Compass says it brought in $51 million more than it spent in the second quarter, the first time the residential brokerage has been cash-flow positive since going public in 2021.

The company still posted a net loss – which includes stock-based compensation and other expenses – of $48 million, according to its second-quarter earnings. That loss, however, was a big improvement from the same period last year, in which it lost $101 million.

Reaching cash-flow positivity was a key target the company had declared for itself last year, and Compass said it met the goal while still growing market share and agent count, according to its earnings report. It posted an adjusted EBITDA — earnings before interest, taxes, depreciation and amortization — of $30 million, up from $4 million a year ago.

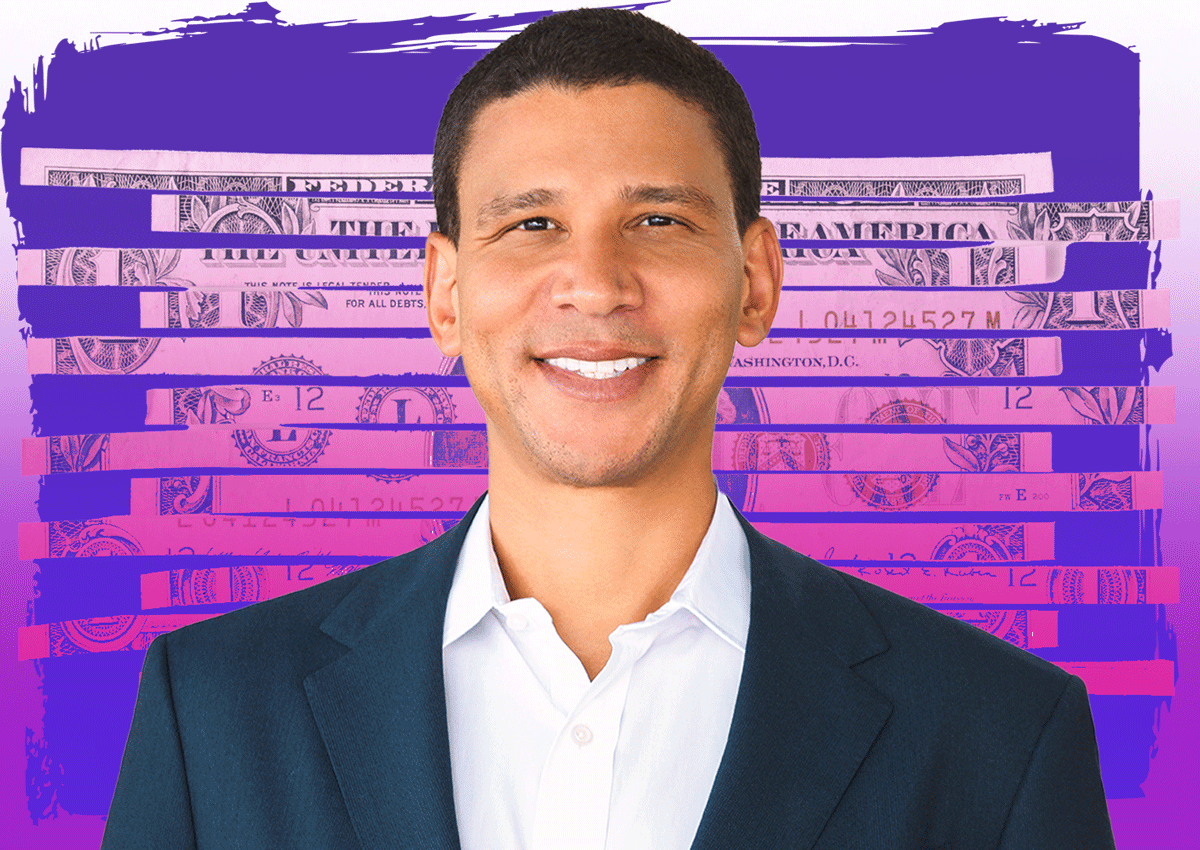

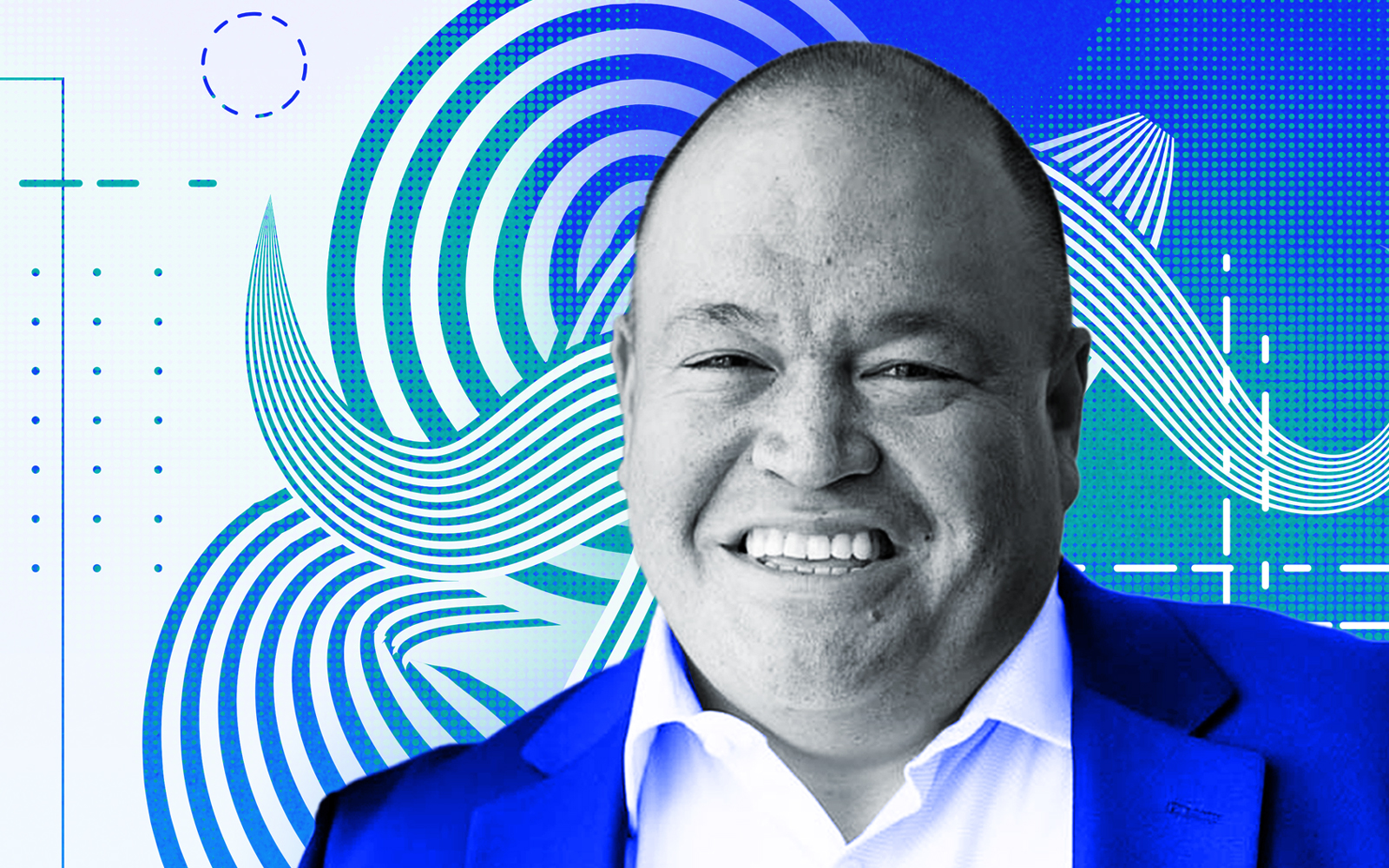

“We have made up most of the free cash flow deficit from Q1 2023 and we believe we are in position to achieve our goal of being free cash flow positive for 2023,” Compass CFO Kalani Reelitz said in the earnings release.

Second-quarter operating expenses came in at $1.5 billion, down roughly $600 million from a year ago.

The company’s commissions payable increased to $98 million last quarter, up $41 million over the prior quarter but in line with the $96 million figure a year ago.

The firm’s revenue fell 26 percent year-over-year to $1.5 billion, with transactions falling by a fifth and fewer deals in luxury home markets such as California.

Compass finished the second quarter with $335 million in cash and cash equivalents, but in July paid back the $150 million draw it had taken on its revolver loan.

The results reflect efforts from a year-long cost-cutting campaign announced in the earnings call this time last year, when Compass pledged to cut $320 million from its budget. As part of that pledge, it stopped offering new agents cash and equity incentives, one of its most effective recruiting tools.

Compass was the top residential brokerage in the country by sales volume in 2022, according to RealTrends. As losses mounted — the firm lost over $600 million last year, up from $500 million in 2021 — and the market slowed, critics and rivals seemed to relish in the company’s struggles and questioned its viability.

Compass CEO Robert Reffkin said during the company’s earnings call that he’s seeing a “critical shift” among other residential brokerages that’s leading to “structurally weaker” competition for agents.

“We are seeing many traditional brokerages that historically competed for agents with value-added support and services now significantly reducing investments in these areas,” he said, attributing that trend to “rising debt service costs, increases in agent departures, declining market share and margin, worsening free cash flow and for some VC backed companies a pullback in the VC funding market.”

Reffkin said Compass has invested $1.5 billion in its back-end platform, including equity compensation.

Compass grew its market share for the third consecutive quarter, reaching 4.6 percent nationally, up 13 basis points quarter-over-quarter.

Compass added 118 principal agents quarter-over-quarter, the same increase in its total number of agents, meaning the number of agents who don’t lead a team or work alone didn’t change, according to its investor presentation.

Reffkin said Compass plans to next year launch a consumer-facing portal, which he said will “become the client’s single destination for everything home, before, during and after the transaction for both buyers and sellers,” echoing Zillow CEO Rich Barton’s plans for a real estate super-app.

This article has been updated with comments from Compass’ earnings call.

Read more