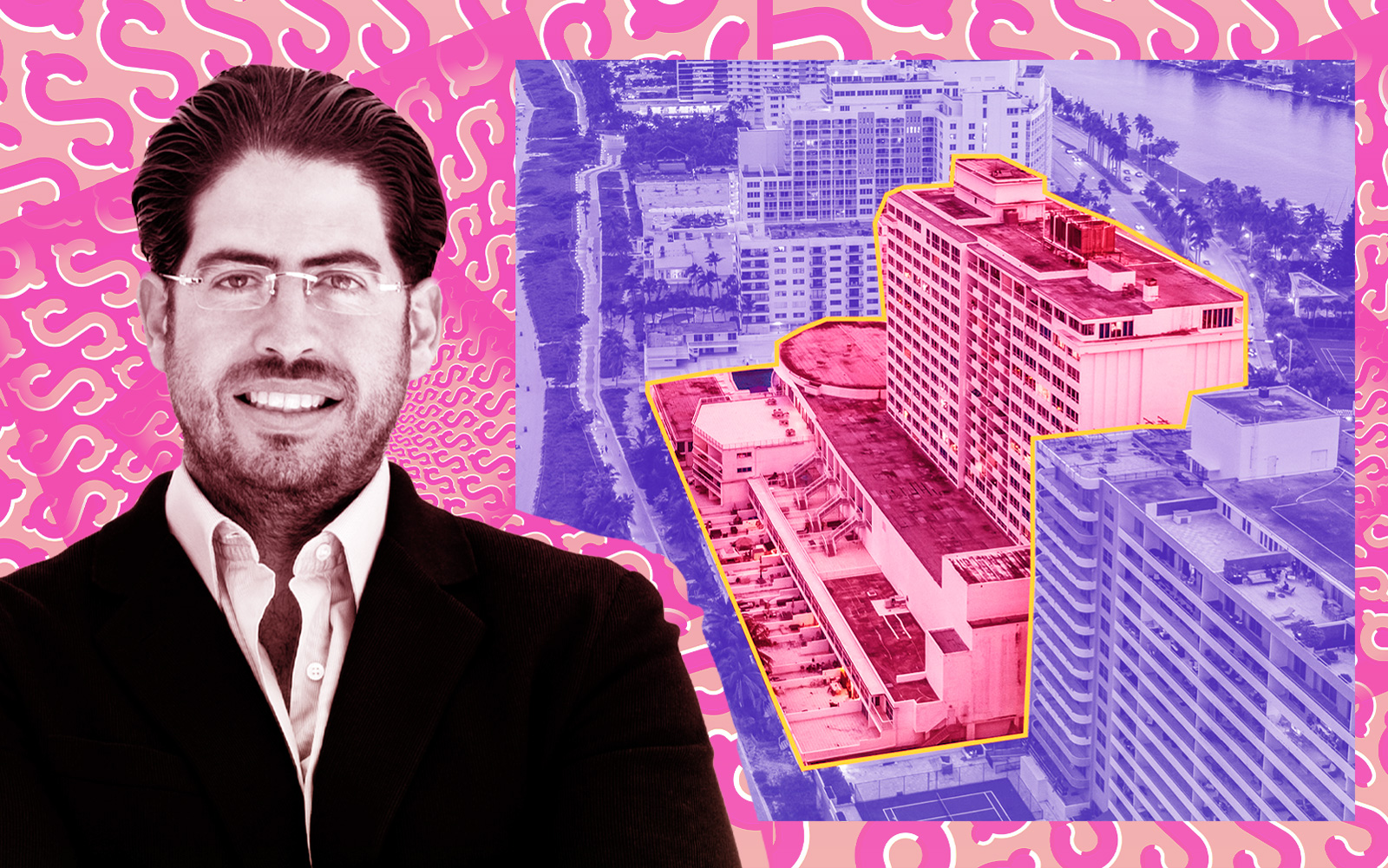

Developer David Martin’s record bid to acquire Castle Beach Club, an aging oceanfront condo building in Miami Beach, could be dead in the water.

Contracts with the majority of unit owners expired at the end of January, sources told The Real Deal.

Martin’s firm, Coconut Grove-based Terra, is still interested in purchasing the roughly 570-unit property at 5445 Collins Avenue, and said it gave holdout unit owners a deadline of the end of February to move forward with the deal, according to a letter Martin sent to condo owners that was obtained by TRD. Martin would still close on Nov. 30 of this year.

In a statement, Martin said that Terra is working with the property’s 350-plus owners to secure at least 95 percent of the units and expects to close on the units by the end of the year.

“Condo redevelopment deals are complex and time-intensive, but we are encouraged by our continued dialogue with the Castle Beach board and the vast majority of owners who have agreed to sell their units,” Martin said in the statement.

If successful, it could mark one of the largest condo buyouts in recent history in terms of units, and it would likely mark the priciest.

“Currently, we are faced with three owners that own multiple units that did not sign the extension agreement, along with some unreasonable owners that have made the project economically unfeasible,” Martin wrote in the letter. “We believe that our offer is substantially above the market price for the unit owners and still represents a great opportunity for owners.”

Terra’s offer and months of negotiations mark the second attempt of a major developer to acquire the 18-story condominium in the past two years. Condo giant Related Group and its partner 13th Floor Investments pulled out of a similar $500 million deal nearly a year and a half ago.

Castle Beach Club sits on 4 acres zoned for a 200-foot tall development with the capacity for nearly 600 units, though a developer like Terra would likely build fewer, yet more high-end, units to maximize profit. The site also has 576 feet of frontage on the beach, allowing a developer to offer oceanfront views to more units, and charge more in the process.

Castle Beach, built in 1966, is like many older buildings along the water in South Florida. Insurance premiums have doubled or tripled for many, and older structures’ condo associations are being forced to spend millions of dollars to make necessary repairs. After the deadly collapse of Champlain Towers South in Surfside in June 2021 that killed 98 people, the state legislature passed a condo safety law that mandates associations complete financial reserve studies, fully fund their reserves and maintain their structures. Those deadlines are approaching.

Castle Beach Club was the largest older condo building to hire a brokerage to market the property to developers following the Surfside tragedy. The association tapped Colliers to market the property. Terra was among the bidders that responded, a group that included Related and 13th Floor.

The majority of units at Castle Beach Club are rented out as short-term rentals, which in theory could make a bulk buyout easier because most owners don’t live in the building.

In an interview with TRD late last year, Martin acknowledged the challenge of working with so many owners, but pointed to Castle Beach’s “strong hotel program.”

“I’m very, I’m very, very hopeful, very happy with what, what we hopefully can do there,” he said at the time.

In the letter that Martin recently sent when the contracts expired, he said that Terra will not ask for another extension if the “Final Chance to Get this Done Together” fails. If Terra gets the remaining owners on board, the developer will request owners sign an extension for due diligence to end on May 31, according to the letter.

Despite demand for new luxury condos in Miami Beach and nearby towns, it’s difficult for developers to move forward with condo buyouts because state law allows 5 percent of owners to block deals. The high interest rate environment has also made financing these deals trickier and more expensive.

Terra and its partners are also working on securing financing for the Miami Beach Convention Center Hotel, a long-planned development that voters approved in 2019.

Read more