UPDATED, 1:20 p.m., Sept. 20: To back its instant home-buying program, Zillow Group opened two credit lines with Credit Suisse and Citibank over the past 14 months totaling $1 billion.

The revolving debt pushed the Seattle-based company’s borrowing to a record level as its earnings fell nearly 75 percent in the first half of 2019 to just above $26 million. Zillow then doubled down last month, when its executives announced plans to sell $1.1 billion in corporate bonds to help fund its iBuying operations.

The online real estate firm’s rising leverage is a big flag to many — especially with signs of a looming recession that could hammer the U.S. home-buying market way before the outstanding debt’s paid off.

Analysts say if a downturn hits the housing market in the next year or so, Zillow takes a double hit: Its advertising would suffer from a reduction in home sales, and the company would take a loss on the value of the unsold homes it’s stuck with.

“This time around, compared to the last cycle, Zillow has more risk from the amount of leverage on its balance sheet,” said Justin Patterson, an analyst at Raymond James who covers the company.

READ MORE IN THIS SERIES:

Others in the real estate industry and broader corporate America have also voiced concerns.

U.S. corporate debt rose to $9.8 trillion in the fourth quarter of 2018, roughly 47 percent of the national GDP, according to the Federal Reserve. Low interest rates have made cheap money readily available to large public companies, and as the economic cycle wears on, everyone from the Federal Reserve to Wall Street analysts is sounding the alarm that such heavy credit loads are ticking time bombs in the face of a downturn.

All in all, however, the U.S. real estate industry is far less saddled with debt than it was 10 years ago, when many companies got crushed under their leverage when things turned south.

But many firms — including Zillow, SL Green Realty and Mack-Cali Realty — still rely heavily on debt either to fuel new growth or as a holdover from the last cycle. And there are a number of investment-grade companies with credit ratings on the edge of junk status that risk becoming so-called fallen angels if their ratings drop.

Morris DeFeo, chair of the corporate department at the New York-based law firm Herrick Feinstein, said lenders are competing so vigorously to win borrowers’ business in 2019 that it’s hard to remain disciplined when it comes to leverage.

Morris DeFeo, chair of the corporate department at the New York-based law firm Herrick Feinstein, said lenders are competing so vigorously to win borrowers’ business in 2019 that it’s hard to remain disciplined when it comes to leverage.

“There’s almost like a FOMO moment when it comes to the debt markets,” he said, referring to the anxiety some feel when they look at their friends’ Facebook and Instagram pages.

“It’s kind of hard to say ‘no’ when somebody puts a pile of money in front of you with very loose covenants and very good rates,” DeFeo added.

Credit bondage

The We Company’s impending Wall Street debut is a real estate play that will likely be backed by a massive credit line when it happens.

The startup — which recently delayed its IPO and capped CEO Adam Neumann’s power “in response to market feedback” — is reportedly in talks with JPMorgan to lead $6 billion in financing to fuel growth after going public. That’s quite a sum, considering the co-working company lost $900 million on earnings of $1.54 billion in the first six months of 2019. It also slashed its valuation by more than half in September.

“Every single company in this space has gone broke,” real estate investor Sam Zell told CNBC in September — pointing to WeWork’s disclosure of net losses and its pattern of “creating long-term liabilities and short-term assets.”

Above and beyond iBuying and flexible office space, the International Monetary Fund and other organizations have been flagging the dangers of corporate debt for more than a year now.

There’s also been a steady rise in lending from private equity firms, debt funds and other alternative players that tend to charge higher interest rates than traditional banks. Nonbanks had more than half a trillion dollars’ worth of outstanding loans to midsize companies at the end of 2017, according to estimates from Ares Management cited in the Wall Street Journal. That’s up from roughly $300 billion in 2012.

There are a variety of ways that public companies can borrow from bank and nonbank lenders, including credit facilities (similar to giant credit cards) and loans secured by company assets (similar to large mortgages taken out on properties). Many companies also turn to the corporate bond market — where some of the world’s largest firms issue more than $1 trillion a year.

To be sure, real estate plays a relatively small role in driving U.S. corporate debt through bond sales, while the biggest issuers tend to be Fortune 500 behemoths like Ford Motor and General Electric.

Telecom giants that spend huge sums building out infrastructure, including AT&T, Verizon and Comcast, have been the biggest drivers behind this cycle’s debt. Of the roughly $1.4 trillion in new bonds last year, meanwhile, REITs issued about $25 billion, according to figures from the National Association of Real Estate Investment Trusts. That’s just slightly more than 2 percent of the total.

In the real estate world, Simon Property Group and Prologis issue the most bonds.

When it comes to overall leverage, though, SL Green and the cell phone tower REIT SBA Communications have the highest net debt-to-earnings ratios among the 30-plus real estate firms in the S&P 500, according to figures from S&P Global Market Intelligence.

Both firms’ debt levels are close to 10 times their earnings before interest, taxes, depreciation and amortization, while the rest of the S&P-listed real estate firms hover at around six times.

But Sandler O’Neill analyst Alexander Goldfarb said he didn’t see leverage as an issue for SL Green or its main competitors.

“Coming out of the credit crisis, the REITs effectively resized their balance sheets,” Goldfarb said. “Most of the companies have gotten better.”

Red lines

Other public real estate firms are dealing with debt levels that could come back to bite them as the economy loses steam. In the homebuilder space, both Hovnanian and Beazer Homes remain highly levered.

“Those two were left over from the last recession,” said Ivy Zelman, CEO of the housing industry research firm Zelman & Associates. “They never really cleaned up their act.”

And some firms, like Zillow, have piled on debt late in the cycle.

As Zillow moves ahead with the latest funding rounds to support its iBuying platform, one priced at $600 million that matures in 2024 and the other priced at $500 million that matures in 2026, observers say it could end up with a large portfolio of unsold homes.

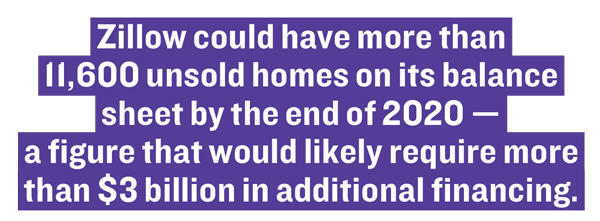

Guggenheim Securities analyst Jake Fuller calculated that Zillow could have more than 11,600 unsold homes on its balance sheet by the end of 2020 — a figure that would likely require more than $3 billion in additional financing.

Short-seller Steve Eisman, who famously predicted the subprime housing crisis, has even taken a short position in the online real estate company, and cites Zillow Offers as a weak link when a recession hits and home-buying dries up.

At the same time, many economists and industry analysts are forecasting a significant downturn in 2020 or 2021. Guggenheim predicts that the next recession won’t be as severe as the last one but could be more prolonged than usual because policymakers have fewer tools at their disposal to help spur the economy.

A spokesperson for Zillow said the company doesn’t think it’s overleveraged and that “the additional capital we raised recently will provide us with increased strategic flexibility and enable us to scale our businesses even more quickly and efficiently.”

Zelman said that while Zillow Offers is attractive to buyers and sellers who want to simplify the process, the company ties up too much capital in the homes it holds.

“From a business model perspective, we’re more skeptical,” she said. “What does this look like in an environment where housing is softer or you’re in more of a buyer’s market versus a seller’s market?”

Ratings slide

New Jersey-based Mack-Cali is another company that’s struggling under the weight of its debt, which may only grow larger.

High vacancies in the REIT’s assets — including office properties in Jersey City and suburban office parks — have driven down the company’s ability to service its debt.

Moody’s downgraded its credit rating for Mack-Cali in December. And in the past year and a half, Fitch has lowered its rating on the company twice.

One of the main reasons is Mack-Cali’s leverage, which stood at roughly $2.7 billion, 9.3 times its earnings, at the end of the second quarter.

“Aside from challenges in their portfolio and where their portfolio is located, they have very high leverage [compared to] their peers,” said Moody’s analyst Philip Kibel.

Poor credit ratings have become an Achilles’ heel for many companies as the corporate bond market expanded in the years since the recession: The largest growing sector of bonds — rated BBB — are just a step above junk status.

Once a company gets downgraded and slips into junk status, it essentially gets cut off from the public markets to secure new debt. And while the number of investment-grade REITs has grown in recent years, there’s still a large chunk near the bottom of the barrel.

Brookfield Property REIT, which the global real estate giant Brookfield Property Partners launched to hold its retail properties after its $15 billion GGP takeover last year, received lower-grade ratings and has been slow to change them.

Moody’s analysts noted that the REIT has strong properties and a stable outlook. But some are concerned it may need to rely on its $1.5 billion credit line to balance cash shortages, and possibly to pay dividends. The company’s “deleveraging will continue, albeit at a slower pace than originally anticipated,” according to Moody’s.

Credit analysts also took Vornado Realty Trust down a notch to BBB in May, after it sold a large retail portfolio stake to Crown Acquisitions for $1.2 billion. S&P said that the sale left Vornado’s competitive position “somewhat weakened,” as it impacted operating margins and reduced the firm’s scale and asset diversity.

And while companies like Brookfield and Vornado have huge balance sheets that help ease concerns over leverage, many smaller players are more exposed — especially in troubled sectors like retail.

When Nicholas Schorsch’s Vereit, one of the country’s largest owners of single-tenant commercial properties, went public in 2015, it got a noninvestment-grade credit rating. ( Vereit was the successor to American Realty Capital, which was mired in an accounting scandal.)

Likewise, Blackstone Group in 2013 spun off retail REIT Brixmor, whose credit ratings have been stuck on the verge of junk status since then. This summer, Brixmor’s former CEO and CFO were charged with accounting fraud for allegedly fudging the company’s income numbers.

A handful of mall operators, including CBL Properties and Washington Prime Group, have also seen their ratings slip.

“In some cases, we’ve seen three-notch downgrades,” said Fitch analyst Steve Boyd. “The issue with [Class] B malls is that they’ve really lost access to the secured mortgage markets.”

Debt diets

Shopping mall owners aren’t the only ones watching their leverage.

Realogy, the country’s largest residential brokerage, for example, had $3.4 billion worth of corporate debt in the fourth quarter of 2018 as its deal volume fell and its profits slid nearly 6 percent. That put the firm’s leverage at 4.6 times its earnings.

Tim Gustavson, Realogy’s interim chief financial officer, said in a statement to Inman News in February that given the “uncertain housing market … you will see us focus on debt paydown.”

Other publicly traded real estate firms are beginning to take similar measures.

Since November, Boston Properties has sold $1.8 billion worth of green bonds to finance projects like the LEED-certified Salesforce building in San Francisco — the tallest U.S. office tower west of Chicago.

But despite the office REIT’s activity in the debt markets, its CEO, Owen Thomas, said he plans to dial that back. With U.S. economic expansion and corporate debt both at record levels, Boston Properties’ appetite for leverage is gone, he said on the firm’s most recent earnings call.

“We don’t want to increase our leverage,” Thomas said, “given where we are with the economy.”

This story was updated with the latest news of WeWork’s IPO status.