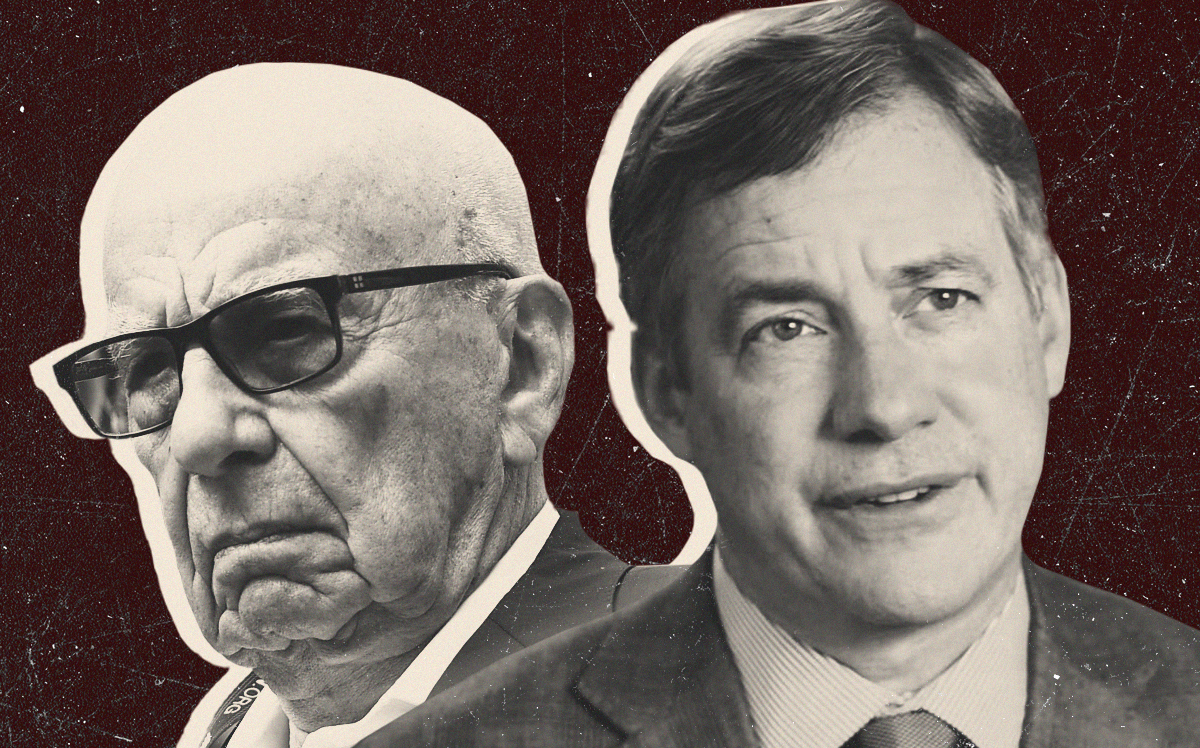

CoStar Group has ended talks with Rupert Murdoch’s News Corporation to acquire Move, Inc.

Chief executive Andy Florance revealed the potential deal was off during this week’s fourth-quarter earnings call. Florance did specify a reason for deal talks ending, but said the company was preparing to monetize its Homes.com platform.

Florance added that the company would continue to look at other merger and acquisition opportunities in both residential and commercial markets.

Murdoch’s company was reported last month to be in talks to sell the parent company of Realtor.com to CoStar Group in a deal that would’ve valued Move at $3 billion. That acquisition would’ve further entrenched CoStar in the residential space after it acquired HomeSnap and Apartments.com.

The company, which confirmed talks had ended, has received interest from other potential buyers, a person familiar with the matter told Bloomberg.

News Corp said earlier this month it will cut 1,250 jobs. Specifics about the layoffs were not disclosed, but the eliminations emerged after Move’s revenue fell by $23 million in the fourth quarter due to the housing market’s broader slowdown.

The company in its earnings report confirmed it was engaged in talks with CoStar about a potential sale, saying “any transaction would be designed to create shareholder value and strengthen Realtor.com’s competitive position.”

Other parties have reportedly expressed interest in Move, according to the Wall Street Journal. In a statement, News Corp said it would “continue to actively assess opportunities to support the company’s strategy to optimize the value of its digital real estate services segment.”

CoStar has had a few near misses on the merger and acquisition circuit, spending more than $2 billion on residential plays since 2014. In 2020, the company struck a deal to acquire RentPath, a holding company for listings sites, out of bankruptcy. The deal fell through after the Federal Trade Commission sued to block the sale.

The company also attempted to buy CoreLogic, a leader in residential real estate data, before the company was sold two years ago to two private equity firms.

Read more