The once-fervent pace of sales that catapulted Miami to the forefront of the U.S. luxury housing market is now but a memory.

As of this year’s third quarter, sales volume in both mainland Miami and its barrier islands continued to grind downward, according to a newly released market report from Douglas Elliman.

And while prices continue to rise in spite of the slowdown on the mainland, the same can no longer be said of Miami Beach.

Miller Samuel President Jonathan Miller, the analyst whose firm prepared the reports on behalf of Elliman, told The Real Deal that Miami’s barrier islands were the weakest housing markets among the five he examined in South Florida.

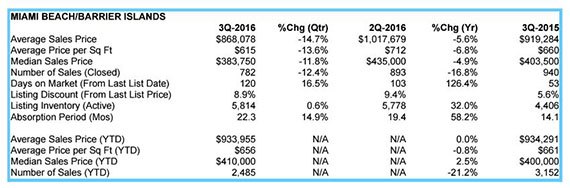

The report shows 782 homes and condos were sold from Sunny Isles Beach to Fisher Island in the third quarter. That volume has fallen nearly 17 percent compared to the 940 properties that sold during the same quarter last year.

In previous quarters, condos had primarily been the cause of the barrier islands’ slowing sales pace. But both unit sales and single-family homes saw significant reductions in sales for the third quarter. Condo trades fell 15 percent from 834 units to 705, while single-family home deals plummeted 27 percent from 106 properties to 77. A strong U.S. dollar and economic turmoil in Miami’s major feeder markets from Latin America, like Brazil and Venezuela, are often cited by market watchers as the primary factors behind the slowdown.

As a result, median sales prices for the barrier islands market, overall, dipped nearly 5 percent year-over-year to $383,750. Individually, the median sales price of a condo on the beach fell 2.7 percent to $355,000 per unit, while single-family home prices actually spiked upward by 22.6 percent, reaching $1.75 million in the third quarter. Condos have a greater weight on the overall market results: 705 sold in the third quarter compared to 77 single-family home sales.

Miller said much of Miami Beach market’s softness — as well as the mainland’s, to an extent — is in the luxury sector. He said much of the new development this cycle has been skewed toward high-end condos, leading to a greatly expanded inventory.

“It’s not that there’s no demand for it,” he said. “It’s just that the demand does not match up with the supply, so we have a slowdown in sales activity.”

Another reason that Miami Beach is seeing a decline in pricing is because its inventory of distressed properties, which typically trade for lower prices, has been all but depleted. As lender-owned properties and short sales cleared the market in previous quarters, their absence helped buoy Miami Beach’s prices. But now that the number of those properties selling has dropped significantly — 44 distressed homes and condos sold in Q3, down 35 percent — Miller said the median sales price is much more reflective of the market.

The product that’s still moving: one- and two-bedroom condos, which traded for between $265,000 and $455,000. The report states both of those subsections’ saw their share of sales explode by roughly 40 percent, which Miller said is a sign that there’s still plenty of activity on the entry- to mid-level portion of the market.

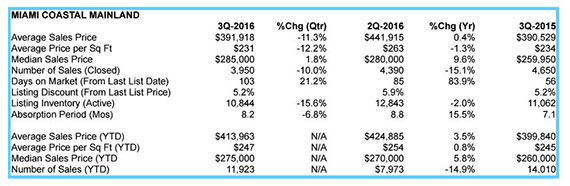

That continued demand for more modestly priced condos is one the reasons prices are still rising on the mainland, defined as neighborhoods east of I-95, Miller said. His report shows the median sales price for a home or condo rose 9.6 percent year-over-year to $285,000. Even with near double-digit jumps in pricing, the median cost for a home on the mainland is still almost $100,000 below what’s selling in Miami Beach.

Sales, however, are still down significantly on the mainland. The overall market saw 3,950 condos and homes trade in the third quarter, marking a 15 percent decrease in volume compared to 2015’s third quarter.

Much like the beach, Miller said, the softness is blamed on the luxury sector. Unlike the beach, however, mainland Miami has a big thing going for it: absorption is holding steady.

The mainland’s major neighborhoods had 10,844 active listings in the third quarter, marking a rise in inventory of only 2 percent. Its rate of absorption means the market would take 8.2 months to chew through those listings at its current pace of sales. Though housing markets vary greatly, the general rule of thumb is that six months of inventory is considered balanced.

Comparatively, Miami Beach’s supply buildup is much more exaggerated. The Elliman report states 5,814 properties were for sale in the third quarter, equating to 22.3 months of supply for the barrier islands — a 14 percent jump year-over-year.

But Miller said just because the market’s condition now doesn’t compare favorable to 2013 and 2014 doesn’t mean Miami and its barrier islands are approaching another bust. The majority of home sales are cash purchases, he said, meaning Miami is in a substantially different position than in 2008, when a swath of the housing market lost its equity and ended up in foreclosure. On top of that, developers have begun canceling or pausing a number of luxury residential projects in the face of slower sales, which could give the market much-needed breathing room to absorb the existing supply.

“When you move away from the luxury market, [Miami] is in pretty good shape,” he said. “We’re just resetting from a euphoric mini housing boom.”