If every person on Earth lost $10, it still wouldn’t match the losses Chinese real estate giant Evergrande suffered between 2021 and 2022.

The beleaguered developer recently disclosed $81 billion in losses over the course of those two years, the Washington Post reported. The disclosure came courtesy of an earnings report from the company that had been delayed repeatedly.

In 2022, the company hit $335 billion in liabilities. That easily dwarfed the $251 billion in assets and will do little to assuage concern about how financial difficulties at one of China’s largest apartment builders may affect the rest of the nation’s economy.

As the losses piled up two years ago, Evergrande took on the unsavory distinction of being the world’s most indebted developer. The company first reported more than $300 billion in liabilities in June 2021 and went into default six months later.

Since then, Evergrande has been on a quixotic quest to restructure some of its debt. The company announced a restructuring plan several months ago, but is still engaging in talks with overseas investors on its debt pile.

Prism, an external auditor for the company, declined to comment on the financial reports because it couldn’t obtain enough evidence about Evergrande being able to meet its obligations. Additionally, shares on the Hong Kong stock exchange have been suspended since last March and are nearing the deadline before the company is delisted altogether.

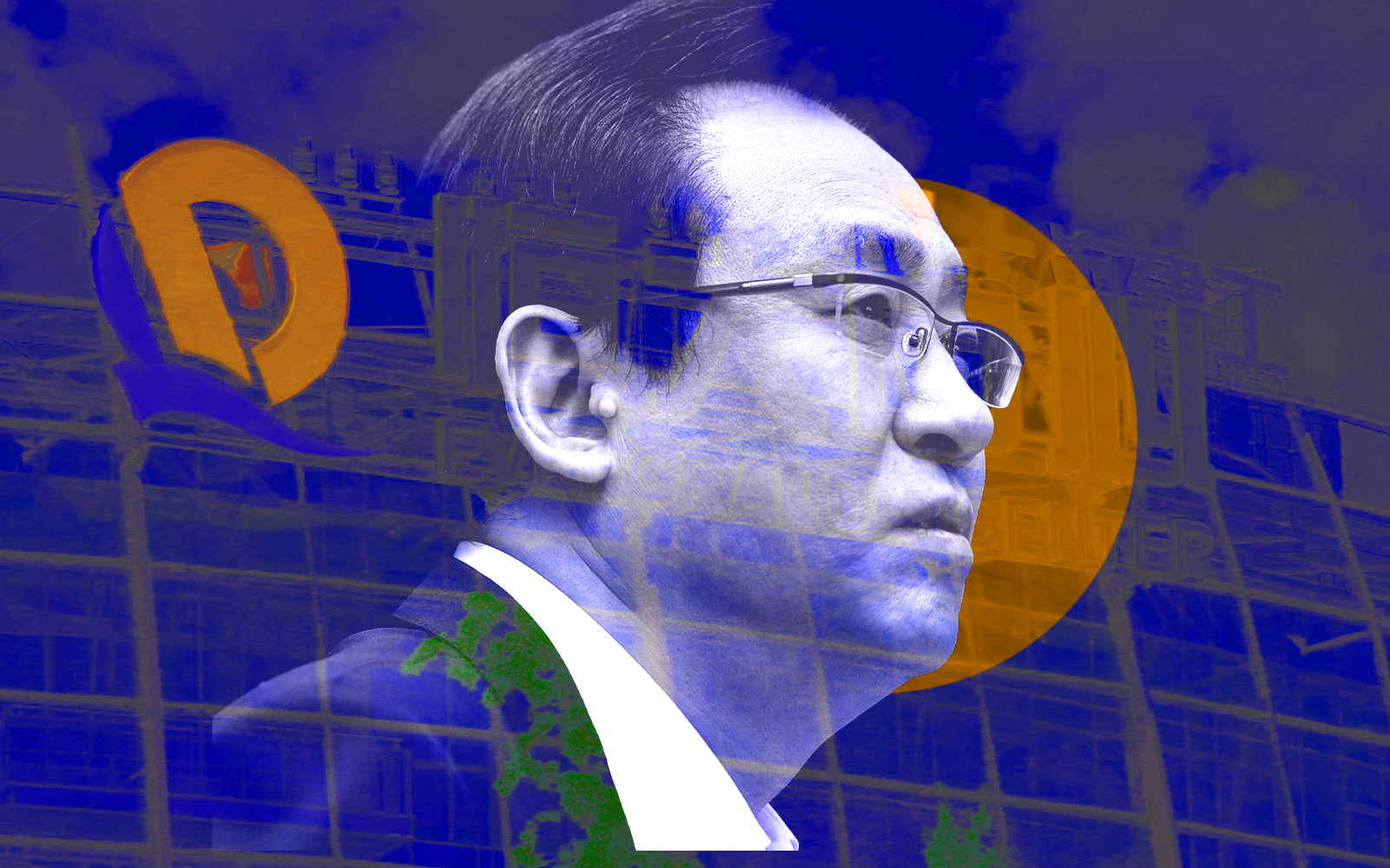

A year ago, chief executive officer Xia Haijun and chief financial officer Pan Darong resigned, according to the New York Times. They have since been replaced by Siu Shawn and Qian Cheng, respectively.

Another embattled Chinese developer is Kaisa, which previously defaulted after failing to make a repayment on a $400 million bond. The companies’ outsized struggles are notable because of the outsized impact of real estate on China — the sector represents a quarter of growth in the country’s economy.

— Holden Walter-Warner

Read more