As Wynwood blossomed into one of Miami’s hottest spots to visit in recent years, the neighborhood seemed immune to the calamity afflicting the retail sector across the country. Rents soared as trendy boutiques, head shops, casual dining spots and bars — all largely catering to a tourist clientele — filled empty storefronts converted from raggedy warehouses. But over the past 18 months, Wynwood’s retail market has started to show signs of a slowdown as construction of new retail spaces puts negative pressure on vacancy and rental rates.

With a development boom underway that will add at least a dozen apartment, condo and office buildings, the trendy district is morphing from a tourist destination into a more solidly residential neighborhood, and Wynwood’s ability to diversify its retail mix will soon be tested by that shift.

Can Wynwood welcome dry cleaners, community banks, hair salons and storefronts that thrive on local customers? Or will Wynwood become an urban version of Lincoln Road Mall, where only top national brands can afford to lease spaces? Those are questions facing developers, landlords and commercial brokers as retail spaces in new buildings vie against existing storefronts converted from old warehouses.

READ RELATED STORIES

— Movers & Shakers: Jon Paul Perez and others join Wynwood BID & more

— Co-living development for the creative class is coming to Wynwood

— Little Havana could be redeveloped like Wynwood

A 2018 Downtown Development Authority demographic study shows that last year, Wynwood’s residential population was an estimated 1,576 individuals. The delivery of 464 new residential units by the end this year could nearly double Wynwood’s population by adding 1,206 potential new residents, according to the Wynwood Business Improvement District’s 2018-2019 market report. “The added daytime and full-time population will impact the nature of some of the retail tenants, which currently cater mostly to a transient customer base,” the report states.

At the same time, the neighborhood has lost a few pioneering millennial brands as a result of the slumping retail industry. In March, Detroit-based watch and bicycle maker Shinola closed its showroom at 2399 Northwest Second Avenue before reaching its fourth anniversary in Wynwood. Men’s online clothier Bonobos and sports casual store Kit and Ace also recently shuttered their stores there.

Spokespeople for the three retailers declined to comment, but commercial brokers in the Wynwood area said Shinola left due to the company shifting its business strategy to focus on its Midwest and Northeast operations, as well as the property owner, JSRE Acquisitions, wanting to more than double the rent.The broker for JSRE, Tony Arellano, a principal with DWNTWN Realty Advisors, maintains that the brand moved only because of a shifting retail strategy. In either case, the vacancy leaves a hole for a new, innovative brand, or perhaps a staid but necessary provider of essentials for new residents.

“Wynwood’s primary customer is someone who is an entertainment destination user,” said Joe Furst, chair of the Wynwood Business Improvement District and a neighborhood developer. “That is going to shift as the physical landscape starts to change, once these new residential and office buildings like the one I am developing are completed.”

Furst is principal of Place Projects, which partnered with Chicago-based real estate firm Sterling Bay to develop 545 Wyn, a 10-story office and retail building set to rise on 26th Street and Northwest Fifth Avenue. “You will start to see more dry goods and service-oriented retailers open in the district,” he said. “There are pockets of Wynwood that yet to be developed and built where rents are very low compared to the average asking rents in the neighborhood.”

Falling flat

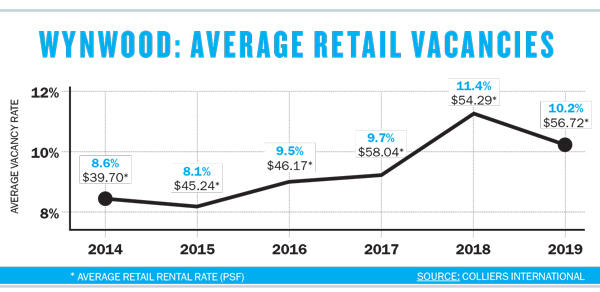

Data suggests the Wynwood retail market is hitting a plateau in the midst of all the new construction. In the past five years, developers have added 233,000 square feet of new retail space to the area, according to a recent market analysis by Colliers International. Another 114,121 square feet is under construction. Vacancy rates have been steadily climbing into the low double digits as rental rates have started to dip after a healthy growth spurt between 2014 and 2017.

Five years ago, the average asking rent started at $39.70 a square foot, according to Colliers. In 2017, it peaked at $58.04. Today, landlords’ starting average is $56.72 a square foot.

Landlords jacked up rents too fast, which contributed to the exodus of tenants, according to the Wynwood BID report. “It’s not that these concepts didn’t work,” said Dave Preston, an executive managing director with Colliers. “It was more a matter of escalating rents didn’t make sense for their business models.”

Landlords jacked up rents too fast, which contributed to the exodus of tenants, according to the Wynwood BID report. “It’s not that these concepts didn’t work,” said Dave Preston, an executive managing director with Colliers. “It was more a matter of escalating rents didn’t make sense for their business models.”

Rents tripled in parts of Wynwood between 2014 and 2017, with some blocks crossing the $100-a-square-foot threshold, according to the BID. Along Wynwood’s main drag, Northwest Second Avenue, some landlords are seeking rents in the $90 to $110 range, Preston said. On some side streets, rents are between $65 and $90. “You have some owners who have come in recently and paid peak-of-the-market prices,” Preston said. “They need those high rents to meet their pro formas.”

For instance, JSRE Acquisitions paid $35.3 million in 2016 for three commercial buildings that included the Shinola space, and it has been seeking a tenant to replace the Detroit watchmaker for the past seven months. According to a December 2018 listing on the commercial real estate website Loopnet, the New York-based real estate investment firm was asking for $170 a square foot and a minimum 10-year lease term. Arellano of DWNTWN Realty Advisors, which brokered the sale three years ago and is handling the listing, said that the price is negotiable and his team has turned away about 10 offers.

“We’ve had bids for $160 a square foot triple net that we have turned down,” Arellano said. “When we sold the Shinola building, the rents were about $60 a square foot triple net. We told the new owner it was a $100-a-square-foot market.”

Arellano said he’s not worried about the vacancy rate creeping up and the average asking rent price plateauing because the artsy district has one of the highest foot traffic counts in Miami.

“Wynwood is a landlord’s market,” he said. “We get retailers saying they are a great brand and they want to do percentage rents. We tell them that we appreciate their interest and then put their name in a file.”

Still, the neighborhood has also proven it can be an incubator for homegrown businesses, Furst pointed out. He noted that Panther Coffee, Zak the Baker and the Base clothing store are some of the early Wynwood settlers that are thriving amid the rising rents and market fluctuations. “A lot of these spaces turned out to be the pillars of Wynwood retail,” Furst said.

While Wynwood’s retail market is experiencing a pullback, Furst said it will quickly bounce back once new buildings are completed and new tenants can actually move in. “I think the vacancy rate for turn-key space is relatively low. That said, you see a lot of for-lease signs because owners are waiting for the right tenants.”