South Florida real estate players became giddy in recent years over the influx of businesses and ensuing office leasing spree at record rents. The bonanza prompted an investment sales flurry, with buildings from Brickell to Boca Raton trading at ever-rising prices.

But that party ended. The Federal Reserve imposed 11 aggressive interest rate hikes, lenders turned skittish, and property expenses, especially insurance, skyrocketed, taking a toll on deals.

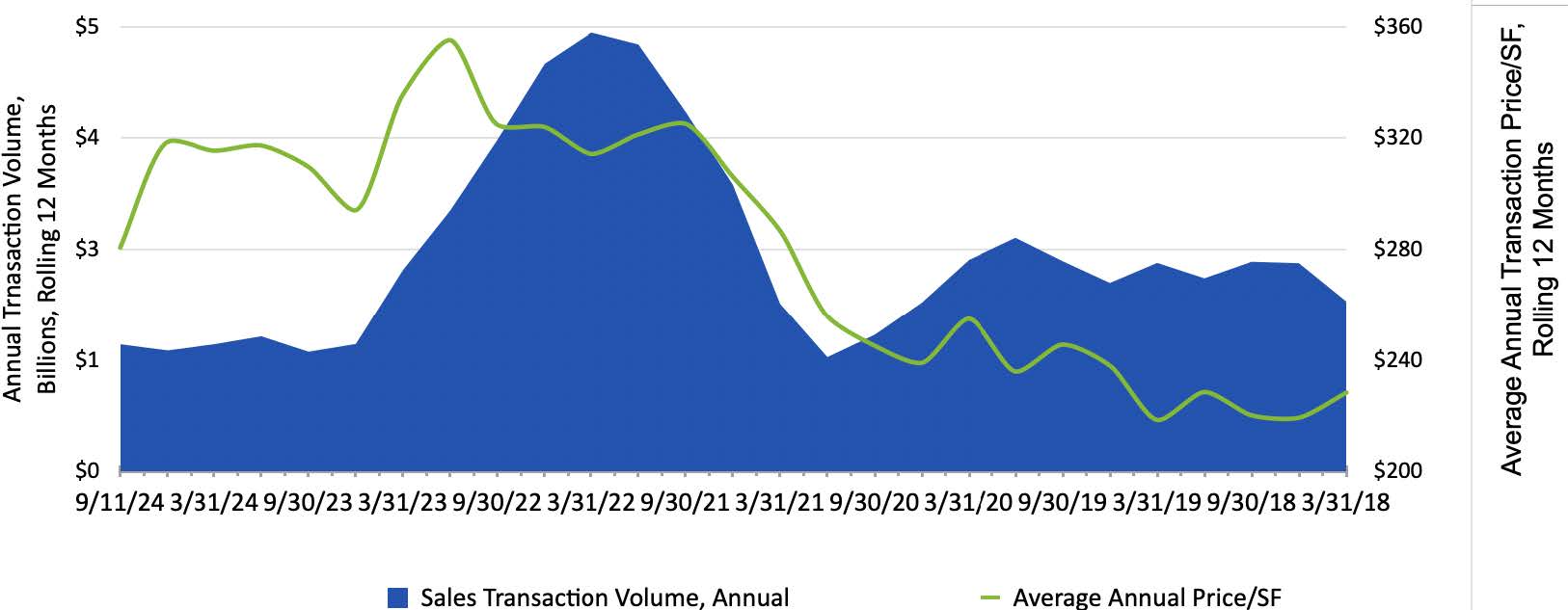

Investment sales are now down not only from the record years of 2021 and 2022, but also from the calmer 2018 and 2019, prior to the pandemic-induced frenzy, according to data from CoStar Group.

Deals dropping from record years was expected, as the boom was bound to run out of steam. But the decrease from slower pre-pandemic years shows the ramifications from economic woes are deep, contrary to optimists’ narrative that South Florida will remain an office market haven.

“The equity that is required to raise is very difficult to achieve for large deals,” said broker John Bell of Transwestern. “The smaller deals are trading, but at a reset pricing. And the larger deals are very few and far between.”

Yet, experts warn that deal volume isn’t a tell-all.

Average price per square foot is one measure of how office buildings’ values are holding up. This year, it’s topping that of 2018 and 2019 because South Florida is still reaping benefits from its reputation as an office mecca earned during the boom, brokers say.

“The price per square foot should be going up because the buildings have increased in value,” said broker Jeremy Larkin. “And you can’t take that part away.”

Still, this year’s average price per square foot has dropped from that of 2021 and 2022, CoStar’s data shows, as the market rush is over. The pipeline of new-to-market firms has turned off, and some firms that leased during the bonanza already backed out of South Florida.

“Miami,” Larkin said, “has jumped the shark.”

The breakdown

In the one-year period that ended on Sept. 11, South Florida investment sales totaled $1.4 billion, according to CoStar. That’s 34.5 percent and 45.8 percent less than deal volume in 2018 and 2019, respectively.

It’s also a 71 percent drop from the $4.9 billion in investment sales that marked a South Florida record in the year that ended in March 2022, CoStar shows.

The deal flurry was partly fueled by billionaires Steve Ross, who homed in on downtown West Palm Beach, and Ken Griffin, who picked Brickell as his playground. The biggest sale in 2021 was Ross’ $282 million purchase of the Phillips Point office towers in downtown West Palm. Griffin’s $286.5 million purchase of the 1221 Brickell tower in Miami was the top 2022 deal.

Even as the Fed started its interest rate hikes in March 2022, hype over South Florida offices lingered. But CoStar’s data shows that investment sales consistently decreased since then, dropping to $2.9 billion in 2022 and $1.5 billion last year.

A bid-ask gap emerged, with buyers unable to pony up as much as landlords expected for their well-leased buildings. Financing became more expensive due to higher rates, and became scarcer as banks blacklisted offices, including in South Florida. Investors pulled back on equity because they usually rank second in line to get paid, and steered clear of offices.

Sellers are often funds with a deadline to divest, experts said. Others faced debt trouble.

Brookwood Financial Partners’ $325.4 million loan on a nationwide office portfolio went into special servicing last year due to the firm’s failure to meet the required debt yield to extend the maturity a year. To pay down the senior loan, the Beverly, Massachusetts-based private equity investor started selling off portions of the portfolio.

Last month, Brookwood sold Commercial Place I and II at 3230 and 3250 West Commercial Boulevard in Oakland Park for $26 million. The firm had paid $23.5 million for the properties in 2015, according to records.

Others are settling for discounts. In April, Starwood Capital Group sold a four-building suburban office portfolio in Miramar for $45 million, 45 percent less than the firm had paid in 2015. Buyer YMP Real Estate Management secured a $31 million loan for the purchase at a fixed interest rate of a “normal” 6.95 percent from Banco do Brasil Americas, according to Moshe Popack, co-founder of YMP.

The complex, consisting of Miramar Centre I and III and Huntington Centre I and II buildings, was 75 percent leased at the time of sale and had an “extremely high” cap rate of 11 percent, Popack said. YMP is betting on an upside, including increasing occupancy to 85 percent.

Popack argues that values have nowhere to go but up. “South Florida office has the greatest potential for appreciation,” he said.

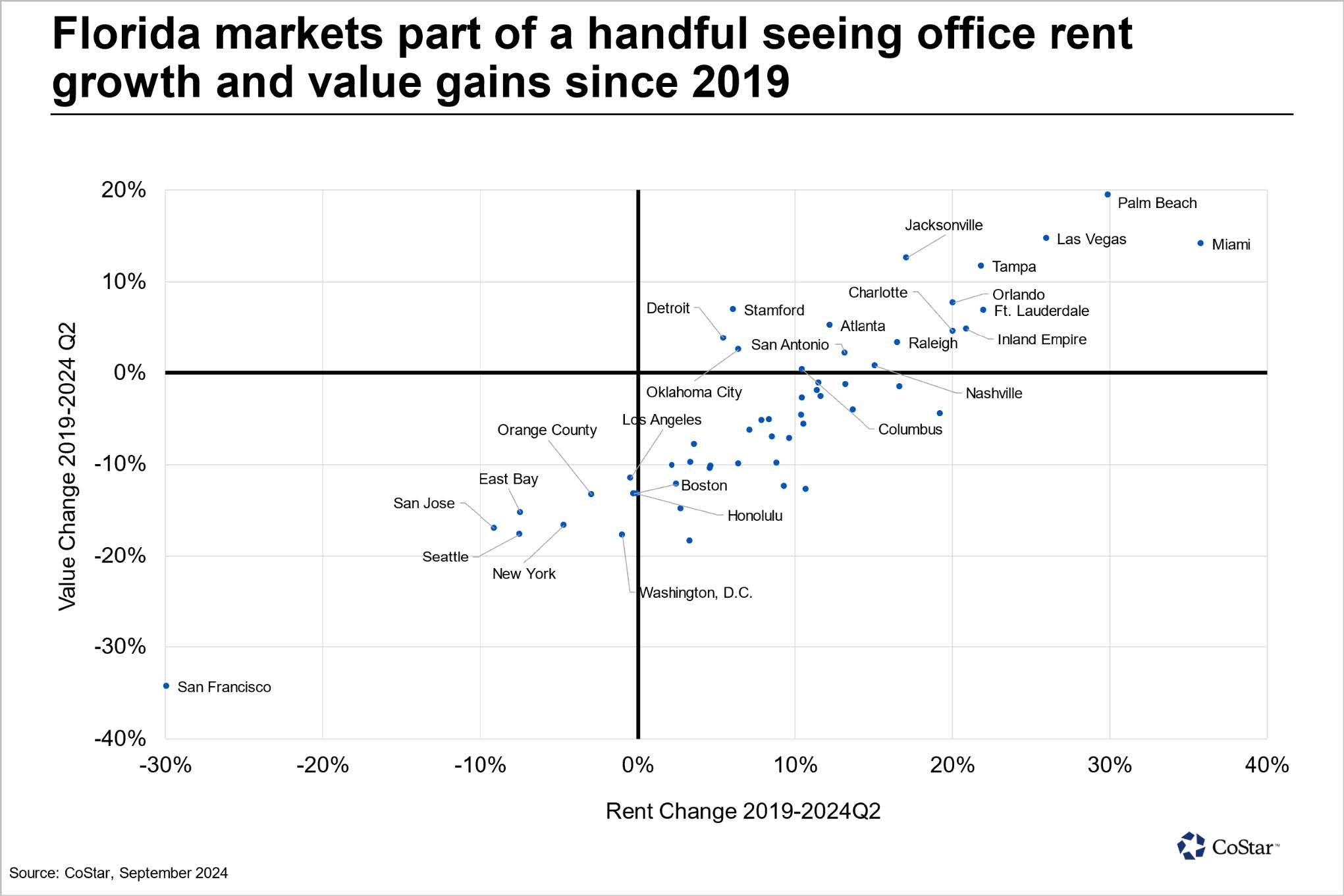

According to CoStar’s data, South Florida occupancy and rents have remained strong, even as investment sales nosedived.

Buildings that traded during the year ended Sept. 11 had an average price per square foot of $281. That’s 23 percent and 19 percent more than the average price per square foot in 2018 and 2019, respectively, CoStar shows.

Only Broward County had a drop in the average price per square foot in the third quarter compared with the same time period in 2019, Avison Young data shows. The county hasn’t attracted as much investment as Miami-Dade and Palm Beach counties.

But it’s also a 21 percent drop from the record $355 average price per square foot during the 2022 boom.

That was expected, said Juan Arias, CoStar’s South Florida market analytics director, adding that higher interest rates pushed up treasury rates. “If the 10-year treasury is up, that pushes cap rates up,” Arias said “If cap rates go up, values of properties go down.”

The future

Real estate players are hopeful about the Fed’s planned interest rate cuts this year. The Fed delivered the first drop of a half point on Wednesday.

But incremental rate drops won’t make a big difference in investment sales, Arias said. If big rate drops come, it would signal a wider economic slowdown, which also doesn’t bode well for office real estate.

That’s because rate drops are expected to be too small to make a difference in financing. If big rate drops come, it would signal a wider economic slowdown, which also doesn’t bode well for office real estate, according to Arias.

More distressed deals are in the pipeline next year, he added. Landlords with fixed interest rate loans and healthy occupancy and rents will continue to hold their buildings. But those with floating rate loans or maturing debt will feel the squeeze, potentially prompting discounted sales.

“We will start to see a few of these distressed transactions trickle into the market,” Arias said. “I don’t see a significant recovery [in investment sales]. It will take time, and it will be a matter of years. … It’s a tough situation for offices.”