Trending

Harbor Group pays $106M for West Palm Beach apartments

HGI pays Carlyle, Alliance Residential $377K per apartment for 280-unit property

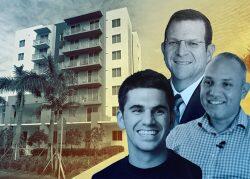

Harbor Group International is adding to its already massive South Florida multifamily portfolio, picking up a newly completed West Palm Beach apartment complex for $105.5 million.

The Norfolk, Virginia-based investment firm purchased the Locklyn West Palm, a 280-unit property at 3590 Village Boulevard, from an affiliate of developer Alliance Residential Company and private equity giant Carlyle, according to records and real estate database Vizzda. Harbor took out a $56.6 million loan to finance the deal.

Alliance and Carlyle finished the complex last year after paying $11.5 million for the development site in 2021 and financing construction with a $42.9 million loan from Santander Bank, records show. At $105.5 million, Harbor Group’s purchase breaks down to nearly $377,000 per unit.

Locklyn consists of six four-story apartment buildings, three clubhouses and four garages on 30.8 acres just west of Interstate 95.

It offers one- to three-bedroom units with monthly rents ranging from $2,399 to $3,874, Apartments.com shows. The complex is 95 percent occupied, according to a Harbor news release.

Harbor, led by Jordan Slone, has been making a hefty bet on South Florida multifamily. The firm’s portfolio in the tri-county region now spans 15 properties with over 3,800 units, according to the news release.

Last year, Harbor paid $440 million for ParkLine Miami, a pair of apartment towers that combine for 816 units atop Brightline’s downtown Miami station. The deal, which broke down to more than $539,000 per apartment, marked South Florida’s biggest multifamily sale of 2022.

Since then, Harbor’s shopping spree has included the $113 million purchase of the Oak Enclave complex at 2301 Northwest 167th Street in Miami Gardens and the $184.5 million purchase of Miro Brickell at 251 Southwest 11th Street in Miami.

After a slowdown in South Florida commercial sales caused in part by high interest rates, activity has picked up in recent months. This month alone, The Connor Group paid $121 million for The Villas at Wyndham Lakes complex at 11500 Northwest 56th Drive in Coral Springs, and Praedium Group bought Manor Lantana at 861 Water Tower Way in the Palm Beach County town for $138 million.

Led by CEO Bruce Ward, Scottsdale, Arizona-based Alliance is a multifamily developer that has built over 115,000 units across 16 states since 2000, according to its website.

Carlyle, one of the world’s largest private equity firms, has $381 billion in assets under management across, according to its website. Its real estate portfolio accounted for 13 percent of that, or about $18 billion, according to the firm’s first-quarter earnings report.

Read more