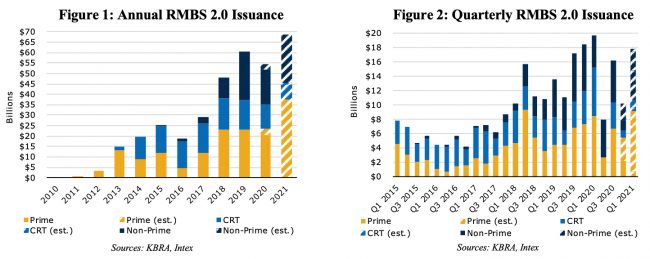

With nearly $20 billion in loans issued, the first quarter of 2020 was the residential mortgage-backed securities market’s strongest quarter since the 2008 financial crisis. But then came Covid-19, which brought several years of rapid expansion to a halt.

Total RMBS issuance for 2020 is now expected to reach $55 billion, according to a recent report from Kroll Bond Rating Agency. That’s down 10 percent year-over-year, and down more than 20 percent from the $70 billion that Kroll analysts had forecast in late 2019.

While the nation continues to grapple with the economic fallout of the coronavirus pandemic, low mortgage rates and booming home prices mean the RMBS market may be set for a rebound in 2021.

“Mortgage rates are generally expected to remain low for some time, incentivizing refinance and purchase activity, while housing supply is expected to remain low,” Kroll analysts write in the report. “Delinquencies relating to COVID may continue their decline, especially as payment deferrals increase, while the performance of borrowers on such plans will be a key factor in the overall recovery of mortgage performance for this segment.”

The prime RMBS sector is expected to come back strongest with issuance rising by 60 percent, while the non-prime sector may recover at a slower rate, with issuance rising around 23 percent. Meanwhile, credit risk transfer (CRT) securities, which are issued but not guaranteed by Fannie Mae and Freddie Mac, could see issuance decline by 35 percent as the agencies’ regulatory future remains unclear.

In sum, Kroll’s predictions have RMBS issuance increasing by 27 percent to nearly $69 billion in 2021, with prime securities accounting for more than half of the total.

Read more

Existing RMBS loans have also faced greater stress amid the pandemic, with delinquency rates spiking in the summer and gradually recovering since then. At the peak, more than 5 percent of prime RMBS loans and more than 20 percent of non-prime RMBS loans were at least 30 days delinquent, according to the report.

The fallout of the pandemic also led Kroll to take its first downgrade actions against RMBS transactions in its 10-year history. Delinquency rates remain well above historical levels after coming down from their peak, and loan modification rates have continued to rise in recent months.

“Performance among borrowers who have received payment deferral will be an important post-pandemic indicator for COVID-affected loans,” the report notes.