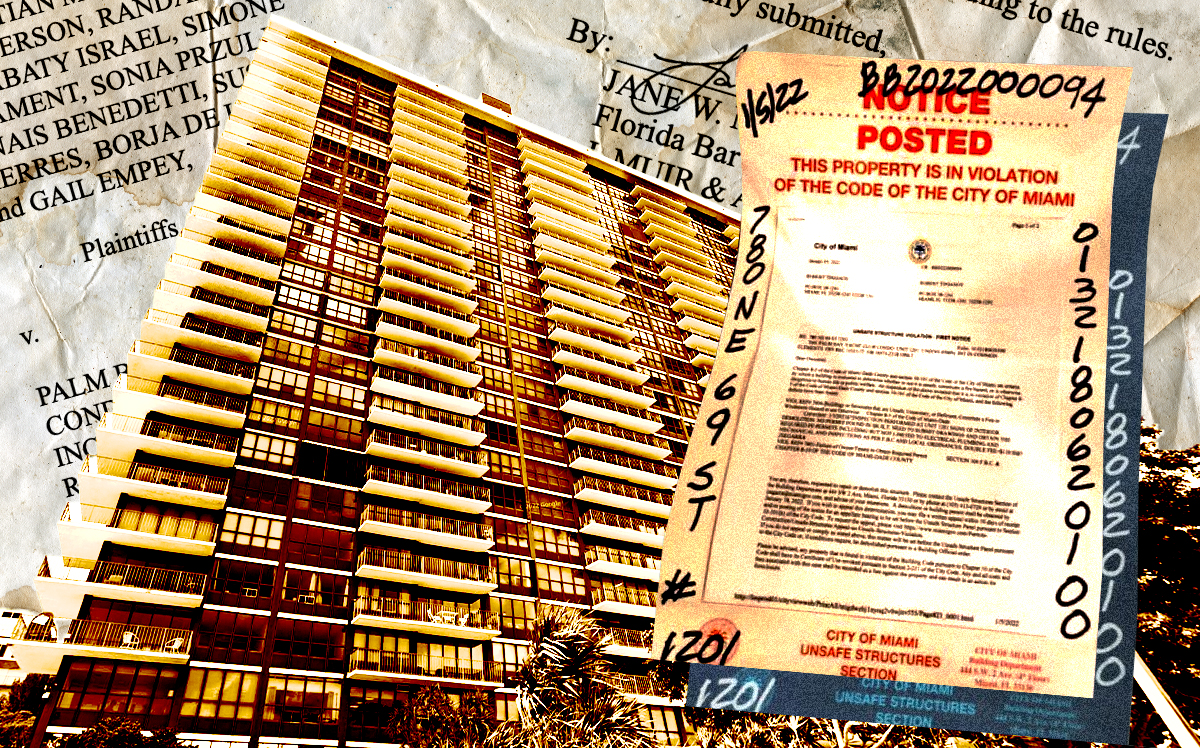

Across Miami-Dade County, condominium owners are facing escalating assessments for building repairs. It is among the aftereffects of the deadly Surfside condo collapse that prompted associations to take a hard look at their buildings’ structural integrity.

Relief may be in sight for some condo owners. Miami-Dade County launched a program that will issue loans of up to $50,000 to residents who live in their condos full-time, according to the county. The loans will be specifically for assessments levied to pay for building repairs and rehabilitation.

The program targets condo owners who earn no more than 140 percent of the area median income. This means a maximum annual income of $95,610 for a one-person household, $109,200 for a two-person household, and $122,920 for a three-person household.

The loans will have 40-year terms, during which low-income families will be on hook for $50 monthly payments and the remaining balance at the loan’s maturity.

But how far the program will go to help cash-strapped households remains to be seen.

The county budgeted $9 million for the loans. That pencils out to 180 households, assuming each gets the full $50,000 loan amount.

At a town hall in Aventura last week, Miami-Dade County Mayor Daniella Levine Cava said additional funds could be allocated in the future, the Miami Herald reported. The June 2021 collapse of Champlain Towers South in Surfside, which killed 98 people, played only a partial role in the county’s decision to launch the loan program, she said.

After the tragedy, state lawmakers tightened building safety laws, requiring 30-year and 25-year recertifications, and mandated that association budget reserves be fully funded. Miami-Dade already had required 40-year recertifications.

Condo owners also have been battered by skyrocketing insurance rates, as some carriers have exited the market outright, leaving little competition for those that still provide coverage in South Florida. Escalating expenses have opened the door to investors that seek to buy out condos, likely for redevelopment.

Read more