Trending

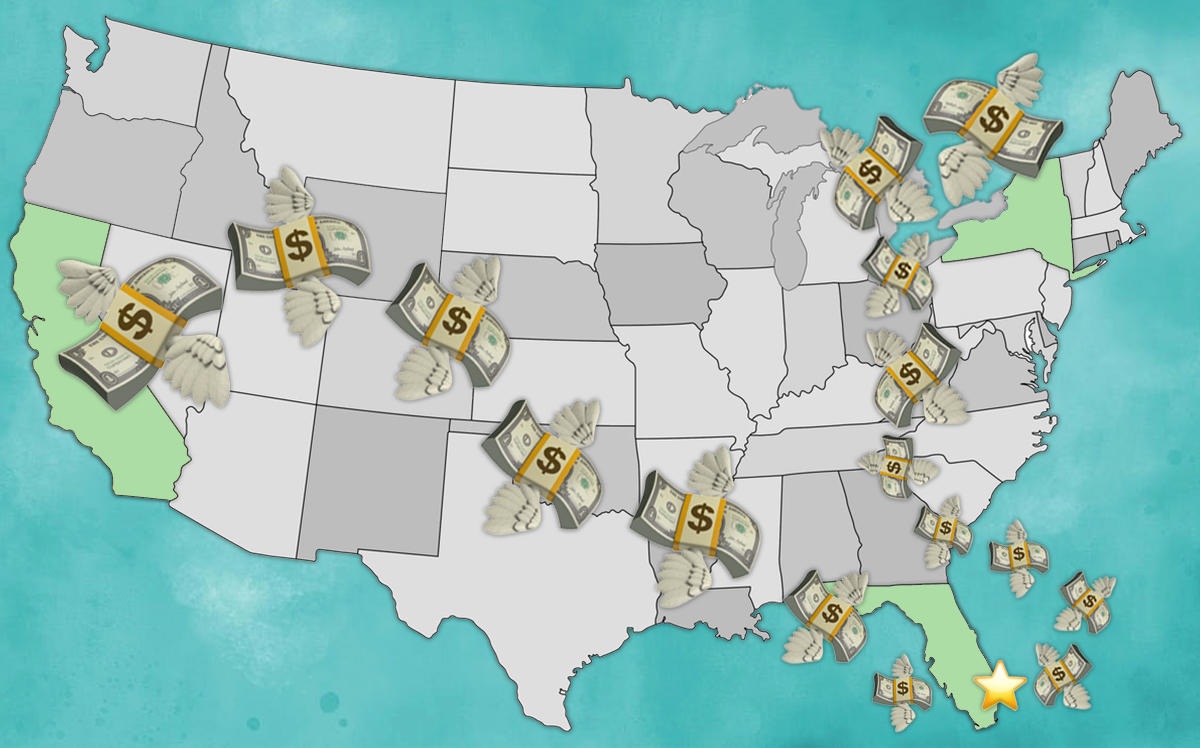

Rent reform in New York, California propels new wave of multifamily investors to Miami

Brokers are reporting a sharp rise in inquiries and offers from NY, CA investors

First, it was tax reform that pushed CEOs, hedge fund managers and other high-net-worth individuals to South Florida. They were lured in by the favorable climate, luxury residential properties and most of all, substantial tax savings.

Now, it is the multifamily investors who are heading to South Florida, and for a different reason: rent control, something the Sunshine State lacks.

In June, New York state passed a sweeping rent reform law, expanding its protections for millions of rent stabilized tenants. The law dramatically limits how landlords can increase rents on stabilized apartments and opens the door for rent stabilization to expand outside of New York City. It stopped short of a rent cap, but that is expected to be on the table in some form in the next legislative session.

In Illinois, although rent control advocates lost a legislative battle earlier this year, they’re gearing up for a push to overturn the statewide ban on rent control in Springfield next year. And California is now poised to implement a statewide cap on annual rent increases.

Multifamily investors are moving quickly and making offers on properties in South Florida, brokers say. But they are also encountering a strong rental market and low supply, which have pushed up prices.

Eleventrust, a commercial brokerage in Miami, is working with investors from New York and Los Angeles who are looking to shift their focus to Florida because of the impact the new laws will have on their current investments.

Jose Ramos, a broker with Eleventrust, said at least 40 percent of the calls it’s getting have been from New York investors who want to close on properties in South Florida. “There’s a lot of confusion, a lot of focus on getting their money out of there and getting it into high-yield markets,” he said.

The brokerage is negotiating with two groups of investors to acquire apartment properties, via 1031 exchanges. One is for the River Lofts Apartments, a 43-unit complex at 500 to 522 Northeast 78th Street in Miami’s Upper East Side neighborhood, which hit the market with Ramos and Rafael Fermoselle, Eleventrust’s managing partner, earlier this year. It’s on the market for about $7.8 million.

Ramos and Fermoselle are showing investors properties in gentrifying markets like Little River, Little Havana and Allapattah. “The thing with Miami-Dade specifically is there’s not a lot of product that’s big enough,” Fermoselle said.

The investors they’re dealing with are looking for deals in the $5 million to $30 million range.

Deme Mekras, managing partner of MSP Group, has also received offers from New York buyers who plan to invest in South Florida multifamily properties because of the recent rent reform measures. New Yorkers especially, are more comfortable with properties in the urban cores, he said.

Rent reform is also becoming a national issue, as more than a third of Americans are considered rent-burdened. The problem is worse in South Florida, according to a report from Freddie Mac earlier this year, which found that Miami ranked as the most rent-burdened market in the U.S.

Vermont Sen. Bernie Sanders, a self-described Democratic socialist, is proposing a $2.5 trillion housing plan that would cap annual rent increases at 3 percent or one and a half times the consumer price index, whichever is higher.

Searching for yield

Multifamily investors from out of state would prefer to spend their money on one large deal but are challenged by a lack of supply, brokers said. They’re non-institutional players, looking to spend in the range of $30 million and $40 million.

But because South Florida’s rental market has remained strong, some sellers aren’t willing to part with their property. And if they are, the prices are too high. Rents have increased by 15 to 20 percent over the last eight years, according to Hernando Perez, director of multifamily investment sales for residential brokerage Franklin Street. More people are also moving to Florida, in part because of the favorable tax climate.

“There are not a lot of deals that make sense and not a lot of deals to buy,” he said.

Perez said he is seeing a number of California buyers looking to use the proceeds of 1031 exchanges to buy in South Florida. They cited the pending statewide rent control legislation, known as AB 1482, as a reason. Perez said he is working with a group that wants to spend $10 million for a multifamily building. The group, which Perez declined to identify, is looking at properties in Hallandale Beach, Fort Lauderdale and Pompano Beach.

And what if Florida was to enact similar statewide rent regulations? Simple, Perez said.

“It would crush the profitability of the real estate market.”