Trending

Former Miami mayor Maurice Ferré dies, banks seek to revise Adam Neumann’s credit line: Daily digest

A daily roundup of South Florida real estate news, deals and more for September 19, 2019

Every day, The Real Deal rounds up South Florida’s biggest real estate news, from breaking news and scoops to announcements and deals. We update this page throughout the day. Please send any tips or deals to tips@therealdeal.com

This page was last updated at 5:00 p.m.

Maurice A. Ferré, former mayor and “father of modern-day Miami,” died at the age of 84. Ferré, who was mayor from 1973 to 1985, led the transformation of high-rise development along Brickell Avenue. [Miami Herald]

Banks seek to revise Adam Neumann’s $500 million credit line. Following a cool reception from investors over his company’s valuation, lenders are looking to revise the terms of the WeWork CEO’s credit line — of which he’s drawn $380 million. The exact changes to the credit line were not immediately apparent. [Bloomberg]

Jon Paul Pérez, Jorge Pérez and the downtown Miami skyline (Credit: iStock)

Miami’s biggest condo developer is going micro. The Related Group is planning to build micro condos on a downtown Miami site it recently closed on. The Miami-based developer is planning to build a roughly 400-foot tower with about 350 units, Jon Paul Pérez, a vice president at the firm, said. [TRD]

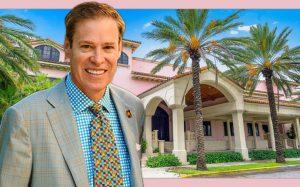

Robert Matthews and Palm House Hotel

The developer behind a Palm Beach condo-hotel project that once promised foreign investors that Celine Dion, Donald Trump and Bill Clinton would be on the advisory board has consented to federal securities charges. Robert Matthews agreed to charges brought by the Securities and Exchange Commission that he defrauded EB-5 investors of his Palm House Hotel project and used the money to pay off personal loans and to purchase a luxury home in Washington Depot, Connecticut. [TRD]

Airbnb’s war with NYC deepens as it heads toward an IPO. The startup’s aggressive tactics have backfired in New York as the city continues to wage a muscular crackdown on illegal operations. [Bloomberg]

Profits on home flips are declining. Buyers flipped 59,876 single-family homes and condos in the second quarter, down from 5 percent a year ago. Profits decreased as well, with the average return on investment hitting 39.9 percent last quarter, down from 44.4 percent. [CNBC]

A tax hike in Fort Lauderdale will bring in an extra $10.3 million in property taxes to the city. On Tuesday, the Fort Lauderdale commission approved next year’s tax rate and a nearly $373 million general fund, according to the Sun Sentinel. Homeowners will pay an additional $22.50 per $100,000 in assessed value for the fiscal year that begins Oct. 1. [Sun Sentinel]

Miami firm buys 224-unit apartment complex in Pensacola for $25.3 million. PIA Residential closed on the Crystal Lake Apartments, a 24-acre Class B community that is 98 percent occupied. The deal marks PIA Residential’s first multifamily purchase since it transitioned from single-family home rentals. Cushman & Wakefield brokered the deal.

JQ Group topped off construction of Quint Collection Hollywood, a luxury condo building in Hollywood. The 57-foot, five-story development will have 10 units starting at $2.9 million, and a private marina. Units, ranging from 4,650 square feet to 5,137 square feet, will include at least one boat slip, and terraces with outdoor kitchens and hot tubs.

A mixed-use development in Pompano Beach’s Old Town District is the first to secure financing under the city’s CRA program. Old Town Square, a 10-story, 282-apartment project being developed by Cavache Properties, was approved to receive a $7.8 million tax financing incentive. The $63 million project will be built on nearly 2 acres of land on the east side of Northeast First Avenue, between Northeast Second and Third streets. [TRD]

Compiled by Katherine Kallergis