Just one week after Hurricane Irma’s rampage through Florida, storm-related insurance claims filed already reach an estimated $2 billion in losses, according to Florida’s Office of Insurance Regulation.

Insurance claims filed

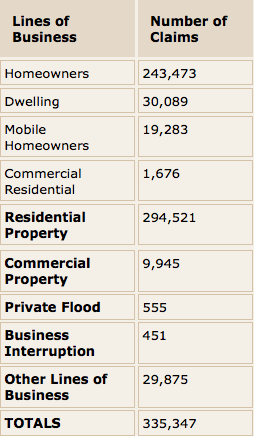

A total of 335,347 claims have been filed through Sunday. That figure includes 243,473 claims from homeowners, as well as 19,283 from mobile homeowners.

Commercial property owners have filed 9,945 claims. Another 555 claims are related to private flood insurance and 451 claims are tied to business interruption, according to insurance regulators.

In the wake of Hurricane Irma, Gov. Rick Scott signed an emergency order that will give homeowners more time to update their insurance policies. The order provides homeowner’s insurance policy holders an additional 90 days to supply required information to their insurance companies and file claims.

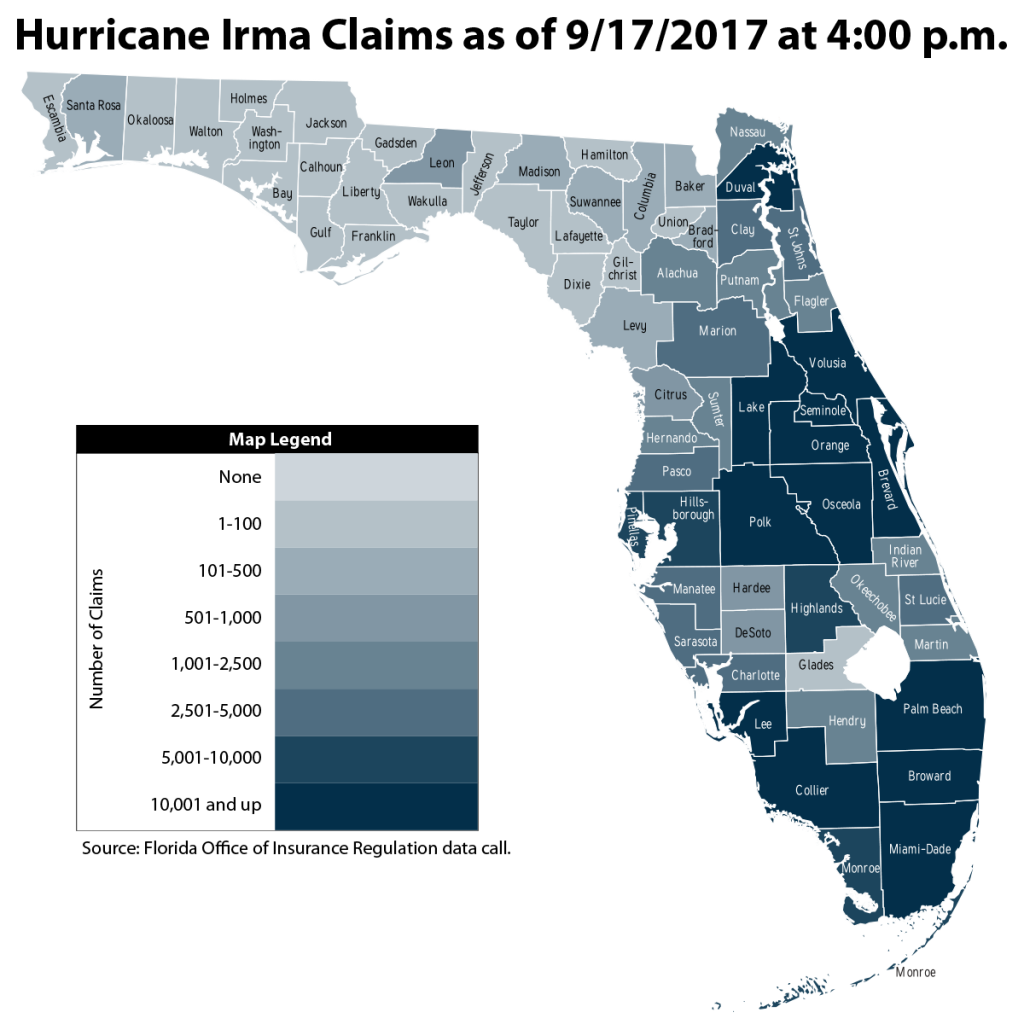

Hurricane Irma claims filed

Hurricane Irma may have caused up to $40 billion worth of insured industry losses in the United States, according to an estimate from catastrophe modeling firm AIR Worldwide.

Losses will likely range from $20 to $40 billion, and the firm estimated that exposure value in counties running along the Gulf Coast up to Tampa would reach $1 trillion.

AIR’s estimates for insurance losses include damages from wind and storm surges to automobiles, onshore industrial, commercial and residential properties, and factors such as an interruption of business for commercial properties and added living expenses for residential properties. The estimates do not include losses to uninsured properties, infrastructure, pleasure boats, or losses that would be paid out by the National Flood Insurance Program.

Some of the most impacted areas in Florida were in the Keys. About 25 percent of homes in the Florida Keys were destroyed after Hurricane Irma barreled through the islands, according to estimates by the Federal Emergency Management Agency.

Irma also caused about $40 billion of CMBS debt, $6.41 billion of which was in Miami, according to an analysis from Morningstar Credit Ratings.