Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 5:30 p.m.

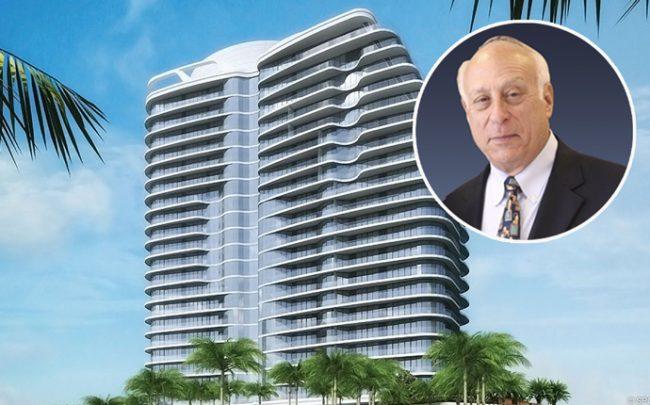

James Harpel and The Bristol in West Palm Beach

Edgewater developer snagged a condo at The Bristol in West Palm Beach. James Harpel, who is a partner at Eastview Development, bought unit 1204 at the luxury condo development at 1100 South Flagler Street from the development group. [TRD]

Jeffrey Soffer taps ex-Turnberry CEO to lead resi division at his new company. In March, brother and sister duo Jeffrey and Jackie Soffer officially split up their interests in Turnberry Associates. Jeffrey left to launch Fontainebleau Development, and has hired Bruce Weiner, a man he once sued. [TRD]

South Florida Logistics Center

JPMorgan buys an Amazon-leased warehouse next to Miami International Airport. Fueled by growth in the e-commerce sector, South Florida’s industrial market isn’t showing signs of slowing down. And when Amazon is the tenant, it’s a seller’s market for a company looking to unload that property. [TRD]

Brookfield, RXR are among major companies urging action on gun violence. Some of the country’s biggest landlords and developers have thrust themselves into perhaps the most contentious national debate: gun control. [TRD]

PMG and Greybrook land $162M loan for a downtown Miami co-living tower. Kevin Maloney’s Property Markets Group and Greybrook Realty Partners closed on a $161.5 million loan for a rental tower it’s planning in downtown Miami. [TRD]

Babylon Apartments and Francisco Martinez-Celeiro (Credit: Google Maps and Wikipedia)

Showdown in Miami? A former Spaghetti Western star has lost his final battle with the Miami City Commission. The commission did not override Mayor Francis Suarez’s veto. The veto prevents developer Francisco Martinez-Celeiro from securing the rezoning of the former Babylon Apartments to allow for a 24-story residential building. [TRD]

Forever 21 may be winding down, but Old Navy is only getting bigger. Fashion retailer Old Navy said it planned to open 800 new stores over an unspecified period as it prepares to split with Gap, its parent company. Old Navy has been outperforming its sister companies, Gap and Banana Republic. [WSJ]

Blackstone says it has closed a $20 billion fund — the largest in real estate history. The company surpassed its own record of $15.8 billion, which it set in 2015. Blackstone has earned itself a reputation for bringing in double-digit returns on its “opportunistic” funds. [WSJ]

President Trump wants to the Fed slash interest rates below zero. He tweeted Wednesday that the Fed should slash interest rates to zero or below, raising questions about how negative rates would work, and what they would do for the economy. [NYT]

Miami Beach claims over 7 percent of its stores are vacant. With about 7.4 percent of the city’s commercial spaces vacant, the city will seek to beautify buildings with empty shops. A July survey found 117 empty storefronts in Miami Beach. In the second quarter of this year, the city’s retail vacancy rate rose slightly by 1.7 percent year over year. [Miami Herald]

Greg Pinkalla and ORA Flagler Village Apartments (Credit: Google Maps)

Fairfield Residential sells new Flagler Village apartments for $92M. Amid a growing influx of high-end apartments in Fort Lauderdale, a company tied to a former Silicon Valley executive bought a new 292-unit apartment complex in Flagler Village for $92 million, or about $315,000 per unit. [TRD]

Orlando Padron picks up Regency hotel near the airport. A company tied to the Miami investor has acquired a 3.8-acre hotel property near Miami International Airport and David Beckham’s planned soccer and retail complex. OPB Capital Group Fund 1 LLC paid $25.8 million for the Regency Miami Hotel at 1000 Northwest 42nd Avenue. [TRD]

Compiled by Keith Larsen