People looking for homes on CoStar Group’s Homes.com and Apartments.com have catapulted the company to the second-most visited residential platform — bringing it in direct competition with its largest rival Zillow.

Traffic to the company’s residential platform hit 84 million average monthly unique visitors in the second quarter, Costar said as it announced quarterly earnings Tuesday.

That was enough to surpass Realtor.com as the second-most trafficked residential platform after moving past Redfin at the beginning of the year.

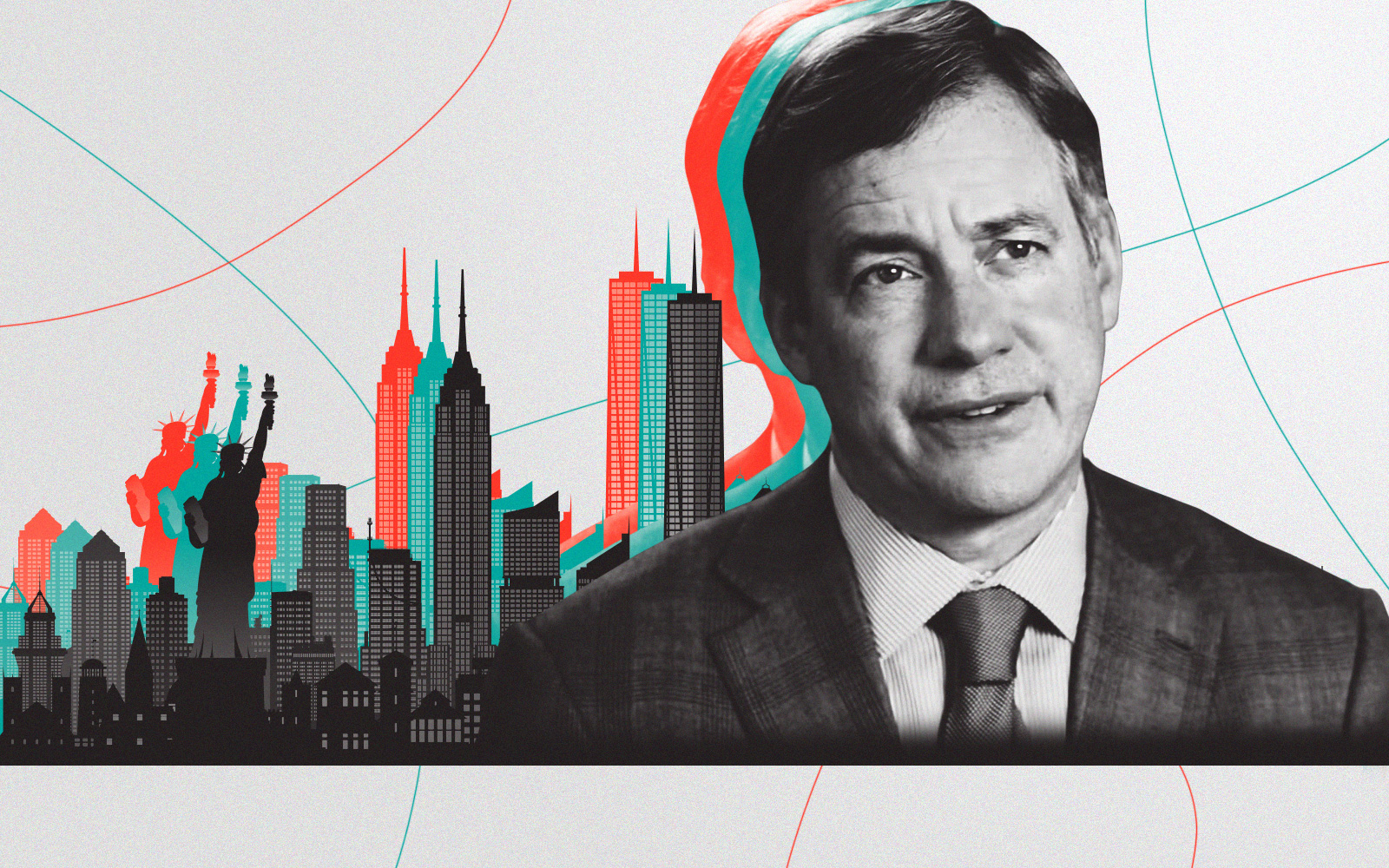

CoStar Group CEO Andy Florance said on the company’s earnings call that consumers were choosing Homes.com because they can easily and clearly contact the listing agents.

“The ones who know more about the property than some other, unrelated agent,” he explained in an apparent dig at Zillow’s Premier Agent program, where unrelated agents can pay to advertise next to a listing.

“Competing sites are sending that lead into a call center and often syndicating that lead out to multiple unrelated agents that don’t know that listing at all,” he added. “So consumers are reasonably smart sometimes and I think they’re onto that.”

For the second quarter, CoStar reported net income of $100.5 million, up from $83 million the same time last year.

The company hit $82 million in new bookings in the quarter for the second-highest sales quarter in the company’s history. Florance said high vacancy figures from new rental construction were helping to grow Apartments.com

On the commercial side, the CEO acknowledged the troubles the industry is facing, with sales in the second quarter down 63 percent, a wall of debt maturities and increasing office vacancies.

“The office sector continued to weaken in the second quarter and can now be characterized as the worst it’s ever been,” he said. “What a horrible thing to have to say.”

TenX, the company’s commercial auction site, had to turn down $2.9 billion worth of deals because owners had unrealistic expectations.

Sales growth on the Loopnet platform should have been stronger, Florance said.

He attributed the disappointing figures to a relatively young sales team, a training program “which has room for improvement,” a large number of account transitions and a “poorly conceived” commission program — all issues he said were correctable.

“Does that sound like a CEO that’s not happy with something?” Florance asked.

Read more