Real estate prices in the U.S. have risen at a steady pace since the last recession, and even a pandemic didn’t slow things down much in 2020, according to a new report. But your mileage may vary depending on the asset class you’re interested in.

Real Capital Analytics’ US National All-Property Index ended 2020 up 7.8 percent year-over-year, with a late surge following a mid-year slowdown. Growth was particularly strong for industrial and multifamily properties, which rose by 8.8 and 8.3 percent, respectively. Office prices rose by just 1.5 percent, and retail prices fell 4.3 percent

“In looking at the performance by property subtypes in 2020, it is clear the pandemic that hit the U.S. in early March had a sweeping negative effect on deal volume, with each subsector posting year-over-year declines,” RCA’s latest report states. “Pricing, on the other hand, has shown more variance, with some sectors faring much better than others.”

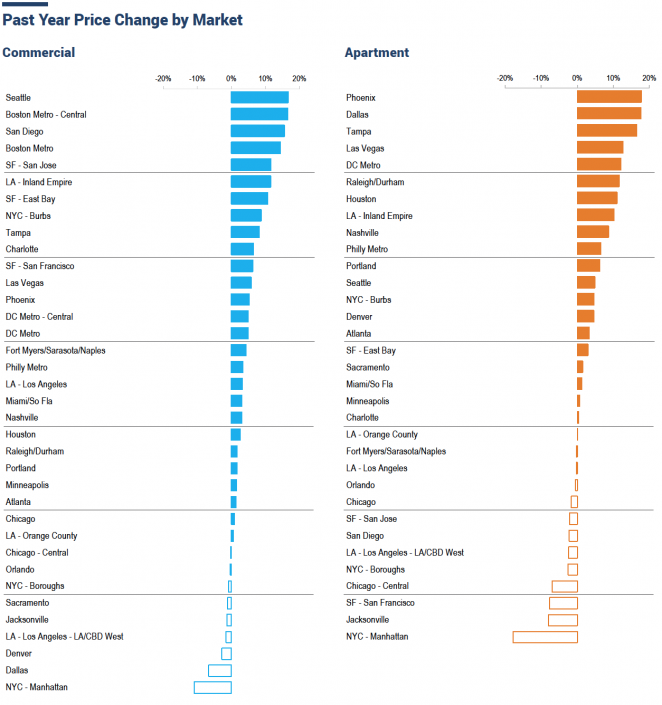

The spread between prices in the six major metros identified by RCA (New York, Los Angeles, Chicago, Washington, D.C., Boston, and San Francisco) and the rest of the country increased to its largest point in nearly a decade. While the price index in the six major metros increased by 3.7 percent, the growth rate for all other markets was more than double that, at 7.8 percent.

Growth in non-major metros has slightly outpaced that of major cities over the past cycle. The price index for the former rose 113 percent over the past decade, while that of the latter increased by 108 percent.

On both the commercial and multifamily fronts, Manhattan prices suffered the most, according to RCA’s data. New York’s outer boroughs also saw slight declines, while its suburbs experienced positive growth.

Through the first three quarters of 2020, Manhattan was also the most liquid property market in the U.S., and third worldwide behind only Paris and Berlin, according to a separate RCA report. The borough’s liquidity nevertheless hit a 10-year low, and was down 5.1 percent year-over-year at the end of Q3.

Meanwhile, despite some optimism due to the roll out of Covid-19 vaccinations, property prices could still take a beating if current financial pressures lead to more distressed asset sales, which so far account for just 1 percent of total volume.

“Nobody wants to take a loss on what is expected to be a temporary dislocation to income from the Covid-19 economic disruptions. … To the extent that they can, borrowers and lenders will continue to paper over problems in line with this optimism,” RCA senior vice president Jim Costello wrote in a report this month.

“Still, even with anticipation of a temporary dislocation, some investors and lenders will not be able to hold on even with the finish line for the pandemic in sight,” he added.

Read more