South Florida’s top industrial sales crushed last year’s records, marking a return to sale prices in the hundreds of millions, as the sector outperformed the rest of the market during the pandemic.

The largest industrial sale of 2021, CenterPoint’s $184 million purchase of warehouses in Hialeah, was nearly double last year’s top $94 million sale, and slightly above the biggest deals of 2019 and 2018, of $178 million and $180 million, respectively.

The average property size of the top industrial properties sold this year was 330,544 square feet. This was less than last year, when the average was 372,000 square feet. In 2019, the average size was 794,000 square feet; and in 2018, it was 1 million square feet.

Yet, while the average square footage declined, the price per square foot skyrocketed. The average for the top sales in 2021 was just over $213 per square foot, up 32 percent from $161 per square foot in 2020. In 2019, the average price per square foot was $157 and in 2018, $130.

Here are the top industrial sales:

CenterPoint pays $184M for warehouses at a Hialeah business park

The Oakbrook, Illinois-based industrial real estate developer and manager paid $184.4 million for two warehouses and land at and near 4040 West 108th Street in Hialeah, inside Countyline Corporate Park. The seller is an affiliate of Florida East Coast Industries, or FECI, the Coral Gables-based parent of train service Brightline; Flagler Global Logistics, a logistics company; and Flagler, a commercial real estate company. FECI is part of Fortress Investment Group, which is owned by Japan’s SoftBank Group.

Nuveen pays $110M for industrial buildings in Weston

2935 West Corporate Lakes Boulevard (Source: Google Maps)

The San Francisco-based real estate investment trust Prologis sold the properties at 2935 and 2945 West Corporate Lakes Boulevard to Nuveen Real Estate. The deal breaks down to $275 per square foot.

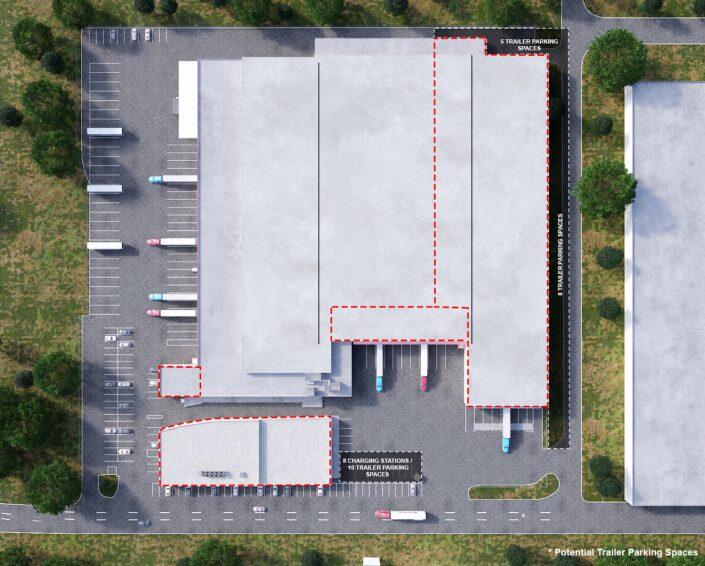

Amazon pays $85M for Sunrise fulfillment center site

(Source: The City of Sunrise)

Jeff Bezos’ e-commerce giant, which hungers for land as customers hunger for online services, bought the property at the northwest corner of 44th Street and Hiatus Road. Section 18, managed by Curtis Deem and the Trust Indenture of Martha Cotton Deem Hook, with Walter Deem Jr. as successor trustee, sold the property to Amazon.

Ivy Realty sells Miami-Dade freezer facilities to New York firms for $74M

(Source: LoopNet)

In two separate deals totaling $74 million, a New York-based joint venture acquired a pair of cold storage warehouses near Miami Gardens and Aventura from Greenwich, Connecticut-based Ivy Realty.

Banner Property Group, headed by Managing Partner Jason Eisenberg, and Apollo Global Management bought a 235,000-square-foot building at 18770 Northeast Sixth Avenue and a 80,000-square-foot building at 650 Northeast 185th Street.

Cabot Properties buys Miramar distribution center for $72M

(Source: LoopNet)

Boston-based logistics real estate investor Cabot Properties bought an industrial building at 15501 Southwest 29th Street from Chicago-based Bridge Industrial.

The recently renovated warehouse has rear-loading, 32-foot clearing heights, 50-foot by 50-foot column spacing and 46 high-dock doors.