The third quarter of 2020 was another slow one for commercial real estate lending, with the pace of commercial loan closings down 28 percent from Q2 and down 39 percent year-over-year according to CBRE’s Lending Momentum Index, which reached its lowest level since 2014.

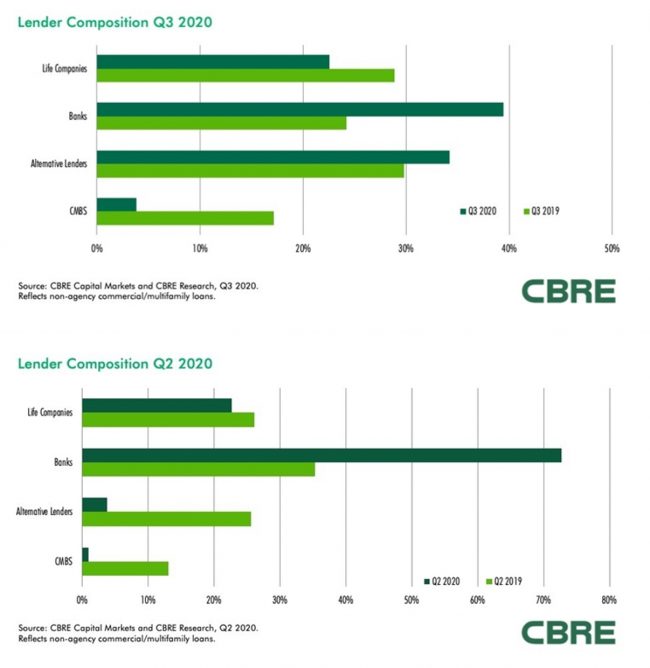

At the same time, the distribution of lender types shifted drastically. Banks accounted for 72 percent of loan originations in the second quarter, then just 39 percent in the third. Alternative lenders saw the biggest gain in market share, jumping from a dismal 3 percent to about 34 percent between quarters.

“One promising sign has been the re-emergence of quotes from alternative lenders in recent weeks, a source of capital for value-add properties and distressed situations,” CBRE’s global president of debt and structured finance for capital markets, Brian Stoffers, said in a press release.

Most recent bank lending has come from smaller local and regional banks and credit unions, CBRE’s report notes, as “large money-center banks” are still assessing their portfolios. Alternative lenders — a category that includes REITs, finance companies, and debt funds — closed on many bridge and construction deals for multifamily and retail in the past quarter.

Among other lender categories, life companies held steady with about 23 percent of loan originations, on par with the previous quarter. Life company loans mostly went to office, multifamily and single-tenant retail properties, with relatively low loan-to-value ratios of about 50 percent.

Read more

CMBS lending, which froze up in the early days of the crisis, saw its market share inch up slightly from about 1 percent to 4 percent. This included a few spurts of big-ticket dealmaking in the securitized mortgage market, such as a $1.5 billion CMBS refinancing for Brookfield Property Partners and Qatar Investment Authority’s One Manhattan West.

Lenders were more conservative overall in the third quarter, with an average loan-to-value ratio of 61.5 percent, down 2 percentage points from the prior quarter and down nearly 6 points year-over-year. “Average LTVs for permanent commercial and multifamily loans fell in Q3 to levels not seen since the global financial crisis,” Stoffers said.