For years, venture capitalists and tech firms from California descended on South Florida. As companies inked office leases from Wynwood to West Palm Beach, real estate players boasted about the tri-county region’s skyrocketing status to tech stardom.

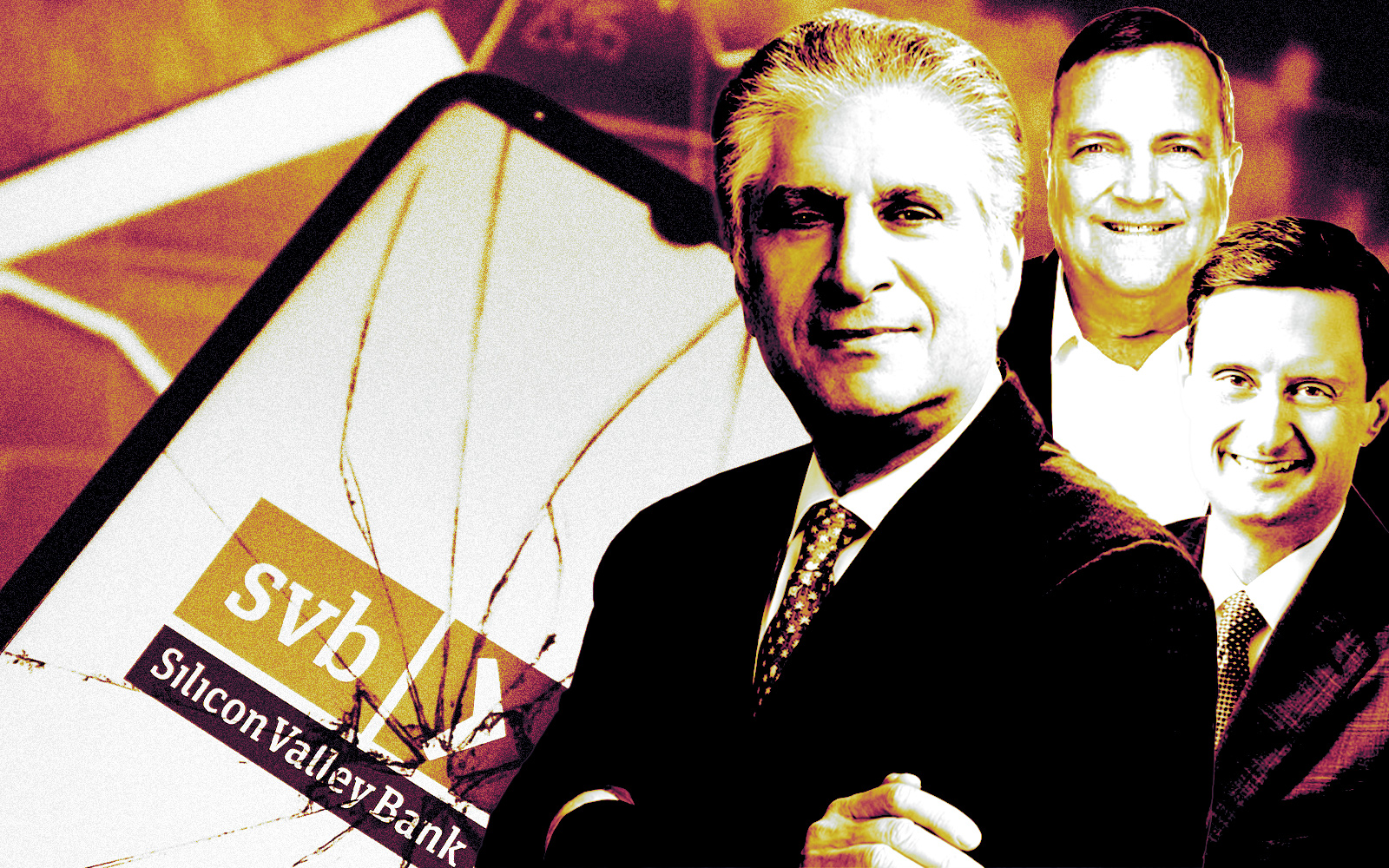

But the industry’s foothold on the market began to falter last year. And now, in the aftermath of the collapses of banks with large tech lending arms, South Florida’s future as a tech mecca is on even shakier ground.

South Florida “wanted California investors,” said Peter Zalewski, a longtime local real estate market analyst. “Well, you got them. But you also got Silicon Valley Bank exposure.… So you live by the sword, you die by the sword.”

The Federal Deposit Insurance Corporation took over both SVB and Signature Bank as receiver last week. That came on the heels of Silvergate Bank, a crypto-focused lender, announcing it is liquidating.

The bank failures could result in stricter lending, adding to existing challenges borrowers have faced in a high-rate environment over the past year, experts say. In the short-term, optimistic brokers and developers say they are banking on a break in interest rates.

The question now is whether tech tenants will back out of their leases, and what effects that will have on South Florida’s office market. Office landlords with tech tenants that banked with Silvergate or SVB may run into trouble with rent collections, giving rise to eviction lawsuits, experts say. And the landlords themselves could be exposed to financing trouble and possibly foreclosures.

Even before the recent bank collapses, it had become clear South Florida isn’t insulated from trouble in the tech industry.

Case in point: After the spectacular FTX meltdown late last year, Miami-Dade County scrapped a 19-year, $135 million naming-rights deal with the crypto-exchange for the arena where the Miami Heat play.

The residential crypto buyer pool shrunk, and condo developers terminated their agreements with FTX to accept deposits through the firm, putting those deals into question.

On the office front, San Francisco-based Blockchain.com backed out last summer from its commitment for a new headquarters at Brick & Timber Collective’s Cube Wynwd. Blanca Commercial Real Estate sued Brick & Timber, which paid $62 million for the building in December, and the previous owners last month. The lawsuit alleges they still owe the brokerage the second half of its $546,000-plus commission tied to Blockchain.com’s lease.

More trouble for landlords with tech tenants could be on the runway.

“If you bought an office building that is heavily tech-focused from a tenant standpoint, and you have a loan coming due soon, how are the banks going to scrutinize your finances?” said Miguel Pinto, president of Miami-based commercial brokerage Apex Capital Realty. “Are they going to downgrade that NOI by 20 percent?”

Quake in Cali, tremors in Miami

In the immediate aftermath of the bank collapses, banks active in South Florida real estate lending scrutinized their balance sheets and focused on assuring depositors of the banks’ health, said Joe Hernandez, a Miami-based real estate attorney. This likely put a pause on financing activity.

Miami Lakes-based BankUnited’s stock price dropped 21.5 percent in five days to close at $23.10 per share on Thursday. But stocks for Bank OZK, which is based in Little Rock, Arkansas and is among the biggest South Florida real estate lenders, rose by nearly 5 percent in the same time period, closing at $37.82.

In one of the bigger impacts, a Miami-Dade County-based real estate firm that had an account with one of the failed banks had to scramble to move its eight-figure deposit to other institutions, according to Hernandez, who declined to disclose the name of the firm.

“If you live in the next town over where the earthquake hit, you don’t feel the earthquake,” Hernandez said. “You feel the tremors.”

While the extent of South Florida tech companies’ exposure to the failed banks is unknown, some speculate it could be hefty.

SVB leased a Brickell office in 2021, after working with companies in Florida for more than 20 years, the bank said in a news release announcing its first Miami outpost. The bank had 35 employees in Miami and envisioned more hiring, the Miami Herald reported.

“That’s a pretty big operation,” Zalewski said. “If South Florida was not exposed to this West Coast phenomenon, why was Silicon Valley Bank operating in Miami?”

Silvergate, which had over $11 billion in assets and announced it was shutting down last week, outlined a liquidation plan that would fully repay deposits. Those who banked with SVB, which held over $200 billion in assets and was the second biggest bank failure in U.S. history, also will be protected after the FDIC stepped in.

Yet, it still will be harder for tech firms and their landlords to take out loans in the future, as both will be viewed as high-risk borrowers, experts said.

“Those capital calls are going to be much harder to make. If your money was tech money, that money may not be there anymore,” Pinto said. “Credit is going to be much harder to come by. Banks are downsizing their lending infrastructure, and not doing as many loans.”

Developers in the market for construction financing could also be affected.

Already, they were challenged by interest rates that more than doubled over the past year, still-high construction costs, rising insurance premiums and in some cases, pricey land acquisitions. Craig Studnicky, CEO of ISG World, said he expects construction lending will take the hardest hit, causing developers “short-term heartburn.”

“Lending on a condo, condo hotel, or even a hotel or an office tower is being seriously securitized right now because it affects [the bank’s] reserves,” he said, adding that it’s “the last thing developers needed.”

Developer and broker Edgardo Defortuna said he’s hoping the Fed’s expected rate hike reprieve later this month will aid in his ongoing negotiations of two construction loans.

“Half a point or a point on $200 million loans is significant,” said Defortuna, CEO of Fortune International Group.

Despite the panic surrounding regional banks, larger banks are viewed as more stable, but they are also being more selective, said Integra Investments principal Nelson Stabile.

“Now is a great opportunity for debt funds to take a bite at the apple,” Stabile said. “Those debt funds now have plenty of opportunities for them to lend against.”

Resi ripples

Some industry proponents say the bank failures could entice more West Coasters to move to the Sunshine State, boosting the residential market.

Condo developer Harvey Hernandez is betting on that.

“We decided to increase our advertising dollars in the West Coast in the immediate future,” he said. “It’s just so recent, it remains to be seen.”

Next week’s expected rate hike by the Fed is now projected to be smaller than previously anticipated — fueling those hopes.

“Any decline in interest rates can offer a little bit more of a buying opportunity. It could be a couple of hundred bucks on a real estate mortgage payment,” said Richard DeNapoli, chief trust officer of Coral Gables Trust. “Your cash buyer, none of this really matters because they’re buying with cash.”

Residential dollar volume across the tri-county region fell by more than 30 percent, year-over-year, in January to $3.2 billion, adding to months of sales declines across South Florida.

“The biggest problem with a bank failure is the ripple effects it sends through the economy,” said Sebastian Vallejo, managing director for Brown Harris Stevens’ Miami Beach offices. “We were already in an uncertain scenario with everything going on worldwide, with inflation and with the measures the Fed had been taking. Many people today are asking, ‘Should I invest in real estate?’”

Mike Pappas, CEO of the Keyes Company, one of the largest independent residential brokerages in the state, cautioned that sales activity may pause as buyers wait for the market to stabilize.

“The impact [of] this would be short-lived and temporary,” Pappas said. “We’ve been a little bit immune to the issues nationally because of our growth.”

Yet, others expect trouble in residential real estate to be longer lasting. As tech firms leased South Florida offices, executives scooped up condos and single-family homes here.

“I would also expect there might be some residential foreclosures, related to mortgages provided for recent transplants who may not be able to make their payments, given the issues that are transpiring,” said Josh Migdal, a Miami-based attorney.

The bank failures are the “first inning of a nine-inning baseball game” that’s bound to affect South Florida real estate, Zalewski said. The next inning, he said, would be tech company layoffs.

“Layoffs mean if you are a big roller in Miami, and your company in California goes sideways, how are you going to pay rent?” he said. “Are [you] going to go bartend or drive Uber?”

Read more