a roundup of the latest market analyses, compiled and explained by The Real Deal.

Three Brickell City Centre

Office Market

Miami and Palm Beach saw some of the country’s highest absorption rates during the first quarter, according to a new report from brokerage Cushman & Wakefield. On top of that, the two cities also saw higher rent growth than almost anywhere else in the nation.

In Miami, a total of 907,000 square feet of office space was absorbed during the first three months of 2016. That puts it in the No. 3 spot for absorption during the first quarter, behind Dallas, Texas, with 2.2 million square feet and Denver, Colorado with 909,000 square feet.

Palm Beach slipped in at the No. 10 spot for absorption with 518,000 square feet, behind Austin, Texas, with 581,000 square feet.

As for rent growth, Miami’s asking price per square foot spiked by 11.8 percent year-over-year. Landlords were asking $35.92 per square foot annually last quarter, up from $32.13 per foot last year.

Palm Beach also saw big growth with an 11.7 percent price hike year-over-year, up to $31.42 per foot from $28.12.

San Jose, California, took the top spot last quarter with a massive 22.1 percent growth in rents year-over-year, followed by Dallas, Texas, with 17.5 percent and San Mateo County in California with 16.5 percent. Miami and Palm Beach landed in the No. 6 and No. 7 slots, respectively.

Multifamily Market

South Florida’s multifamily market was hot last year, with more than $1.2 billion worth of properties trading hands between developers and investors.

In Miami-Dade County, developers are trying to meet that demand in core markets like the downtown area with 6,310 rental units planned to open this year, according to a first quarter report from brokerage Marcus & Millichap.

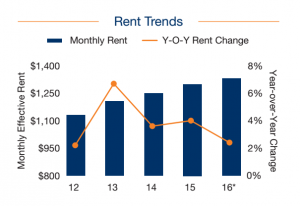

Vacancies fell to a mere 2.4 percent last year, down 0.7 percent from the year before, all while rents grew 4 percent to an average of $1,300 per month year-over-year.

The large influx of new supply set to open this year will likely raise vacancies in Miami-Dade, according to the report, though rents are likely to maintain a steady growth because of increasing employment and population.

As for investment activity, buyers paid an average of $189,277 per rental unit last year, a growth of 13.2 percent year-over-year. On the other hand, cap rates, a widely used metric to measure the worthiness of an investment, fell 0.5 percent to an average of 5.8 percent last year.