The Van Gogh Immersive Exhibit inked a long-term lease on Miami Beach’s Lincoln Road, The Real Deal has learned.

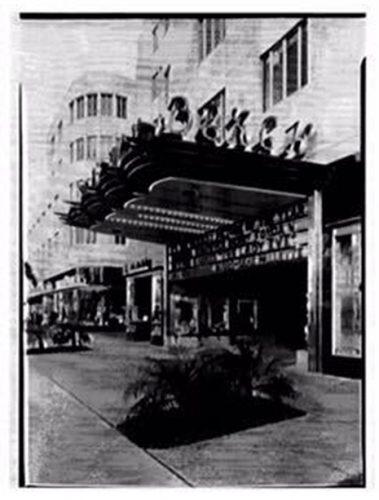

Lighthouse Immersive, the Toronto-based company that runs the experiential art exhibit, signed a nearly 23,000-square-foot lease at 420 Lincoln Road, a property owned by Paul Cejas’ PLC Investments, according to Brandon Charnas, a broker involved in the deal. Part of the space was home to the Beach Theatre dating back to the 1940s, and has been vacant for about 20 years.

New York-based Current Real Estate Advisors co-founders, Adam Henick and Charnas, represented Cejas in the lease. A team led by JLL’s Zach Winkler and Charles Gerace represented the Van Gogh exhibit, according to a release.

Van Gogh is expected to open by the end of the year.

Charnas said the deal marks a significant turning point for Lincoln Road, where occupancy has lagged due to high rents. Lighthouse Immersive will pay about $2 million per year in rent, according to a spokesperson for Current Real Estate Advisors.

“No one could lease this space,” Charnas said. “When we had announced [Current’s expansion to South Florida] on Instagram, the owner of this building reached out to us and had a lot of leasing issues.”

Existing retail tenants include Zara, Scotch & Soda, McDonald’s, Häagen-Dazs, Spar Boxing and Starbucks. About 50,000 square feet of office space is available for lease.

Niki Markofsky, director of leasing for 420 Lincoln Road, said the portion of the building fronting Lincoln Road was previously home to the nightclub Santo in the early 2000s. The theater box is the part of the space that has been vacant for two decades.

Alber Anis designed the building with marble corridors, high ceilings and Art Deco features. It was originally known as the Lincoln-Washington Building when it opened, but was quickly renamed when Mercantile Bank of Miami Beach became its anchor tenant in 1940.

The 257,000-square-foot building was expanded throughout the years and sits on close to 2 acres.

Charnas said that his firm looked into the history of the property and highlighted it on social media to prospective tenants. He compared the original theater, where the “gangsters of Miami watched plays and shows,” to experiential retail today.

In recent years, some longtime tenants on Lincoln Road closed or moved away from the pedestrian-only retail street, while other new-to-market tenants have signed leases. Two years ago, the independent local book store chain Books & Books closed its Lincoln Road store after more than 30 years of a presence on the street.

During the pandemic, Showfields, a popular New York City retailer, leased a two-floor, 14,300-square-foot space at 530 Lincoln Road with an indoor/outdoor food and beverage concept, a speakeasy bar, theater, tattoo parlor, piercing stations and more. Most recently, the Cheesecake Factory signed a 20-year lease, with renewal options, for the 7,000-square-foot corner space at 600 Lincoln Road.

The city plans to begin a $47 million renovations and streetscape improvement project on Lincoln Road.

Glenn Boyer, president of PLC Investments, said the firm now has about 5,000 square feet of retail space available on Lincoln Road, in addition to the office space available. He compared the high foot traffic on Lincoln Road during weekends to Art Basel Miami Beach

Cejas, a former U.S. ambassador, paid $14.5 million in 1997 for the building, which also fronts Washington Avenue. The Cuban-American investor owns nearby real estate, including the adjacent building at 1601 Drexel Avenue, which is home to the Time Out Market Miami.

Read more