As Hurricane Helene churned toward Florida, property owners and insurers braced for the impact from another devastating and costly storm.

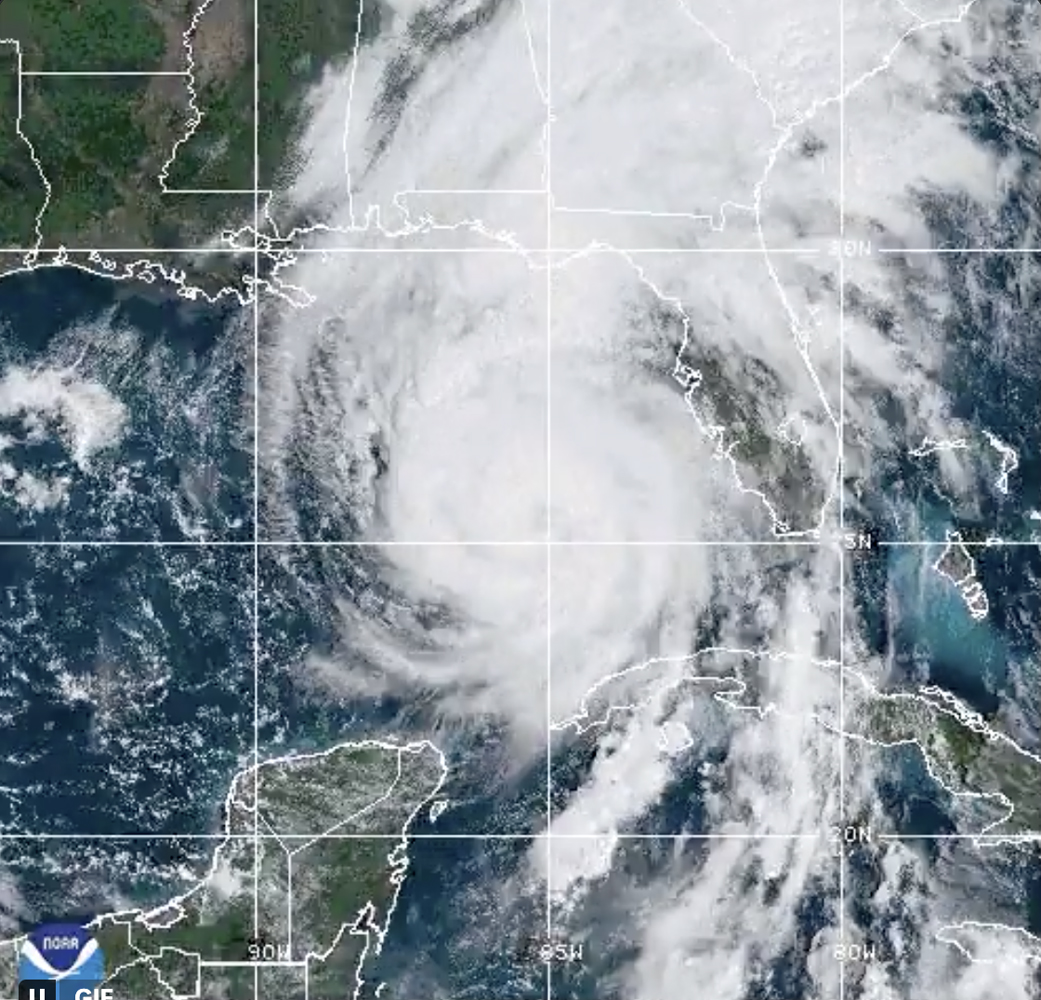

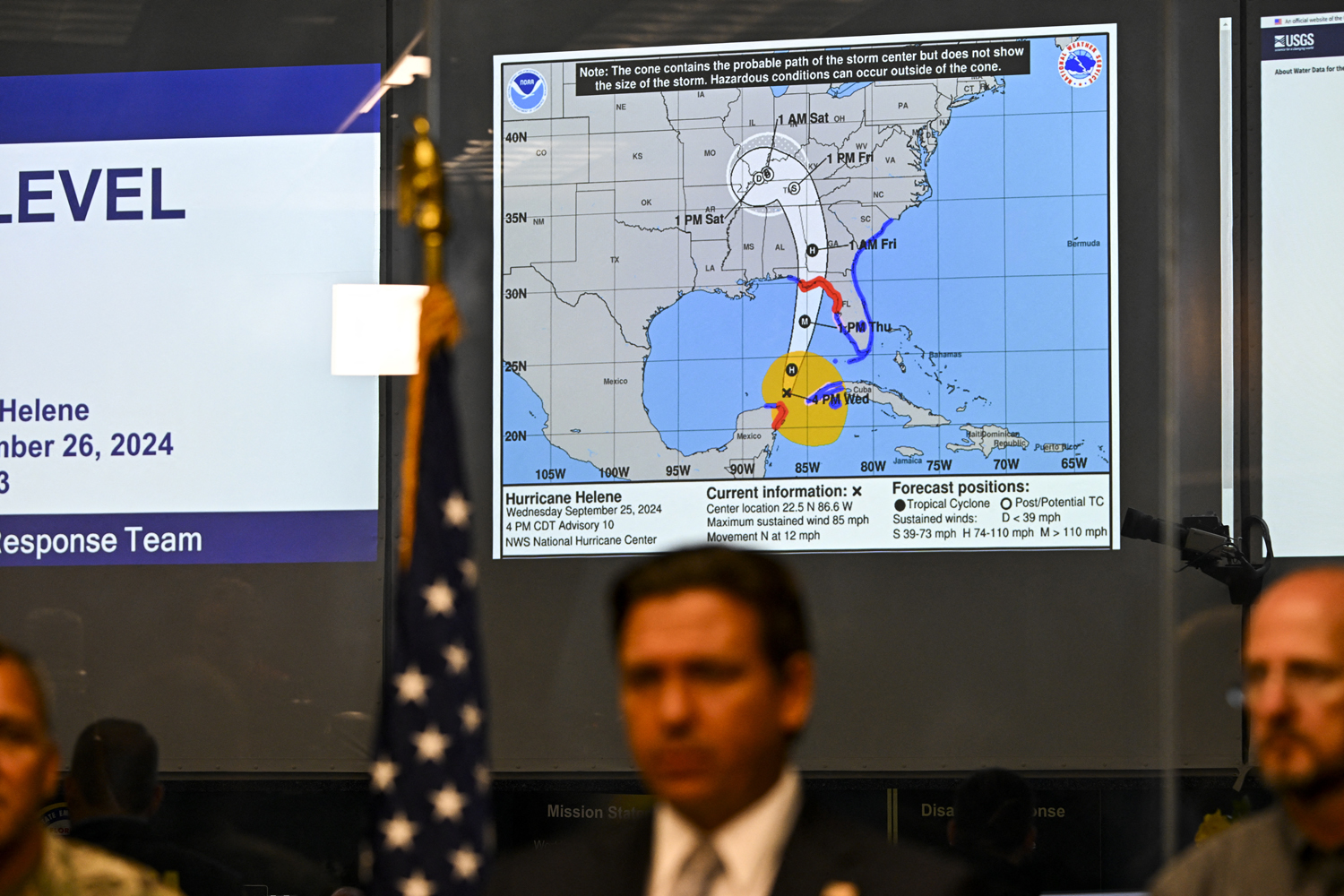

The Category 3 hurricane, which is expected to make landfall Thursday evening in the Big Bend region of Florida as a Category 4, could cause catastrophic storm surge of up to 20 feet above ground in some areas, according to the National Hurricane Center. Gov. Ron DeSantis issued a state of emergency for 61 of the state’s 67 counties.

Helene could cause billions of dollars in damage as it makes its way up the Gulf Coast, and throughout the Southeast, also affecting Georgia, the Carolinas and Tennessee.

In Florida, nearly 25,000 homes with a combined reconstruction value of $5.6 billion are at risk of storm surge flooding, according to CoreLogic. That includes about 7,073 residential properties in Tallahassee and 17,587 homes in Homosassa Springs’ metro area.

Nearly 162,000 commercial properties in Florida and Georgia valued at $425.9 billion are in the direct path of the hurricane, according to Moody’s.

Hurricanes have been a major factor in the unbridled rise of property insurance premiums across Florida, including in coastal areas. Major payouts following storms that wreak havoc to real estate have led underwriters to either raise premiums or exit the Sunshine State altogether. This has strained residential and commercial property owners’ budgets.

Historically, a Category 3 or higher storm hitting the Panhandle has caused insured losses in the low single-digit billions of dollars, according to a Helene advisory report issued by Gallgher Re.

“But Helene is not a typical storm,” the report states.

Because of its large size –– with hurricane winds extending 60 miles from the storm’s eye and tropical storm winds extending 345 miles –– it’s expected to bring winds and storm surge to the heavily populated Tampa Bay region. As a whole, preliminary expectations are for private insured losses from $3 billion to $6 billion on various types of policies, according to Gallagher Re, the reinsurance business of Arthur J. Gallagher.

Losses from the National Flood Insurance Program and the U.S. Department of Agriculture’s crop insurance program could be close to $1 billion, Gallagher Re projects.

“There’s going to be a lot of flood damage, and if covered at all, it’s covered by [the National Flood Insurance Program],” said Miami attorney Fred Karlinsky. Still, rising reinsurance rates will likely affect policyholders in the state, he said.

Complicating matters is that residential development on flood-prone areas in Florida has been robust. Over the past two decades, half of the development on floodplains across the U.S. was in the Sunshine State. Construction in these low-lying areas translates to more flood damage.

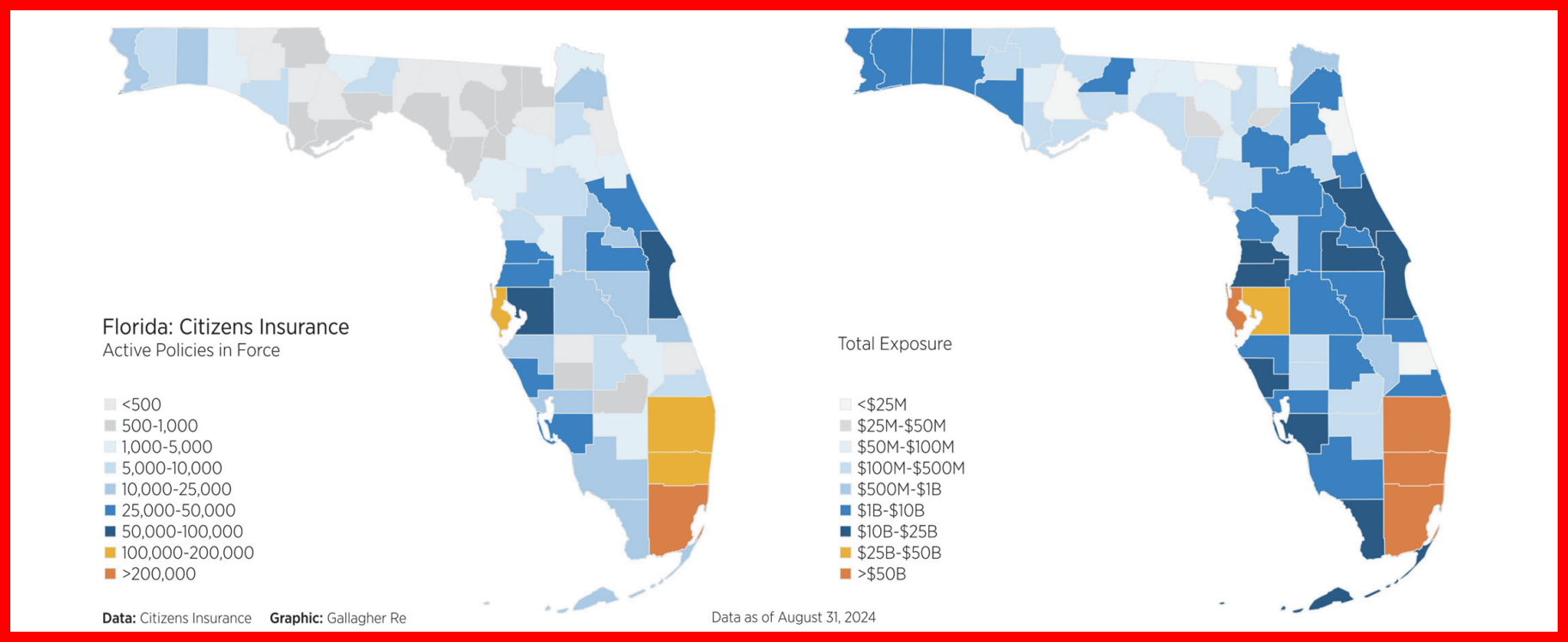

The effects on Citizens Property Insurance, Florida’s state-run property insurer of last resort for homeowners who can’t obtain coverage elsewhere, will be limited if Helene remains on its projected path toward the Big Bend, Gallagher Re says. Most of Citizens’ 1.3 million policies are in heavily populated and developed areas such as Tampa, Orlando and South Florida.

Karlinsky, who leads Greenberg Traurig’s Insurance Regulatory and Transactions Practice Group, said the private insurance market in Florida is in a better position to absorb losses from a storm like Hurricane Helene because of changes in state law that make it more difficult for homeowners to sue their insurers. The legislation aimed to crack down on frivolous lawsuits, which made the insurance situation worse in Florida. But those lawsuits didn’t cause record losses and escalating premiums, according to a report released this year by the state’s Office of Insurance Regulation.

Naples Bay has crested and started to flood downtown Naples, Fl. @winknews #HurricaneHelene #FLwx #swfl @StormHour pic.twitter.com/WHS1sVXcHY

— Chuck 🇺🇲 🇺🇸 🚤🌞🐊🌴 (@chuckbender66) September 26, 2024

After the significant premium hikes of recent years, insurers finally “feel they are bringing in enough premium dollar for the exposure that they are insuring,” said Keith Carroll of Acentria Insurance. Helene making landfall in a less developed part of Florida would minimize insured damages, said Carroll, who focuses on residential insurance and policies for condo and homeowners associations.

Still, a storm that hits anywhere in the Southeast U.S. can impact policyholders in Florida, Carroll said. “Hopefully, we can make it through the rest of the season without being hit by any storms. … If we avoid that, I think people will start seeing [insurance] rate relief moving forward.”

Read more