Miami tops the list of non-married co-borrowers taking out new residential real estate loans in the first quarter of this year, a new report shows.

Non-married co-borrowers accounted for 40.2 percent of single-family residential real estate loans in the first quarter of 2017, according to the U.S. Residential Property Loan Origination Report by ATTOM Data Solutions. Miami had the highest share of non-married borrowers among 35 cities, followed by Seattle at 37.4 percent, San Diego at 28.9 percent, Los Angeles at 28.2 percent and Portland at 27.7 percent.

Overall, non-married co-borrowers accounted for nearly 22 percent of new single-family purchase loans based on the data collected and analyzed by ATTOM.

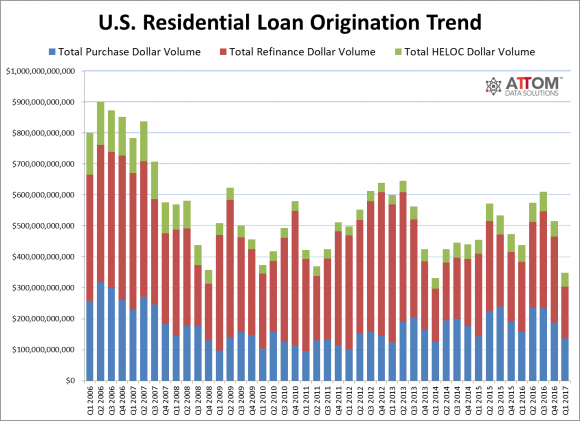

For the United States overall, purchase origination loans were down 30 percent from the previous quarter and down 21 percent from a year ago, amid rising mortgage rates. Only about 1.4 million loans were originated on residential properties in the first quarter, and the total dollar volume of loan originations also dropped by 21 percent year-over-year, hitting a three-year low of $348 billion.

“Despite the sharp drop in purchase originations, there were some encouraging signs in the data that a larger share of first-time homebuyers participated in the housing market in the first quarter: the share of FHA buyers increased from the previous quarter after two consecutive quarters down, and the median down payment decreased following three consecutive quarters of increases,” said Daren Blomquist, senior vice president at ATTOM Data Solutions, in a statement.

Refinanced loans also hit a rocky ten-year low.

“Rising mortgage rates made qualifying for a home purchase more difficult and refinancing an existing home loan less attractive in the first quarter,” Blomquist said.