Signature Bank’s real estate lending didn’t lead to its failure, but its book of loans may be a cause for concern as the FDIC looks to sell the shuttered institution.

Signature was one of the largest lenders to rent-stabilized buildings, which have seen their values drop since New York state lawmakers passed reforms in 2019 limiting rent increases. The legislation drastically reduced the amount of money that lenders could make from these loans — and increased the risk of delinquency.

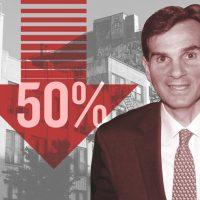

“Loans that were taken out through the end of 2018 were at peak valuations. Values are down 25 to 55 percent since then,” said Michael Weiser, president of GFI Realty Services, a brokerage that represents many landlords who borrowed from Signature.

“I’d venture to say there are a fair amount of problems there,” he added.

After the rent law’s overhaul, Signature executives downplayed its effect on their portfolio. But in the coming months, the impacts could start to hit home.

A typical five-year loan made in 2018 will mature this year, meaning many of Signature’s customers who borrowed against properties at peak value will be forced to refinance this year at lower values and much higher interest rates.

Signature was the third largest commercial real estate lender in New York City. About 46 percent of its commercial real estate loans went to rent-stabilized multifamily, according to data analysis by Maverick Real Estate Partners.

Many of these apartment loans were spread across Manhattan and the outer boroughs. Some went to generational families like Abraham Fruchthandler’s FBE Limited and Douglas Eisenberg’s A&E Real Estate Holdings.

But the bank also didn’t shy away from lending to more controversial landlords, such as Steve Croman and Raphael Toledano, who faced allegations of attempting to harass tenants out of rent-stabilized apartments to convert the units to market-rate.

It was also an active lender to Moshe Piller, who consistently landed on the city’s worst landlord watchlist.

Signature also lent to under-the-radar landlords like Sugar Hill Capital Partners, an investment firm founded in 2009 by David Schwartz and Alex Friedman that became one of the largest owners of rent-stabilized properties in Northern Manhattan.

Sugar Hill was a repeat borrower with Signature, sources told The Real Deal. In November, the bank initiated a foreclosure on a $16 million mortgage on Sugar Hill’s 54-unit building at 4300 Broadway in Washington Heights, which the landlord secured in 2016.

Signature’s 2022 filings with the Federal Deposit Insurance Corporation, however, hardly show any distress. Only 0.42 percent of its $19.5 billion in multifamily loans were marked as past due.

The bank was heavily concentrated in multifamily lending, but about 39 percent of its loans went to other commercial real estate, including office. The bank continued to lend to office owners even as other lenders pulled back because of the sector’s pandemic troubles.

Late last year, Signature provided a $155 million loan to Sage Realty and The Travelers Companies to refinance an office building at 777 Third Avenue. Vacancy rates have soared in the corridor.

In 2019, the bank also provided a series of loans totaling about $115 million to the 34-story McGraw Hill building at 330 West 42nd Street. At the time, McGraw Hill, the anchor tenant, had already said it would move out. Last April, Signature lent another $25 million on the property. The owners are now seeking to convert it to residential. Newmark put the loan up for sale this year, a possible sign of distress.

Read more

The FDIC earlier this week began the process for selling off Signature, making its data available for potential bidders to do due diligence.

The process may take its cues from Silicon Valley Bank, seized just before Signature. Regulators hired investment bank Piper Sandler to find a buyer for the California institution. Private equity firms Apollo Global Management, Ares Management, Blackstone, Carlyle Group and KKR have shown interest in buying SVB’s assets.

Christopher Whalen, chairman of Whalen Global Advisors and a consultant to banks and financial institutions, said the FDIC is going to look to sell Signature Bank whole, not piece by piece.

“Someone will buy it,” said Whalen. “Ultimately, the FDIC doesn’t want a loss. That is their main concern.”