Trending

SF’s biggest hotels to stop mortgage payments

Park Hotels and Resorts will cease servicing $725M debt in “best interest” of investors

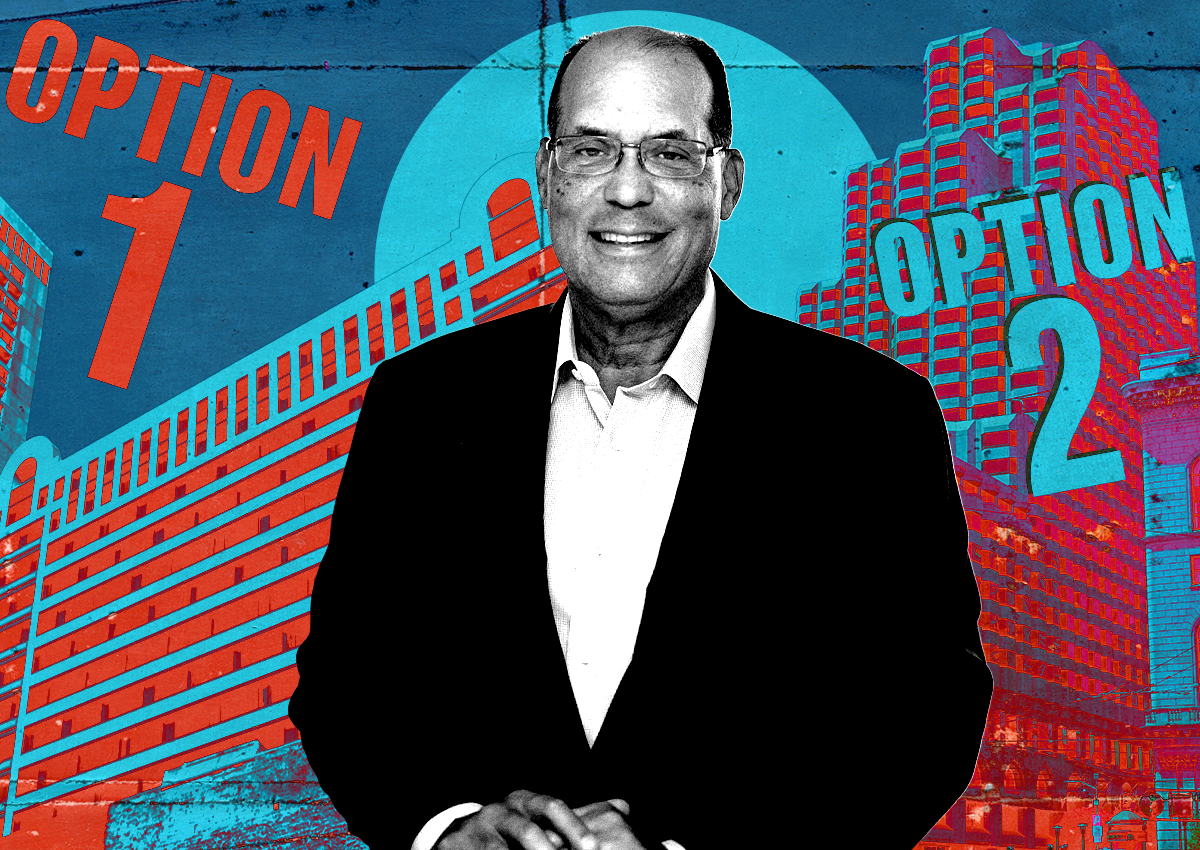

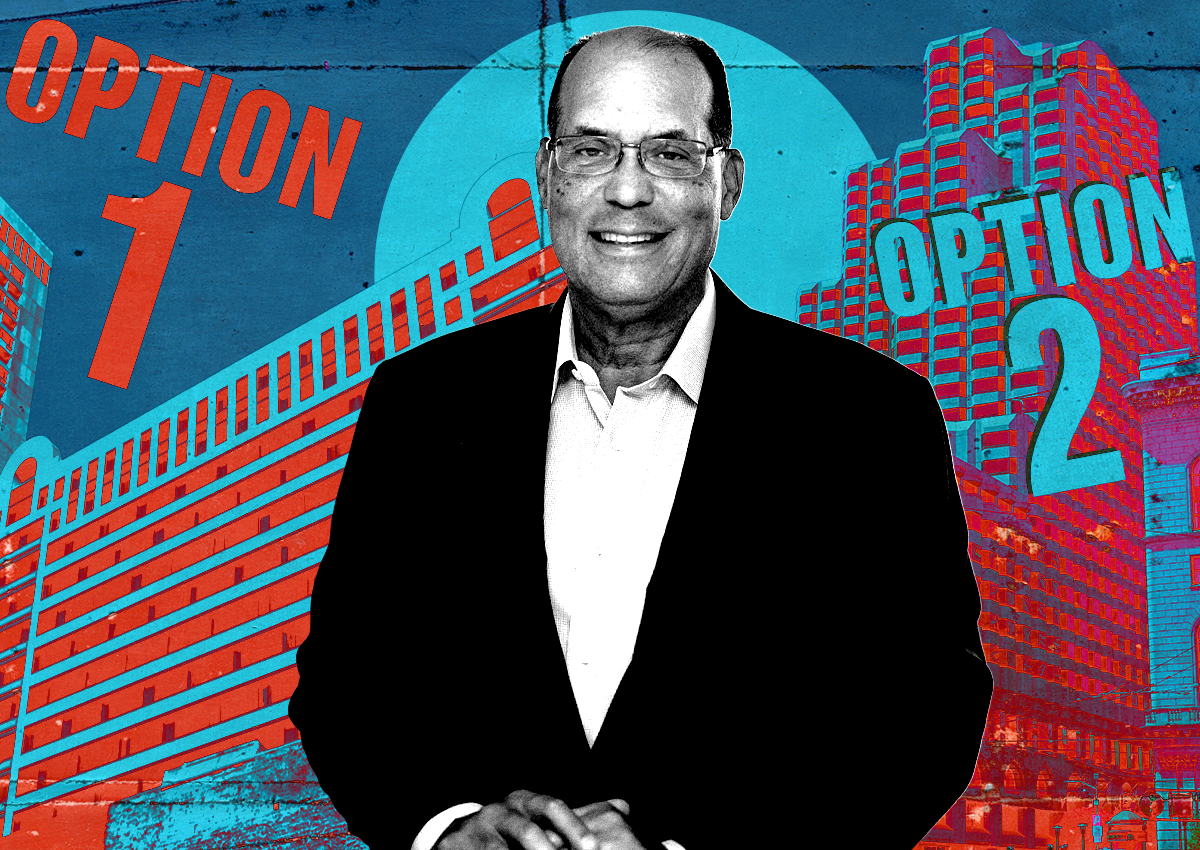

Park Hotels and Resorts announced it will cease making payments toward a $725 million non-recourse CMBS loan which is scheduled to mature in November 2023.

The loan was secured by two of its San Francisco hotels — the 1,921-room Hilton San Francisco Union Square and the 1,024-room Parc 55 San Francisco.

“After much thought and consideration, we believe it is in the best interest for Park’s stockholders to materially reduce our current exposure to the San Francisco market,” CEO Thomas Baltimore Jr. said in a statement. “Now more than ever, we believe San Francisco’s path to recovery remains clouded and elongated by major challenges — both old and new: record high office vacancy; concerns over street conditions; lower return to office than peer cities; and a weaker than expected citywide convention calendar through 2027 that will negatively impact business and leisure demand and will likely significantly reduce compression in the city for the foreseeable future. Unfortunately, the continued burden on our operating results and balance sheet is too significant to warrant continuing to subsidize and own these assets.”

The interest-only loan was originated in 2016 by JPMorgan Chase and sold into the CMBS investor market. Wells Fargo is now the master and special servicer for the loan, which was placed on a Trepp watchlist in 2020 for mortgage-backed securities at risk of default.

The two hotels are the largest in the city and make up 9 percent of the city’s hotel rooms. When the loan goes into delinquency in July, 80 basis points will be added to SF’s hotel delinquency rate and push it above 5 percent, according to Trepp.

Park will now look to “reshape our portfolio by selling non-core assets, and recycling capital to reduce leverage, invest in strategic ROI projects, and opportunistically repurchase stock and/or acquire assets,” according to Baltimore.

Park could look to invest in more leisure markets, such as Hawaii, that are currently more viable, according to Alan Reay, president of consultancy Atlas Hospitality. The San Francisco hospitality market faces challenges as international tourism has yet to return to pre-pandemic levels, particularly from the Asia Pacific region. However, San Francisco has remained more viable than other large markets across the country.

“People are looking at San Francisco and thinking it’s very difficult to build here and if we can hold onto our assets, we might be OK,” Reay said. “Borrowers were sort of quick to turn back keys in Chicago and New York.”

While almost every other market has rebounded to pre-pandemic occupancy rates, San Francisco and San Jose are still trailing 2019 levels. This is due to the Bay Area’s reliance on commercial business travel, according to Reay.

The most recent San Francisco hospitality sales were the two assets sold by Maryland-based Pebblebrook Hotel Trust: the Marker which sold for $370,000 per key and Hotel Spero for $300,000 per key.

Read more