After 27 years at the company, Rocket Companies CEO Jay Farner is blasting off to retirement on June 1, the Detroit Free press reported.

William Emerson, who served as the mortgage lender’s CEO for 15 years prior to Farner, will take over on an interim basis until the board of directors hires a permanent successor. Emerson, 60, has been serving as vice chairman of Rock Holdings and vice chairman of real estate firm Bedrock.

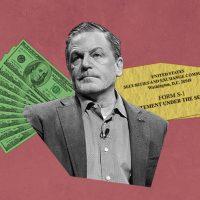

The 49-year-old Farner, who stepped down from the board of directors on Feb. 6, was Rocket Mortgage’s CEO since 2017, and has been Rocket Companies CEO since it went public in 2020. Rocket Companies serves as the parent of several real estate, mortgage, and financial companies, including Rocket Mortgage, Rocket Homes, Rocket Loans and Rocket Money.

The Federal Reserve’s efforts to battle inflation are taking a bite out of Rocket Mortgage’s core business, and shares in Rocket Companies are down about 50 percent since the company went public and closed at $9.02 on Thursday after opening at more than $18 in 2020, Barron’s reported.

Rocket Mortgages is struggling to find its footing in a rising rate environment, which went from about 3.5 percent to pushing 7 percent.

The upturn in mortgage rates has cooled demand for mortgage products, including the bread and butter of what used to be America’s largest home lender, refinancings. (United Wholesale Mortgage passed Rocket as the largest mortgage company in the nation, based on volume, the Detroit Free Press reported.)

The company has tried combating the decline by shifting its efforts to functions like selling mortgages and encouraging customers to pull cash out of their properties.

Rocket Companies’ profits in the third quarter of last year plunged 93 percent year-over-year, the Detroit News reported. Origination volume also plummeted 71 percent, to $25.6 billion, according to the outlet.

The company has not announced its full-year financial results.

— Ted Glanzer

Read more