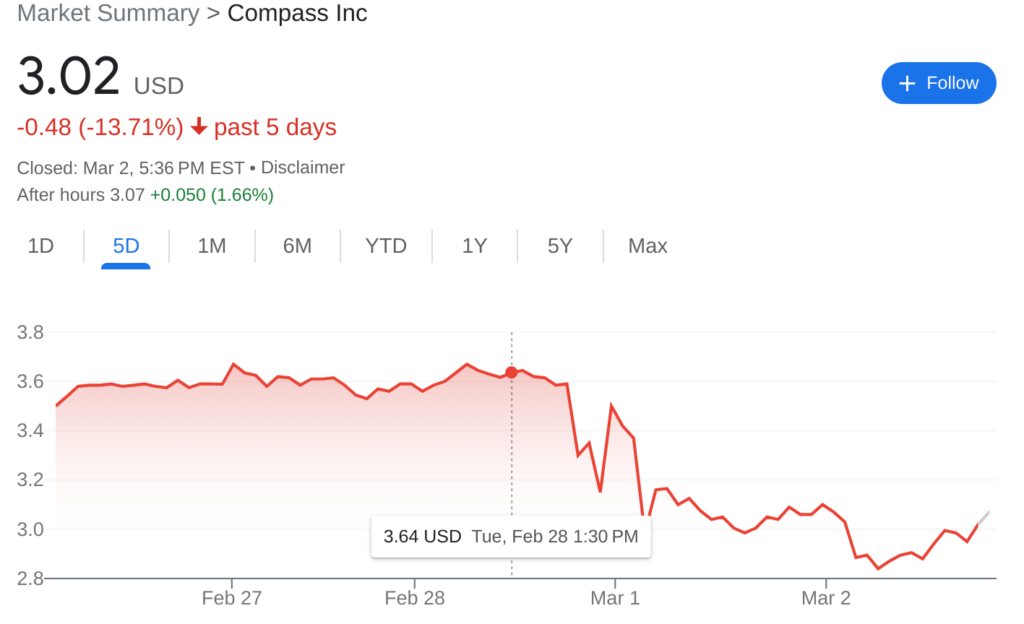

Compass stock fell 5 percent Thursday morning after five analysts said they now doubt Compass will break even by 2025. It mostly recovered in the afternoon but is still down 14 percent since reporting another $158 million in quarterly losses Tuesday.

The brokerage had to drastically alter course last year as its biggest investor, SoftBank, pulled back on funding, U.S. home sales suffered a historic slowdown and Compass burned through over $600 million.

“The 2022 industry decline in units was as bad as the Great Financial Crisis when the number of units fell by 18 percent year-over-year from 2007 to 2008,” CEO Robert Reffkin said on an earnings call.

Though Compass has never posted a profit, its executives are confident it will at least be cash-flow positive by the end of June.

Analyst Mike DelPrete previously predicted Compass will need to make $5.3 billion this year to break even. Revenue last quarter was $1.1 billion.

Beyond those headline numbers, the company’s annual report offers a more in-depth picture of its situation. Here are the biggest takeaways:

Layoffs

Compass had been shy about releasing the number of employees let go during its two rounds of layoffs last year. After reporting that 10 percent of staff was axed in June, it offered no specifics when making another round of cuts later that summer.

In a fireside chat in the fall, Reffkin said roughly 800 tech employees had been laid off. They were no longer needed, he said, as the brokerage’s $900 million online platform had been built.

Although the number of laid-off employees remains a secret, Compass finished the year with nearly 1,600 fewer employees than it started 2022 with, a comparison of its annual reports shows.

Compass put its year-end workforce at just under 3,200, but that doesn’t include the most recent round of layoffs, in January.

SEC filings show Compass estimated the most recent round would trigger $10 million to $12 million in severance costs, compared with $15 million to $16 million for the first layoffs. That suggests head count is now under 3,000.

Though Compass pledged not to eliminate agent-facing roles, documents viewed by The Real Deal revealed that dozens of agent support positions were cut in the most recent round of layoffs. It’s unclear how many agent-experience managers and coordinators were affected company-wide, because cuts were decided at the local level, according to a Compass executive, who said the company is backfilling those positions when someone quits.

Agent retention

It’s likely Compass is seeing more churn than it used to. Compass’ principal agent retention rate remains over 90 percent, according to its annual filing, and COO Greg Hart said during the earnings call that the company has hired 1,000 brokers since August. Principal agents are defined as team leaders or agents operating independently.

But its headcount growth has sputtered, according to its fourth-quarter investor presentation. Compass’ number of principal agents grew by 112 in the quarter, yet its total number of agents rose by just 58. That means it lost more non-principal agents than it added.

Corofy placed Compass’ New York retention rate at 79 percent last year in its annual brokerage report.

Compass has not introduced new lines of businesses since teasing that it might during its second quarter earnings call last year. That means all its revenue — whether from attached services or sales — comes from agents. Retaining them will be crucial in the months ahead.

Office closures

Compass pledged it wouldn’t reduce its office footprint after announcing a $320 million cost-reduction program in the third quarter. It reversed course in January, listing its global headquarters at 90 Fifth Avenue for sublease. More retrenchment might be in store.

Its most recent annual report states the company may review its occupancy costs “with a view to consolidating offices and reducing related costs.”

It’s not clear where else Compass might close offices. As the company said in September, ending a lease early can incur termination costs, and subleasing requires finding a tenant.

What’s clear is the company has several offices within minutes of each other in major markets, many a result of acquisitions. For example, the office it inherited when it acquired Stribling & Associates gave it three within six blocks on New York’s Upper East Side.

In San Francisco, it has three offices on 24th Street, and all of its locations are within a 10-minute drive of another office, according to Mapbox.

Revolver loan

As Compass’ quarterly losses led to questions about how long it could endure them, executives trumpeted the company’s cash position. They emphasized the company’s $300 million revolver loan, which it tapped for the first time in the fourth quarter, taking out $150 million. Its cash balance at quarter’s end was $362 million.

The fund can be tapped as often as needed, assuming it’s not exhausted. But there are caveats.

To satisfy the terms of the loan, Compass needs $150 million in the bank and can’t let annual revenue fall below $3.8 billion.

It isn’t in danger of running out of cash or losing access to the loan yet, but it also doesn’t have much margin if the market takes longer than anticipated to recover. Compass’ cash burn last year was more than its current cash position and revolver loan availability combined. It went through $76 million in each of the last two quarters.

But executives are confident they’ve done enough cost-cutting to avoid running out of cash. Speaking anonymously in an interview Tuesday before the earnings call, a Compass executive said the January cuts, which were not reflected in the earnings report, put the company in a strong position.

“We still have a couple hundred million in cash in the bank so we’re not worried about the cash issue,” the executive said.

Service integration

Integrating new services into its CRM could be critical to Compass’ profitability. Adding escrow, title, mortgage and other services could add $20,000 to $30,000 of fees to an average transaction, with Compass pocketing 80 percent to 90 percent of that, as opposed to the roughly 20 percent it gets from its agent’s commission. In its annual report, Compass estimates that adjacent services could be worth up to $132 billion.

But so far the company hasn’t integrated added services for brokers outside of Southern California and utilization rates remain low, according to the annual report. What’s more, the company did not provide a specific target date for full integration beyond saying it’s a priority this year.

How quickly and broadly the company attaches services may be key to getting into the black.

Read more