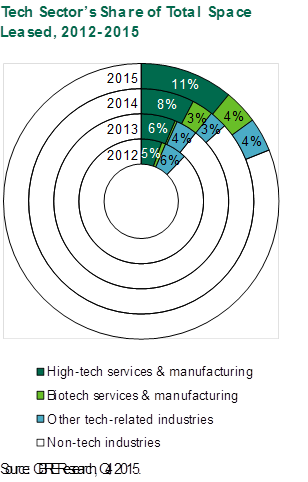

Technology firms have doubled their South Florida footprint from 2013 to 2015, according to a new report released by CBRE.

Via CBRE

The tech sector accounted for nearly 848,500 square feet in new office leases in 2015, an increase of more than 83 percent from 2014 and more than double the space leased in 2013.

Last year, 3-D software developer Magic Leap signed a lease for 259,737 square feet at the former Motorola Mobility headquarters. And the deal, which marks the biggest lease for the tech sector, is reportedly valued at $542 million.

Even without Magic Leap, office space absorbed by tech firms would have increased by 27 percent year-over-year and by 42 percent compared to 2013, according to the report.

In July, Uber signed a lease for 9,333 square feet at Brickell City Tower for its new Miami headquarters.

Quinn Eddins, the report’s author and CBRE’s director of research and analysis, told The Real Deal that the region’s ability to attract a multilingual talent pool and the ability to code is a “powerful combination.” As tech companies in the U.S. chose South Florida over other cities, Latin American firms are targeting Miami as their home base.

“The biotech industry is one of the fastest growing in South America,” Eddins said.

The biotech sector is leading growth in tech office leasing, Eddins said, citing an aging and growing population, which creates a growing demand for health care services. Firms leasing space include those that help connect patients with doctors and companies that create and manufacture medicines in South Florida.

Biotech companies absorbed 181,000 square feet of office space in 2015, an increase of nearly 12 times from the 15,400 square feet in 2013, according to the report. In 2013, biotech firms leased 1 percent of all office space across sectors; in 2015, it was 4 percent.

MDLive, a a Sunrise telehealth company in Sunrise, inked a $50 million in 2015. Electronic medical records software firm Modernizing Medicine is another example, making a $38 million investment in Boca Raton.

The proliferation of the shared workspace has also affected the tech footprint in South Florida. WeWork, for example, leased 40,000 square feet at 350 Lincoln Road. The co-working giant will also open in downtown Miami. Pipeline and Büro, other shared office companies, have also expanded in South Florida. Shared office spaces cater to startups and creative-oriented firms.

Airbnb, for example, is a member of Büro’s Midtown Miami outpost.

A trend to watch is technology companies increasing the amount of space they sublet, as well as fewer new entrants to the market, Eddins said. Unless there’s a chilling in the U.S. tech industry, “I don’t think you’ll see a downsize in footprint,” he told TRD.