The financier of a $7.2 million loan on a three-story office building in Lauderdale Lakes was tired of waiting to get paid.

His borrower stopped making debt service payments two months after taking out the loan last spring, according to court filings. In May, the lender sued to foreclose on the note.

Meanwhile, over at a 38-unit apartment complex in Opa-locka, the lender filed a $3.9 million foreclosure in April following the landlord’s alleged failure to pay the debt when it matured last fall.

And in Lake Park, a lender is suing to foreclose on a $934,800 loan balance for an industrial building, after the borrower stopped making payments in September, according to the complaint.

Across South Florida, real estate owners are getting hit with foreclosures. The suits are for debt collateralized with offices, apartments, retail and industrial space, as well as development sites, a review of the cases shows.

While owners with floating interest rate loans are feeling the squeeze from the Federal Reserve’s increases of the benchmark rate since 2022, those with fixed rate debt are seeing skyrocketing insurance premiums eat up revenues and put a strain on their budgets, experts say. Those looking to refinance maturing loans are finding lenders have pulled back and debt is more expensive.

“A lot of lenders underwrote the deals, especially if it was a three- to five-year horizon on the investment…with certain insurance and interest rates,” investor and developer Ben Mandell said, referring to the underwriting criteria of the recent past. “In terms of refinancing [this debt], you are going to be in a bad spot if you don’t have the capital to cover those differences.”

This comes on the heels of a four-year long hype over South Florida being a haven compared with the rest of the U.S. due to an influx of businesses and residents. The leasing across property types and ensuing record rents created a belief the tri-county region would dodge macroeconomic headwinds.

“The slowdown is here for everyone. For us as well,” said Juan Arias, market analytics director at CoStar Group focusing on South Florida.

As a whole, the number of foreclosure filings across commercial real estate asset classes so far this year is 48, barely higher than the 45 filed in the second half of last year, according to real estate database Vizzda.

But the dollar volume of allegedly unpaid debt subject to South Florida foreclosure has skyrocketed: $226.3 million so far this year, a 108 percent increase from the amount of unpaid debt subject to foreclosure in the second half of last year, the Vizzda data shows.

And that, experts say, is notable.

What does it tell us?

The more than doubling of debt allegedly in default means lenders are now foreclosing on bigger loans, even those tied to high-quality properties owned by well-heeled investors and in coveted prime, Mandell said.

In short, lenders this year are foreclosing on what are considered Class A assets –– exactly the type of real estate said to be more resilient to a market slowdown.

Generally, these borrowers have well-established relationships with lenders, said Mandell, CEO of Miami-based Tricera Capital. This affords them an ability to buy time with lenders and negotiate reprieves on payment due dates. But by now, the uptick in the dollar value of debt under foreclosure signals lenders are done extending and pretending.

“Maybe these owners made deals last year with their lenders thinking rates may come down this year. Now, they are in a little bit of a different situation, so the lenders are getting inpatient,” he said. “From a lender’s perspective, time is running out.”

The increase of the dollar volume subject to foreclosure is indeed a sign of impending trouble, said real estate attorney Sandra Ferrera. Larger loans equate to bigger monthly interest rate payments and to higher property carrying costs, such as insurance, maintenance and utilities. Naturally, these landlords are feeling the squeeze.

“It’s a trickle down effect,” said Ferrera, of Day Pitney. “The higher valued properties are more susceptible in the current economic downturn.”

Lenders who are done granting forbearance are more likely to target the larger loans on their balance sheets.

They “want to write that distress off their books first,” Ferrera said.

The biggest known foreclosure filing in South Florida since the Fed started increasing interest rates came in March. New York-based developer R&B Realty was hit with a suit claiming $101.7 million in unpaid debt tied to two loans on the Gateway at Wynwood office building and an adjacent retail space.

R&B completed the 14-story building with ground-floor retail in late 2021, amid industry excitement of Wynwood becoming “Silicon Valley of the South” due to leasing by California techies and venture capitalists.

As of last month, 59,000 square feet of Gateway’s 195,000 square feet of offices remains vacant, amid doubts that Wynwood would live up to the hype. A judge sided with the lender’s trustee in May, writing in his order that R&B is on the hook for $111.9 million, including interest and fees.

South Florida multifamily was the darling market of the past four years, as record demand pushed up rents by unprecedented rates. But more recently, demand has waned and small apartment buildings are feeling the sting.

A 57-unit apartment portfolio across Miami-Dade, including some buildings in South Beach, which has long enjoyed demand from the local hospitality workforce, is under foreclosure on a $2 million loan with a 10.95 percent fixed interest, records show. The borrower had obtained forbearance last fall but didn’t make the agreed-upon payment due in December, according to the complaint filed in May.

Miami-Dade is the only county that saw an uptick in the number of foreclosure suits, from 22 in the second half of last year to 33 so far this year, Vizzda’s data shows. Foreclosures dropped in Broward County from 13 to 8 and in Palm Beach County from 10 to five.

The Vizzda data is on judicial foreclosures and excludes Uniform Commercial Code foreclosures. In one such case, Coconut Grove-based CGI Merchant Group’s Gabriel South Beach hotel and Gabriel Downtown Miami at the Marquis condo are slated for auctions this summer. The South Beach property is tied to a $71.1 million debt and the downtown Miami one to a $7.6 million loan.

CGI said it’s in discussions with lenders and is “prepared to take all necessary steps to protect the rights of CGI and our partners.”

“We are determined that we will reach a resolution for each property that benefits all parties, despite Florida’s soaring insurance costs and the unprecedented interest rate environment,” the firm said in a statement.

Resilient, not immune

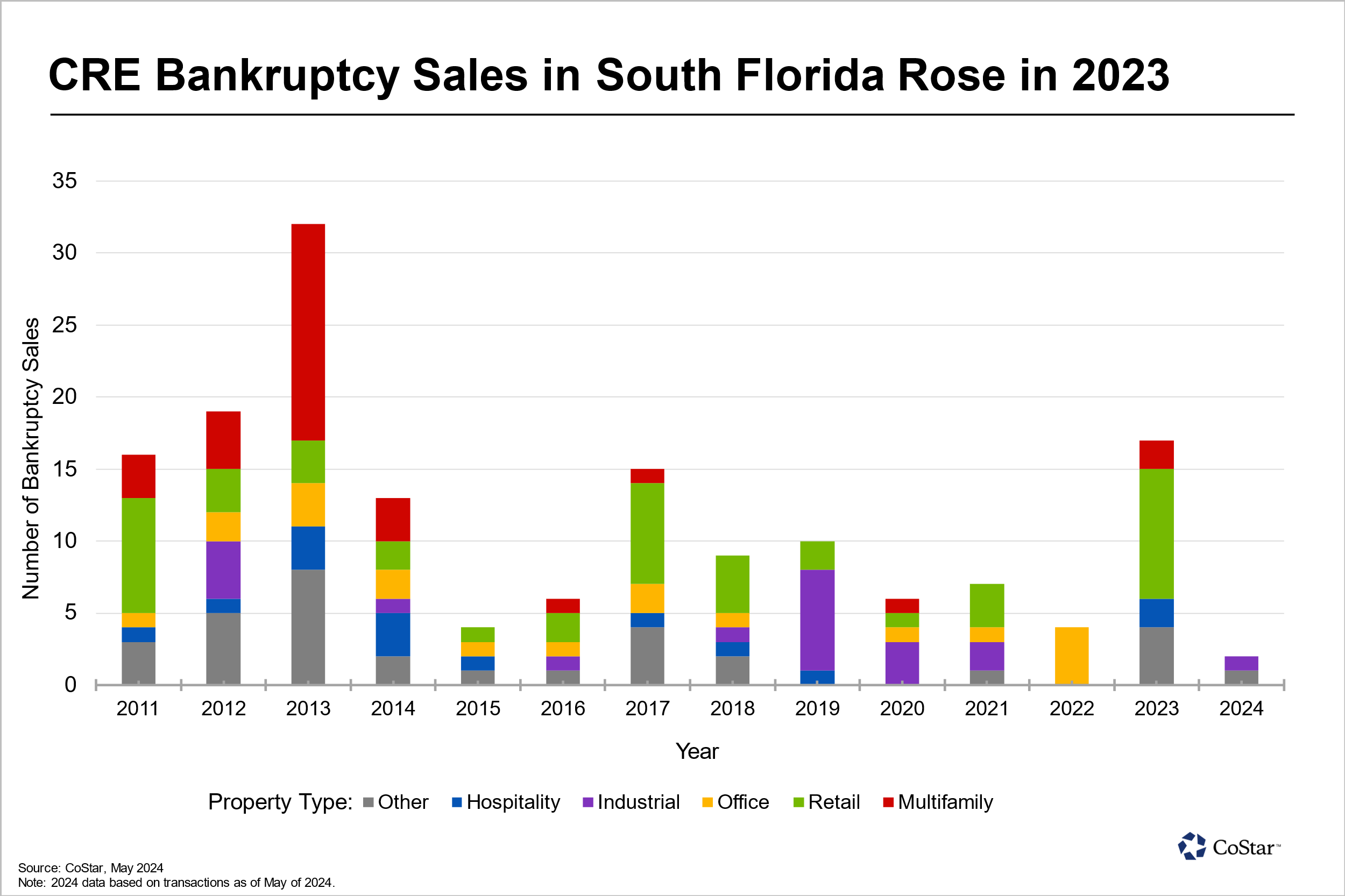

Last year, South Florida had 17 commercial property bankruptcy sales, the highest since 2014, according to CoStar data. So far this year, bankruptcy sales are muted but that’s expected to change.

“I still don’t think we are yet seeing the incoming wave that we will eventually see of overall bankruptcies in the market,” said Arias, the CoStar market analytics director, adding that he expects offices are most at risk.

Further complicating matters is the foiled expectation that interest rates would significantly drop in the near term. Despite hopes last year that the Fed would start dropping the benchmark rate this year, so far there’s been no reprieve and it’s unclear when it will come.

“We are not expecting any rate decreases this year,” said Scott Sherman, founder of Miami-based investment firm Torose Equities. “You will probably start to see more distress later this year.”

As a whole, South Florida undeniably remains a much healthier real estate market compared with the rest of the U.S., experts say. In that, the tri-county region is merely more resilient, though not immune.

“Even though we are a little bit of an outlier,” Ferrera said, “we are definitely not out of the woods.”

Francisco Alvarado contributed to this report.