Despite the recent good news about its debt restructuring, WeWork has — once again — said it will take longer than expected for the company to make a profit.

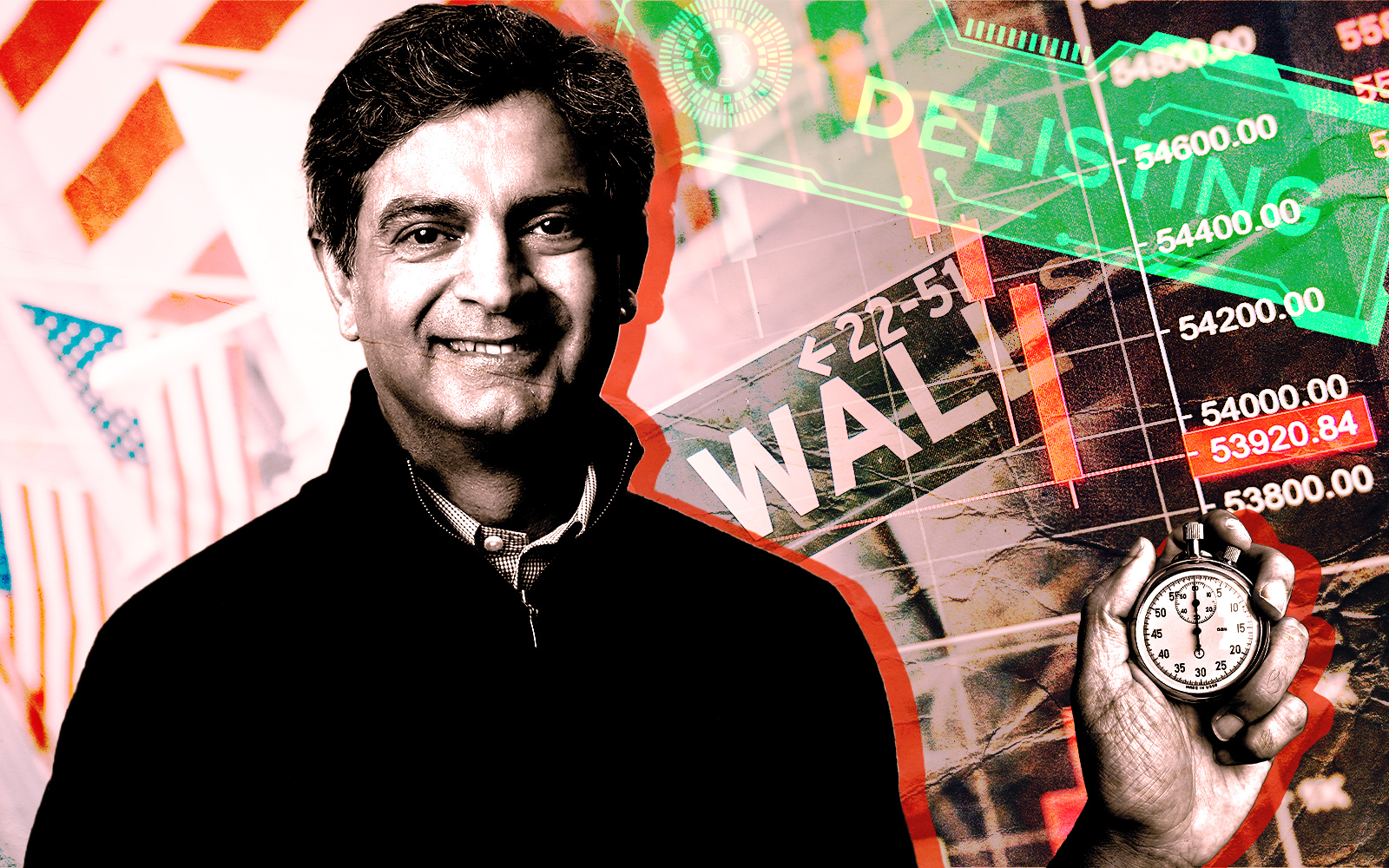

CEO Sandeep Mathrani said on the company’s earnings call Tuesday that WeWork plans to be cash-flow positive sometime in the second half of 2024. Earlier this year he had said WeWork would be profitable by December.

The postponed target date comes after the company said it realized savings from a $1 billion debt restructuring in March.

The update frustrated PiperSandler analyst Alex Goldfarb, who pressed executives on the earnings call about why the company had changed its forecast.

Mathrani said that WeWork expects to be cash-flow positive for a brief period at the end of the year, but will slip back to a deficit before turning profitable on a more permanent basis sometime in the second half of 2024.

“Will 2024 be a free-cash-flow year?” he asked. “The answer is yes.”

To be sure, having positive cash flow is not the same as being profitable, but it is a crucial step toward that goal.

Tuesday was the first time analysts got to question WeWork since the company announced it had reached a deal with its primary investor, SoftBank, to reduce its debt from $3.6 billion to $2.4 billion and push its maturities out from 2025 to 2027.

The company reported a loss of $299 million in the first quarter, an improvement from a loss of nearly $500 million a year earlier.

The New York Stock Exchange last month notified WeWork that it was at risk of having its shares delisted because the stock closed below $1 on average over the course of a 30-day trading period.

WeWork responded by saying it was considering a reverse-stock split to come back into compliance.

Mathrani said Tuesday that he will monitor the share price over the next three months.

“I can assure you we will make sure the stock is not delisted,” he said. “We’ll see how the stock reacts based on our performance over the next quarter.”

WeWork shares closed at 39 cents Wednesday, down 9 percent, after sinking to an all-time low of 38 cents late in the afternoon. It had been at 48 cents after hours on Monday night before disclosing its earnings the following morning.

Read more