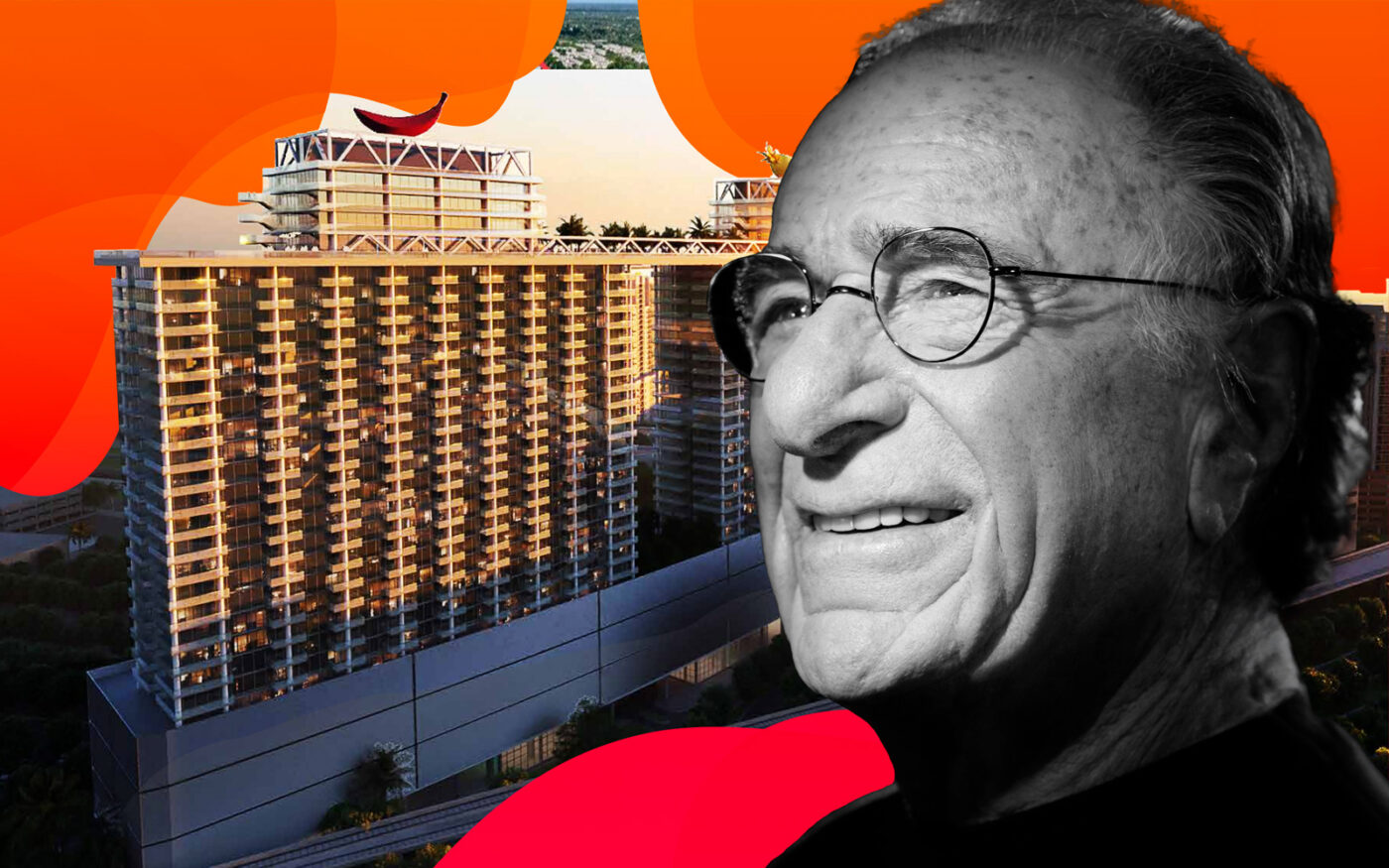

New York developer Harry Macklowe is looking to sell one of his development sites in Miami, The Real Deal has learned.

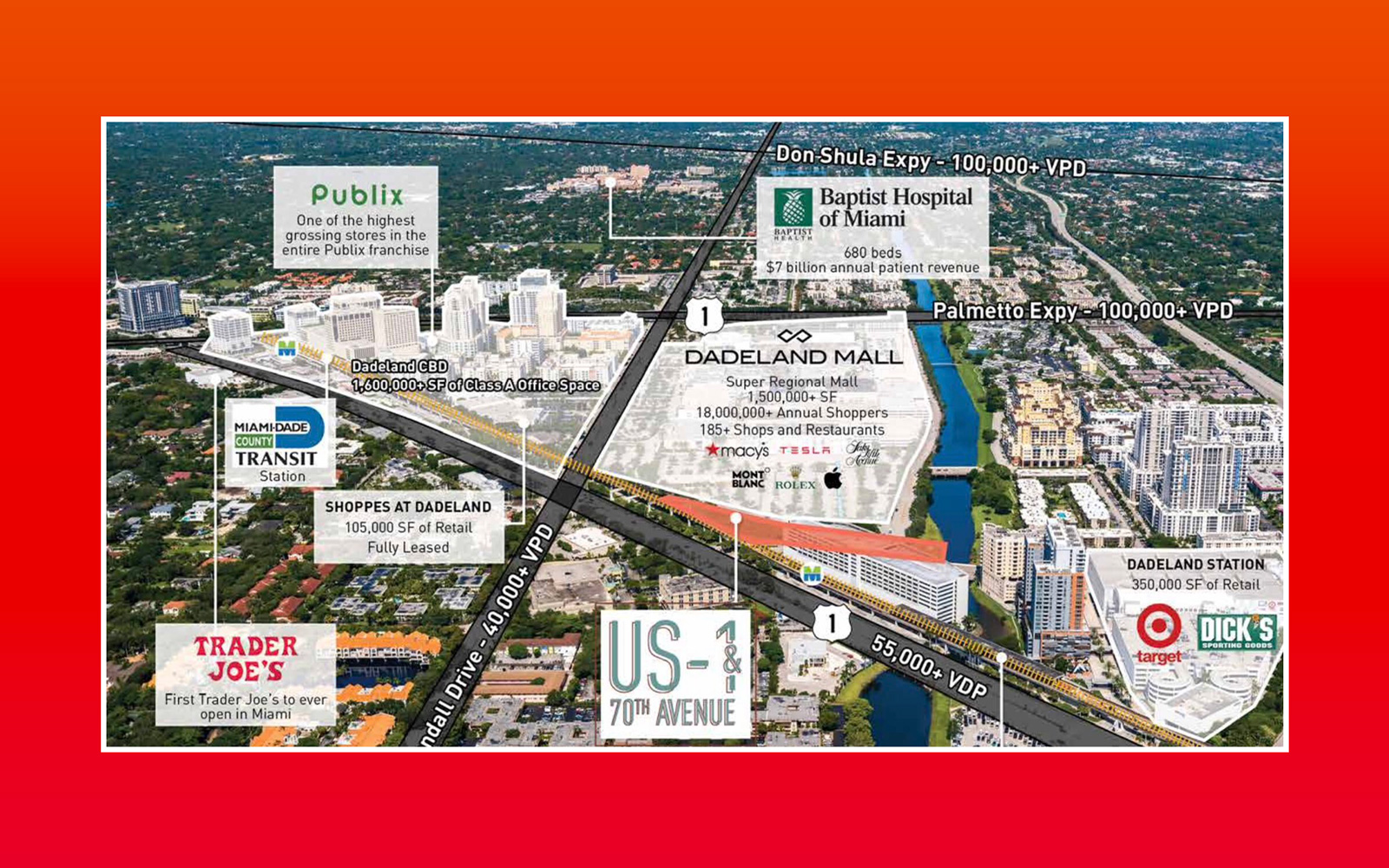

The 1.7-acre sliver of land, fronting U.S. 1 between Simon Property Group’s Dadeland Mall and Jeff Berkowitz’s Dadeland Station, marked Macklowe’s first major purchase in South Florida when he acquired it about two years ago.

The property is approved for 770 residential units in two 25-story towers. A number of new apartment towers have been recently built or are planned in the area.

Macklowe tapped a Berkadia team led by Jaret Turkell, Roberto Pesant and Omar Morales to list the site near Dadeland Mall unpriced, according to the listing. The brokers declined to comment. Macklowe did not respond to requests for comment.

A company tied to Macklowe paid $31.9 million for the Dadeland site in April 2022, and financed the deal with a $39.2 million loan from Fortress Investment Group.

A number of developers and investors have listed their development sites for sale in recent months, in part because of high interest rates, construction costs and soaring expenses like insurance. Land prices peaked between 2021 and 2022, and started falling in the second half of 2022.

Macklowe, CEO of New York-based Macklowe Properties, has had his share of troubles in New York. In the fall, he avoided foreclosure of his personal residences at 432 Park Avenue after putting the entity that controls his equity stake in the units into bankruptcy protection. He’s also been fighting a Hamptons zoning board over more than 20 code violations against his East Hampton home. The property, which the developer recently listed for $38 million, is uninhabitable because it has no certificate of occupancy.

In South Florida, Macklowe is also partnering on a joint venture development with Miami-based Related Group in North Bay Village. Macklowe’s involvement in assembling the waterfront land, including the purchase of a waterfront co-op and units at an older condo building that was deemed unsafe, have been mired in litigation. The Pérez family’s Related is leading the planned development of the assemblage, which is expected to include hundreds of luxury condos.

Read more