Nearly two dozen development sites across Miami-Dade County have hit the market since December.

Though the condo market is still booming*, and apartment builders continue to forge ahead with projects, some are ditching their plans and listing sites for sale as the market begins to correct itself. What’s driving that? It’s a combination of high interest rates, rising construction costs and difficulty finding equity investors to cover gaps in a project’s capital stack.

Sellers are hoping to cash out now to avoid the hassle and cost of building, Francisco Alvarado reports in The Real Deal’s March issue.

Shovel-ready sites (those with approved plans) are especially valuable. All of the development sites reviewed by TRD at least come with site plan approvals. A quarter have full zoning and building permitting approvals.

“You have buyers who don’t want to deal with the brain damage of navigating the city’s zoning and permitting departments,” said broker Arthur Porosoff.

Time will tell how many sites actually trade hands and how deep the correction will be.

Many sellers are still land banking and “are not in a hurry to sell,” said developer William Ticona, CEO of a Peruvian development firm called Grupo T&C. Ticona said he spent months evaluating shovel-ready sites in Edgewater. The company ended up acquiring a condo development site in an off-market deal with more favorable conditions, Ticona said.

* A penthouse at the planned Shore Club project is reportedly in contract for more than $120 million, a deal that would set a new record for condo sales in Miami-Dade County.

What we’re thinking about: Miami Beach and Fort Lauderdale are among the cities trying to “break up with Spring Break” this year. How will the crackdown on parking, curfews and more affect real estate? Send me a note at kk@therealdeal.com.

CLOSING TIME

Residential: Venture capitalist David Sacks sold the waterfront Venetian Islands home at 100 West San Marino Drive for $22.5 million. Sacks, a member of the “PayPal Mafia,” sold the house to Hela Properties, a firm managed by Bulgarian fintech entrepreneur Christo Georgiev.

Commercial: Pantzer Properties paid $83.5 million for the 245-unit apartment complex at 7130 Okeechobee Boulevard in West Palm Beach. Cottonwood Residential sold the property for about $341,000 per apartment.

NEW TO THE MARKET

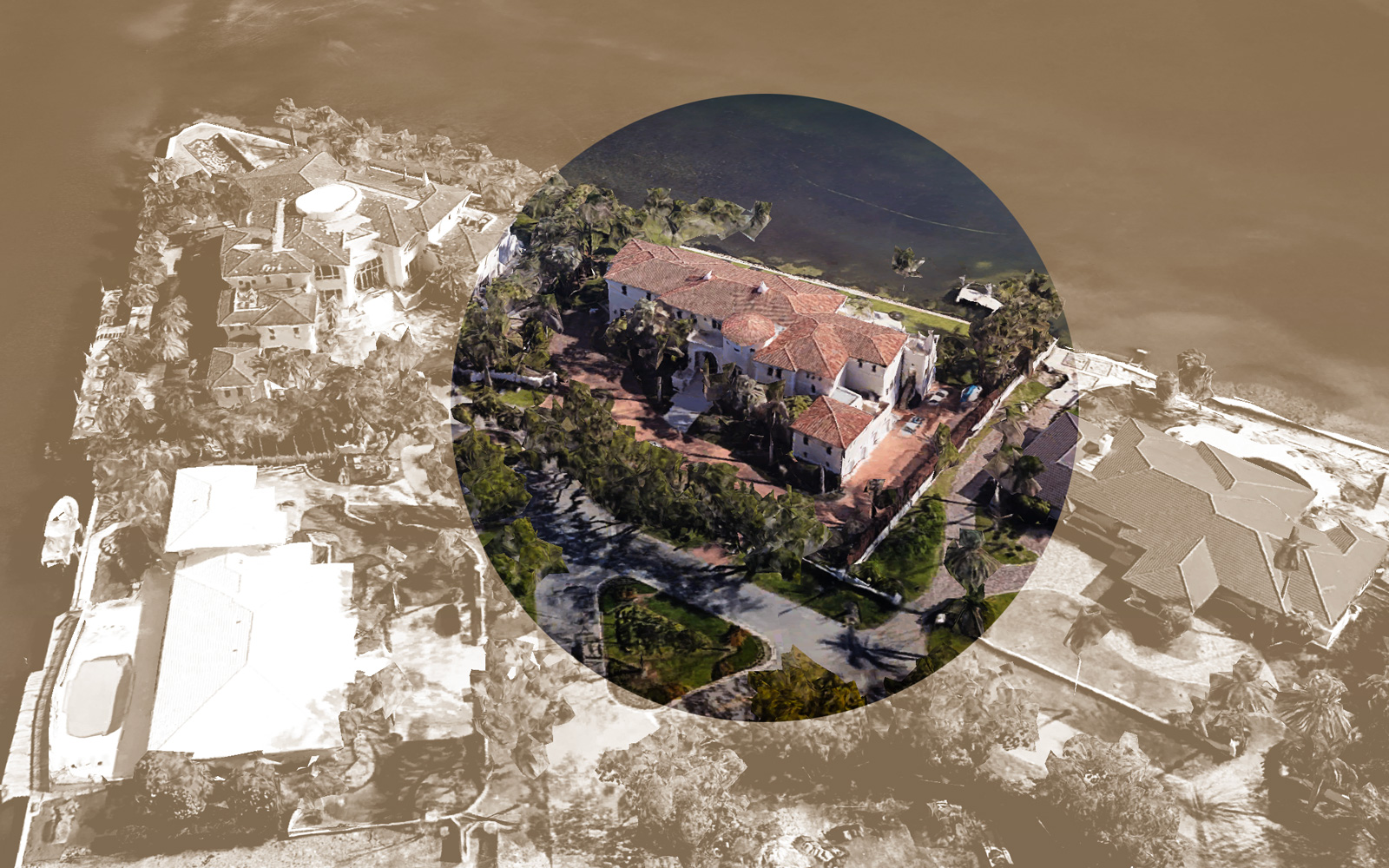

A waterfront estate in Coral Gables hit the market for $47 million, more than four times its purchase price a decade ago. The 15,000-square-foot Gables Estates mansion at 33 Arvida Parkway includes seven bedrooms, eight and a half bathrooms, a 2,700-bottle wine cellar, pool and outdoor kitchen. It sits on a 0.8-acre lot with 225 feet of waterfront, according to the listing. Judy Zeder of The Jills Zeder Group at Coldwell Banker has the listing for the home, which previously belonged to retired Miami Heat player Alonzo Mourning.

A thing we’ve learned

Longtime real estate agent Jo-Ann Forster died earlier this month at the age of 75. Forster led the Jo-Ann Forster team at Compass, and previously hung her license with One Sotheby’s International Realty and what was then EWM Realty International.

Elsewhere in Florida

- The Florida Senate approved a bill that would ban local governments from setting workplace heat standards, including the ability to require water breaks and shade protections beyond what federal law allows, NBC reports.

- The Senate voted to pass a bill that would crack down on short-term rentals across the state. The legislation would set maximum occupancy limits, allow officials to suspend short-term rental registrations for code violations and create short-term rental registration programs, according to the Sun-Sentinel. Regulations adopted by counties before 2016 would be grandfathered in, with the exception of two counties: Flagler County, home to House Speaker Paul Renner, and Broward County. Senate Bill 280 now heads to Gov. Ron DeSantis’ desk for a signature.

- The Miami Seaquarium has until April 21 to vacate the waterfront property it leases from Miami-Dade County. Mayor Daniella Levine Cava terminated the Dolphin Company’s lease with the county, citing a “long and troubling history of violations” in her letter, WSVN reports.