PIMCO’s distress isn’t limited to its office portfolio.

A joint venture led by Pacific Investment Management Company is walking away from a 20-hotel portfolio, Bloomberg reported. The owners forfeited the properties last month rather than repay a $240 million mortgage. The hotels stretched across the U.S., including in San Antonio and Carmel, Indiana.

The joint venture obtained the mortgage in 2017, when the portfolio was valued at $326 million. A December appraisal, however, cut that valuation by 16 percent to $272.8 million. The loan, packaged into a commercial-backed mortgage security, was transferred to a special servicer last August, according to CRED iQ.

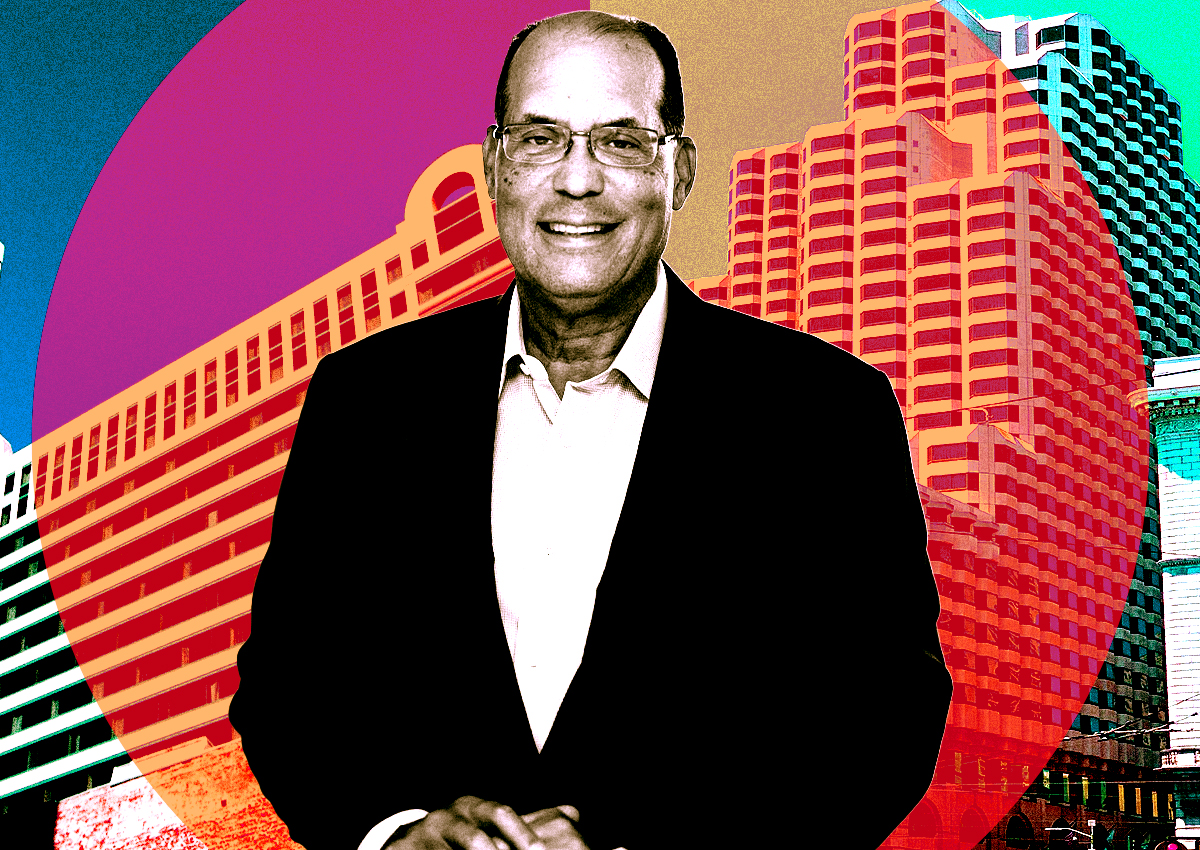

A decade-old PIMCO real estate fund owned a 99 percent stake in the joint venture with a limited liability company tied to hotel operator Steven Angel of Fulcrum Hospitality.

PIMCO did not comment to Bloomberg.

Although tourism has largely recovered from the pandemic, business travel has not, which along with high interest rates, a labor shortage and rising operating and capital improvement costs has caused some hotel portfolios to struggle.

In June, Parks Hotels and Resorts announced it would stop making payments on a $725 million non-recourse CMBS loan secured by two of its San Francisco hotels; the debt is scheduled to mature next month. The lodging real estate investment trust is not looking for a workout.

Read more

Three months ago, Monty Bennett’s Ashford Hospitality Trust set itself on a course to hand the keys to 19 hotels to lenders rather than pay $335 million to extend its mortgages.

As for PIMCO, in February its Columbia Property Trust defaulted on $1.7 billion in loans tied to seven buildings across the country — one of the largest office defaults since Covid hit. Negotiations regarding the debt are ongoing, according to a commentary on the CMBS loan.

— Holden Walter-Warner