Trending

Starwood, Related among RE giants fighting Florida’s Chinese investment ban

Lobbying group representing major firms, banks pressing lawmakers to loosen restrictions

From left: Steve Ross, Ron DeSantis, Stephen Schwarzman and Barry Sternlicht (Getty)

Lobbyists for a group that represents real estate heavyweights, including Steve Ross’ Related Companies and Barry Sternlicht’s Starwood Capital, are hoping to roll back a Florida law passed this year that restricts foreign investment from China and other countries.

The Real Estate Roundtable, a lobbying group that also represents Blackstone, Citigroup and Wells Fargo, is pressing lawmakers to relax restrictions included in the Foreign Countries of Concern law, Bloomberg Law reported. The legislation bans nearly all purchases by Chinese nationals and China-based companies, and restricts real estate investment from buyers hailing from other “countries of concern,” including Venezuela.

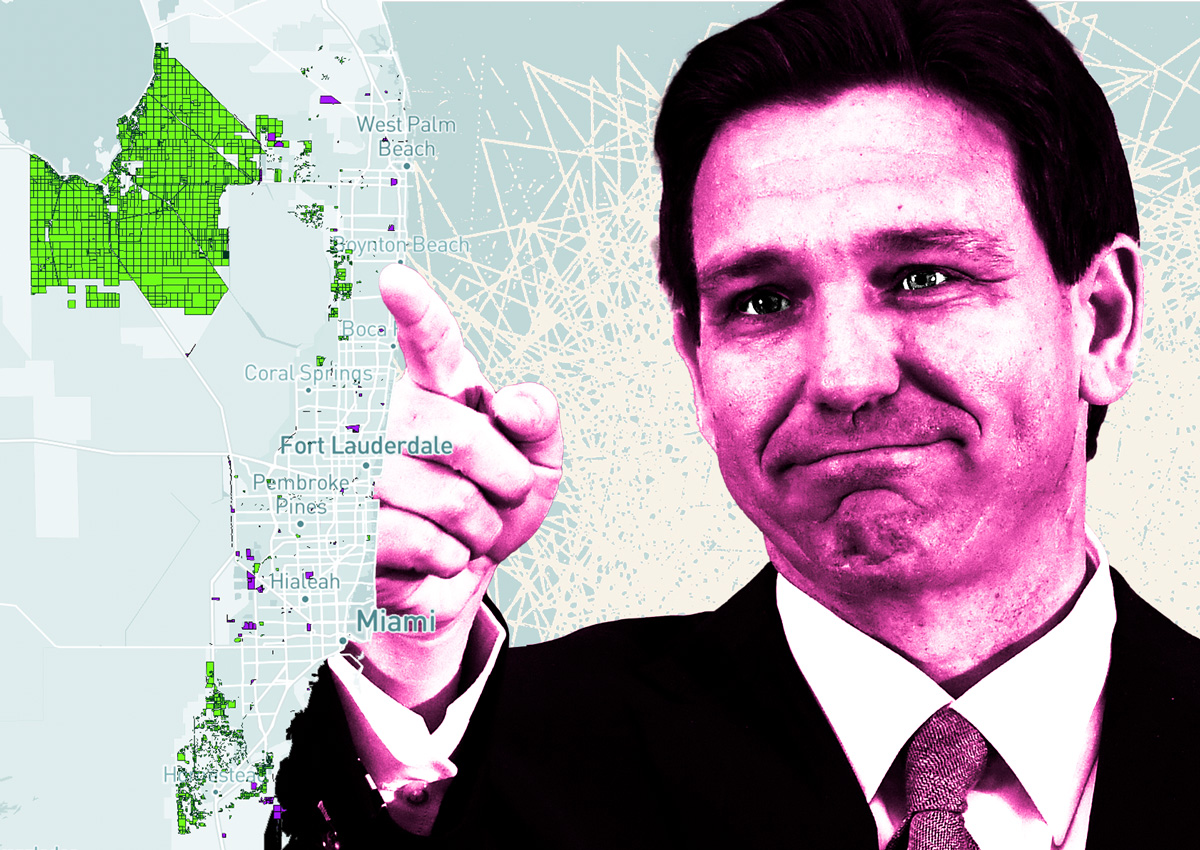

Gov. Ron DeSantis signed Senate Bill 264 into law in May, and it went into effect July 1.

It also restricts landowners from using Chinese capital to fund projects in the state, even if they are non-controlling minority stakes in real estate deals. Lennar has delayed at least two developments in Florida because of the restrictions, according to Bloomberg.

Earlier this year, lobbyists for billionaire hedge fund manager Ken Griffin got lawmakers to relax restrictions on home purchases. Griffin was once one of DeSantis’ biggest political donors.

Read more

Developer Jorge Pérez of the Related Group, a Democrat, said it goes too far. Pérez said investment should “flow freely” and that his limited partners don’t control his projects.

“It’s really making something out of nothing,” he said.

Earlier this year, a group of Chinese citizens sued Florida officials over the law, alleging it is discriminatory and unconstitutional, and that it violates the Fair Housing Act.

— Katherine Kallergis