UPDATED, May 6, 12:30 p.m.: After a rush of high-end residential sales to start 2019, the pace of those so-called “tax refugees” moving to South Florida has slowed but it’s not going away.

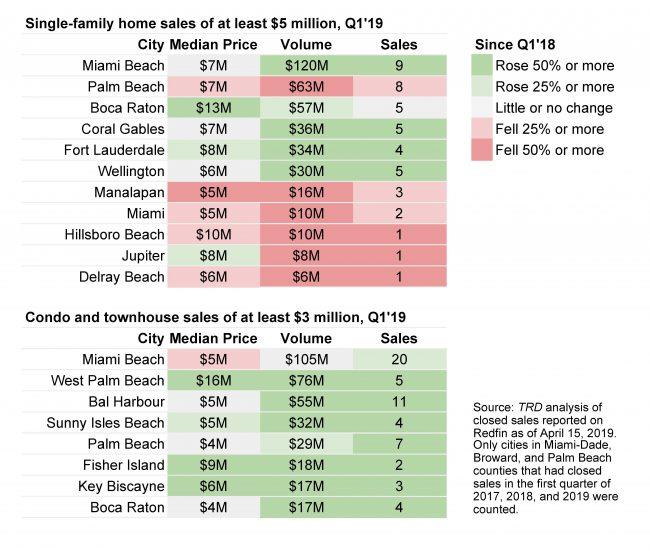

In Miami Beach in particular, nine single-family homes sold for a combined $120 million in the first quarter, according to The Real Deal’s analysis of multiple listings service data. The data tracked all sales on homes $5 million and up. That’s a sharp increase from the five homes that sold last year at the same price point last year from January through March.

While the greater housing market has experienced a nationwide slowdown, the appetite for luxury homes in Miami Beach has surged. Sellers and brokers attribute that in large part to the December 2017 federal tax overhaul, which limited the ability of taxpayers to deduct state and local taxes — dubbed SALT — from their income in 2018.

For ultra-wealthy residents in high-tax states like California, New York, New Jersey, Connecticut and Illinois, the savings from living in a state like Florida that doesn’t have a personal income tax could be enough to buy a luxury home in Miami.

Developers and brokers are also seizing the moment, going to potential buyers in their state in order to more effectively market those Miami homes.

“The amount of showings has slowed down a little bit but that’s not the reason why they’re coming,” said Nelson Gonzalez, a top broker at EWM Realty International who focuses in Miami Beach. “The first quarter was on fire from the top, top, top down. A lot of the cream of the crop homes either sold or are under contract.”

And the wave of tax-motivated buyers isn’t limited to single-family homes. Recent condo sales include the $11.3 million deal for an Apogee unit in South Beach, which went to a trust tied to Chicago’s Crown family.

Sales volume of luxury condos — priced at $3 million and up — increased in all of the markets TRD analyzed, including Miami Beach, Fisher Island, Sunny Isles Beach, Bal Harbour, Key Biscayne, West Palm Beach, Palm Beach and Boca Raton.

But to make a dent in the inventory of luxury homes, it will take more than just CEOs and other top executives buying multimillion-dollar properties in Miami Beach. With the exception of Miami Beach, Coral Gables, Fort Lauderdale, Wellington and Boca Raton, the $5 million-and-up single-family home sales market posted declines in the first quarter of this year, dropping in Manalapan, Miami, Hillsboro Beach, Jupiter and Delray Beach.

“You need the whole [market] to move, not just the very top,” Luxe Living Realty broker Dora Puig said. This year “is the first year got hit with the taxes. Everyone is paying them right now,” she said. “I think that will be the impetus for the next wave. Then they’re going to bring their team and offices and assistants and staff.”

Now, New York City’s elite-level buyers may have more reason to take another look at Miami.

Despite dodging the proposed pied-à-terre tax on luxury homes that was abandoned last month, the city’s ultra-wealthy may still need to pay up. They are facing a new mansion tax — which replaced the pied-à-terre tax — that starts at 1.25 percent on sales of homes $2 million to $3 million. It tops out at 3.9 percent for sales above $25 million.

Agents South Florida could again benefit from the newest tax.

Miami Beach agents Bill Hernandez and Bryan Sereny of Douglas Elliman said they are getting more inquiries from clients in the Northeast. Those numbers have steadily risen since the tax overhaul a year and a half ago, the highest in their 16 years selling Miami real estate, Hernandez and Sereny said. The “pied-à-terre scare,” as Hernandez called it, and the new mansion tax has only heightened buyer interest.

“We’ve had numerous conversations with our clients who feel like they’re not being treated fairly,” he said. “We [were] already a big New York City, New Jersey, Connecticut destination.”

The properties that are selling are newly-built waterfront homes that come with all the trappings of luxury, including ultra high-end finishes, custom door handles, infinity pools and floor-to-ceiling glass doors that span the entire length of a wall, easily hidden to open up a property to the outdoors. Some are designed by starchitects.

Three of the higher-priced mansions in Miami Beach that sold in the first quarter — all of them spec homes — included the $17 million sale of a mansion at 6010 North Bay Road. That sold to Howard Lerman, founder and CEO of Yext technology company. Another sale of a home at 73 Palm Avenue went for $24.5 million to a Memphis, Tennessee, buyer.

Jamie LeFrak, vice chairman and managing director of LeFrak, also went under contract to buy a mansion at 4567 Pine Tree Drive in February, and closed on the property for $19.6 million in April.

Buy the home, bring the staff

At the very top, 3 Indian Creek Island Road, a mansion that previously set the record for the most-expensive single-family home in Miami-Dade County, broke its own record in January when it sold for nearly $50 million. That property was purchased by a foreign entity, but the majority of the top sales have been to out-of-state buyers.

“[We’re] chasing a very affluent niche of the market,” Puig said about working with tax-incentivized buyers. “Those are the guys at the top moving down here for tax purposes…They’ll come down, buy the home and then bring staff and lower tier executives.”

Among the top single-family home sales in Miami Beach is the $7.25 million purchase of a waterfront home at 6431 Allison Road. James Curnin, a member of the famed Jack Parker real estate family, bought the property and is planning to build two spec homes — geared toward Northeastern buyers. Curnin said he was attracted to Miami because of the tax benefits and is moving his company, Clara Homes, from New York to Miami.

Julian Johnston, who represented the buyer of 3465 Meridian Avenue in Miami Beach, a businessman from Chicago, said his client was relocating to Florida because of the favorable tax environment. The five-bedroom, nearly 6,400-square-foot home sold for $6 million in February.

Agents, brokerages and developers have been zeroing in on wealthy buyers in high-tax markets. To try and offload an oversupply of luxury product in markets like Sunny Isles Beach and Brickell, they have paid for targeted advertising and mailers, and hosted events in those states.

Some developers are even registering their projects to market them in New York, like Jim Carr and Armando Codina, who are now registered to sell Canarias at Downtown Doral, a single-family home and townhouse community, in New York and New Jersey.

Kevin Leonard, vice president of luxury at the Keyes Company, said the firm is marketing to specific ZIP codes in high-tax states to attract buyers.

Buy the house, bring the business

But there are signs the ultra wealthy may also be migrating their businesses.

Late last year, an heir to the Gap family fortune closed on a 15.5-acre site in Miami’s Little Haiti neighborhood for $60 million, where he’s expected to open a top New York-based private school, The Avenues: The World School.

I Squared Capital, a $12 billion private equity firm announced last year it was planning to move its headquarters from New York to Miami, in part to benefit from the lack of state income tax and low property taxes.

Barry Sternlicht relocated and brought his Starwood Capital Group with him, and is now building a new headquarters for the firm in Miami Beach. Michael Stern of JDS Development Group also purchased a home.

“Look at the names coming down here,” Hernandez said. “They’re moving here. We’re taking hundreds of millions of dollars in tax revenue from those states.”