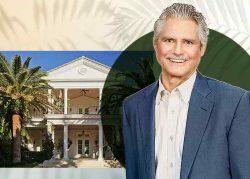

The head of commodities trading at Goldman Sachs bought a newly completed Palm Beach spec house for $16 million from one of Boston’s leading landlords.

Records show Edward and Natalie Emerson bought the house at 261 Nightingale Trail from 261 Nightingale LLC and 527-529 Beacon Street Realty Trust, which had 61.8 percent and 32.2 percent stakes in the property, respectively. The entity 261 Nightingale LLC is a Massachusetts corporation managed by Bruce Percelay, founder and chairman of Boston-based Mount Vernon Company. Mohsen Vessali signed as trustee of 527-529 Beacon Street Realty Trust. Vessali is CFO of Mount Vernon.

Buyer Edward Emerson is head of commodities trading at New York-based Goldman Sachs, among the financial firms that have moved divisions to South Florida. Goldman Sachs’ commodities desk’s revenue topped $2.2 billion last year, making Emerson one of the top earners in the entire company, Bloomberg reported in January.

Natalie Emerson is president of the parent association for New York’s Avenues the World School, a private pre-K-12 school, the school’s website shows.

Margit Brandt of Premier Estate Properties confirmed she represented the sellers, and Gary Pohrer of Douglas Elliman confirmed he represented the buyers.

Records show Percelay bought the property for $4.5 million in March of last year from Palm Beach-based Sabatello Construction. According to Brandt, the purchase included a contract for Sabatello, led by Carl Sabatello, to build a Harold Smith-designed house.

Brandt said the seller originally intended to be an end-user of the property, but commitments in Boston got in the way.

“The house was supposed to be for him and his family,” she said.

Once Percelay decided to sell, it went into contract before Brandt could list it on the Multiple Listing Service.

The completed house spans 5,392 square feet, with five bedrooms and six bathrooms according to an Instagram post by Brandt. Property records have yet to reflect new construction on the nearly half-acre lot. Both brokers confirmed the property includes deeded access to the beach and the Nightingale Trail beach cabana, which Brandt said is a coveted amenity for Palm Beach residents.

Read more

Brandt said the sale reflected the strength of Palm Beach, even as its luxury market begins to stabilize.

“We’re still commanding high prices because there’s just not that much inventory,” she said. “We’re still closing [at] $3,000 a foot.”

Since the onset of the pandemic, Palm Beach’s market has seen unprecedented sale prices and through-the-roof demand. In July, a venture capitalist bought a waterfront compound for $48.9 million. This month, developer Todd Glaser bought back the Palm Beach mansion he sold for $16 million in 2019, dropping $23.2 million for the non-waterfront home. In June, a former Goldman Sachs executive paid $12.1 million for a non-waterfront Palm Beach house.