Real estate titans finally had their prayers answered on Wednesday.

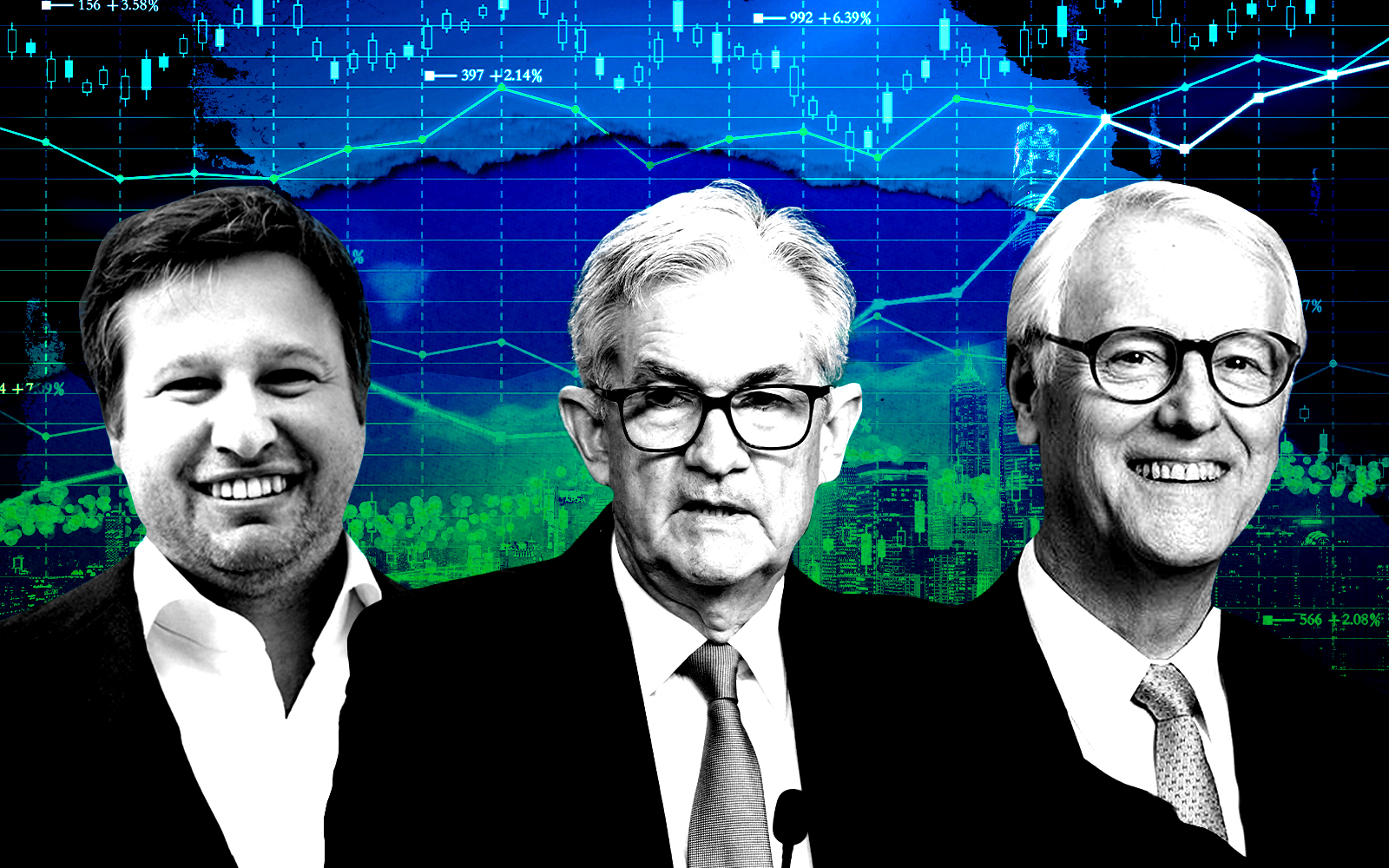

The central bank signaled interest rate cuts are coming next year, CNBC reported. The Fed also decided to hold interest rates steady for the third consecutive time during the Federal Open Market Committee meeting.

The decision to keep rates the same is a reprieve for real estate, but developers and building owners are hoping for more — three rate cuts next year, in fact. The real estate industry has been hampered since March 2022 by near-constant rate hikes that have driven up borrowing costs for investors and homebuyers.

Rate hikes have contributed to a precipitous drop in investment sales. Building owners, particularly in the office sector, have struggled to scrape together the deals to refinance properties, leading to a wave of distress that ensnares more landlords every day.

Those problems could ease if the Fed sees the economy slowing and inflation stabilizing enough for it to cut interest rates.

Members of the Fed committee projected three cuts to the federal funds rate next year, each assumed to be 0.25 percentage points. In the current cycle, there have been 11 hikes, pushing interest rates to their highest levels in more than two decades.

The cuts won’t stop after next year, if things go according to plan. The Fed appears poised to cut interest rates in four increments in 2025, which would total a full percentage point. In 2026, there could be another three reductions, which would bring the federal funds rate back down to between 2 percent and 2.25 percent.

A post-meeting statement from the Fed added that the committee would consider multiple factors before “any” more rate hikes, suggesting that those may be a thing of the past for the immediate future.

“It’s still going to be a little bit of a tentative transaction market out there within CRE,” Moody’s Analytics’ head of commercial real estate economics Thomas LaSalvia told the Commercial Observer, adding that transaction activity may still be slow in the first half of next year before potentially rising in the second.

— Holden Walter-Warner

Read more