Trending

Healthcare Trust of America buys Boca Raton medical offices for $50M

Buyer recently sold Lauderdale Lakes hospital, healthcare offices

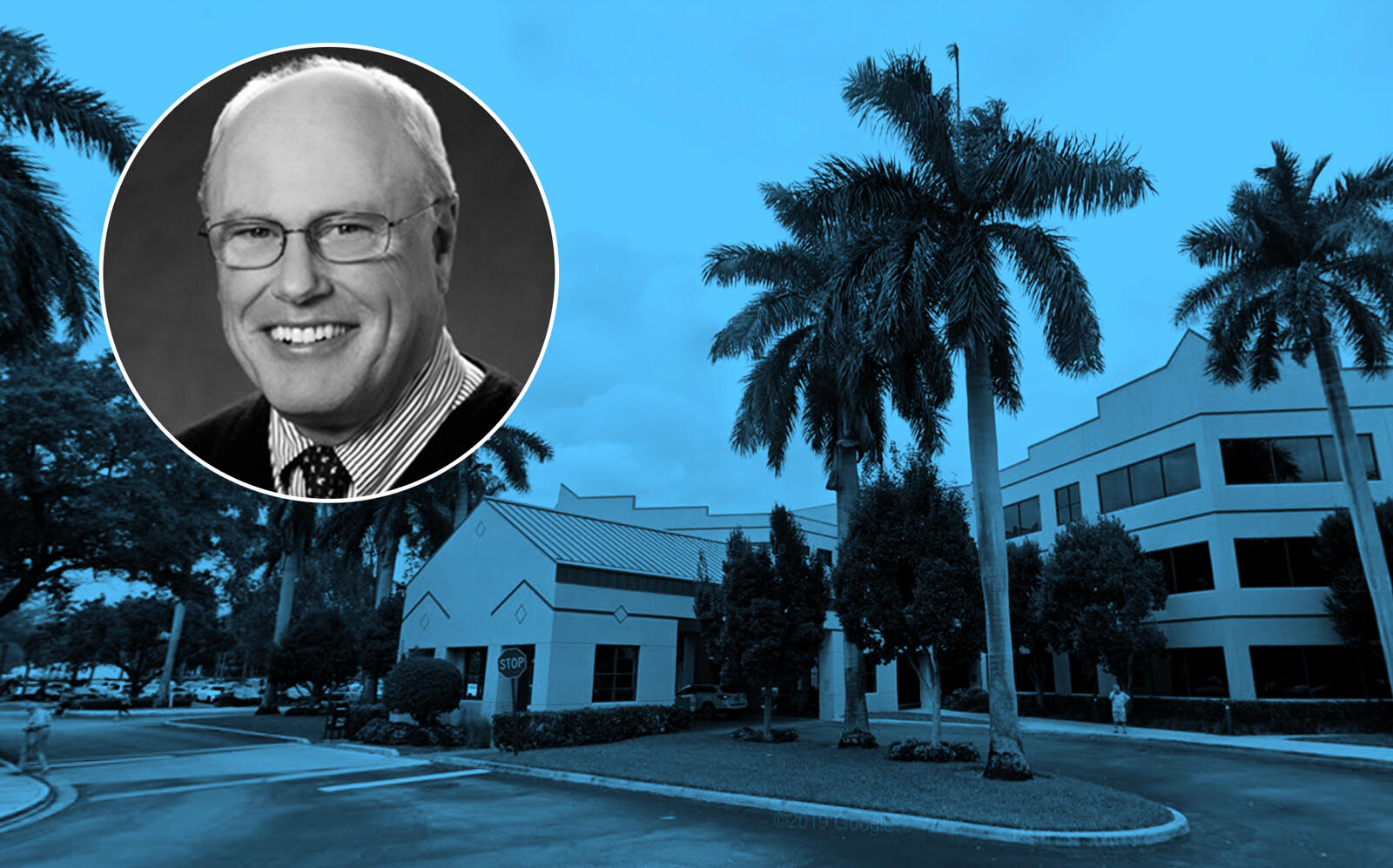

Healthcare Trust of America bought the 1905 Medical Center in Boca Raton for $50 million, marking continued investor interest in healthcare-related real estate.

The Scottsdale, Arizona-based real estate investment trust purchased the 106,135-square-foot building at 1905 Clint Moore Road, records show. The selling group is managed by Rick Werber and Ed Steinhardt, both of real estate agency CDR Realty in Boca Raton, as well as an entity tied to an orthopedic surgeon Kenneth Garrod, who has an office at the property.

The seller paid $23.5 million for the building in 2004, according to property records. Constructed in 1996 on 15.5 acres, 1905 Medical Center includes a 438-space parking lot, LoopNet.com shows.

Healthcare Trust of America, an owner-operator of medical real estate, has a portfolio of 471 properties totaling 25.6 million square feet across 32 states, according to its website. Peter Foss is interim president and CEO, filling in after Scott Peters resigned from those positions in August, according to a news release.

This is not the REIT’s first foray into South Florida medical real estate. Healthcare Trust of America was part of the consortium that sold a 459-bed hospital property, three office buildings and a medical office mall in Lauderdale Lakes to Medical Properties Trust in August for $171 million.

That was part of a Medical Properties Trust portfolio purchase of five South Florida medical complexes for $900 million from Tenet Healthcare, although some of the facilities included other sellers. Medical Properties also bought Palmetto General Hospital in Hialeah for $315 million and Hialeah Hospital for $133.7 million.

These deals show medical office real estate in South Florida continues to enjoy investor appetite. In another recent purchase, an affiliate of Montecito Medical Real Estate bought a Weston healthcare office for $17.2 million in September.