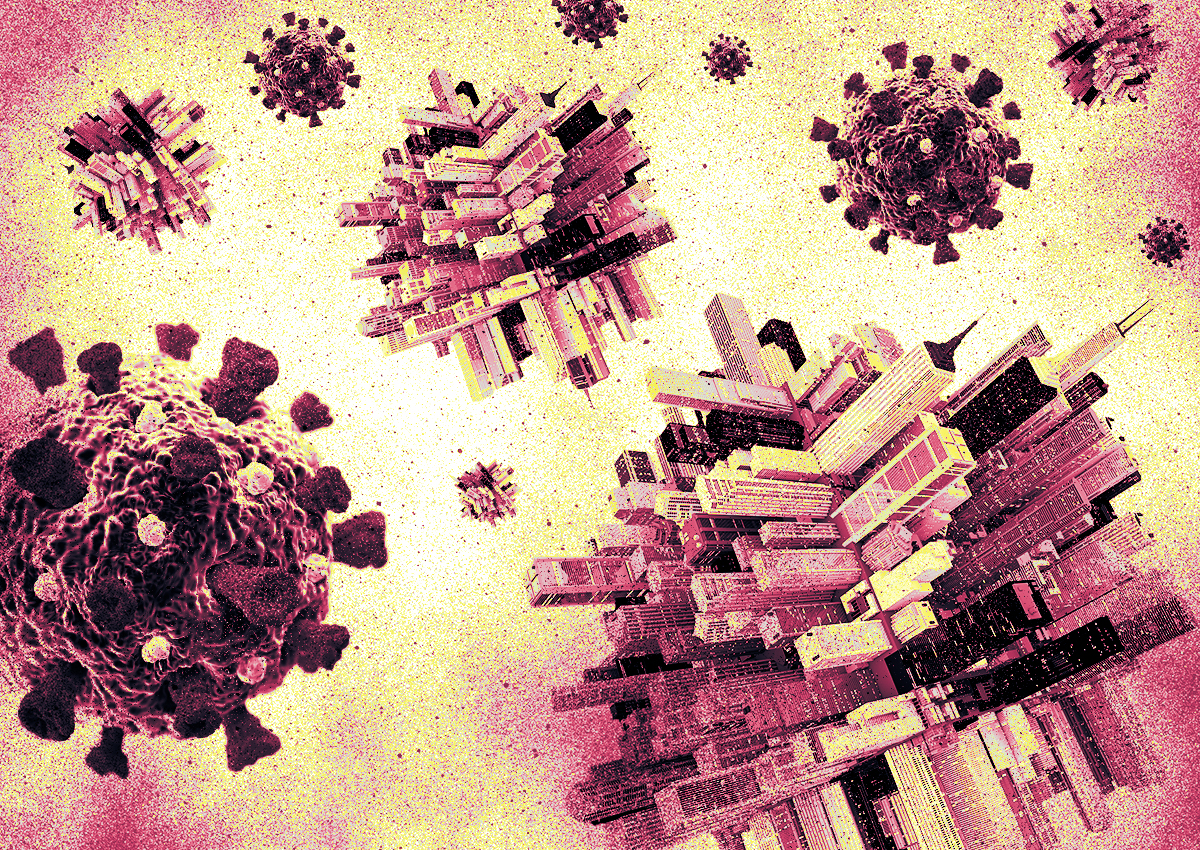

Barry Sternlicht says the loss of office values in recent years is in the trillions of dollars.

The Starwood Capital Group head recently spoke of the “existential crisis” facing the American office market at the iConnections Global Alts conference, Bloomberg reported. Sternlicht spread the blame, pointing towards a dearth of office workers and the Federal Reserve’s interest rate hikes.

He said offices are now “probably worth $1.8 trillion,” and that “there’s $1.2 trillion of losses spread somewhere” for an asset class once worth $3 trillion.

Sternlicht added that “nobody knows exactly where” all the losses are.

Nobody knows exactly how much either, though.

Losses in the office market could very well top the $1 trillion mark, but it’s hard to say that with certainty until more sales heat up again.

“I don’t know how and when we get back to a place where we put a value on office buildings,” Michael Comparato, the head of commercial real estate at Benefit Street Partners, recently told The Real Deal. “You can’t value it.”

Despite Sternlicht’s dour disposition towards office values, his recent comments have suggested the downturn may work in Starwood’s favor. Tightening lending by banks creates “remarkable opportunities for private credit,” Sternlicht said during the company’s third-quarter earnings call; at the time, Starwood had deployed $2.7 billion over the preceding 12 months.

Last year, researchers at New York University and Columbia University calculated that New York City’s offices will lose 44 percent of their pre-pandemic value by 2029, a major shift from a previous estimation of 28 percent.

— Holden Walter-Warner

Read more