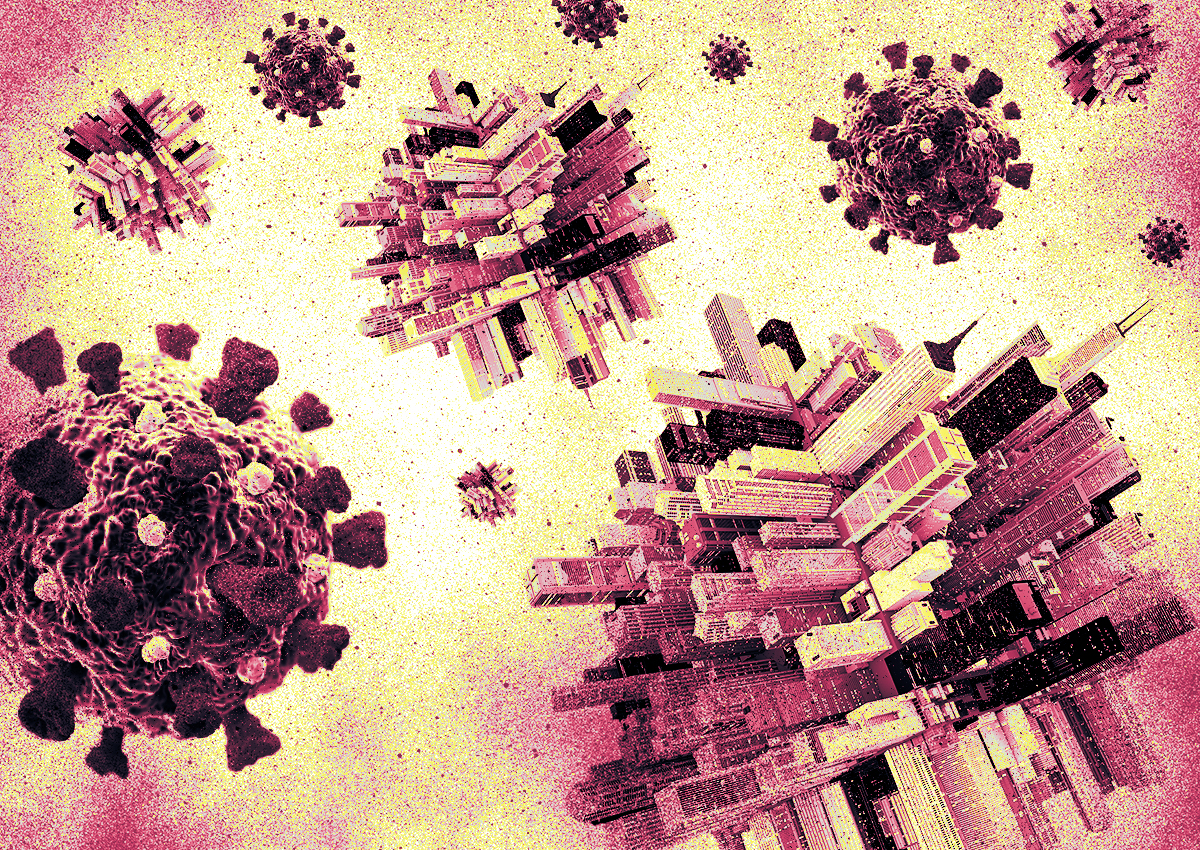

The office market has moved into first place in a ranking landlords likely won’t be celebrating on their social media pages.

Offices have overtaken retail properties — including malls — and hotels as the most distressed asset class in commercial real estate, according to a report from MSCI Real Assets reported by Bloomberg.

At the end of the second quarter, about $24.8 billion of U.S. office properties were in distress, according to the report. The figure, which accounted for the value of properties that were either troubled or repossessed, jumped 36 percent from the first quarter.

The situation likely isn’t going to get better any time soon for office owners as remote work continues to alter cityscapes across the nation.

“Investors are putting a low probability on debt becoming cheap and everybody being back in the office like they were before,” MSCI Real Assets chief economist Jim Costello told the outlet.

This was the first time in five years that retail or hotels weren’t responsible for the most commercial distress in a quarter, according to the report. At the end of the quarter, $22.7 billion of retail and $13.5 billion of hotels were considered in distress; in total, the value of commercial properties in distress rose 13 percent from the previous quarter to $72 billion.

More risks are clouding the commercial skies. The report also looked at “potential” distressed properties, accounting for those with delinquent payments, low occupancy, maturing debt or other troubles. There’s $162 billion in potential distress across the sector, led by $43.3 billion in the office class.

Prices for office buildings are also collapsing. They were down 27 percent this year through June, according to Green Street, against a 12 percent decline for the commercial industry as a whole.

Read more

While multifamily distress is relatively low in comparison to other asset classes — valued below $7 billion at the end of the second quarter — the potential distress is among the highest of the classes, exceeding $38 billion.

The industrial sector was one of the sturdier asset classes at the end of the quarter. More than $15 billion in potential distress looms large, but there was only $1.6 billion in actual distress at the end of the second quarter.

— Holden Walter-Warner