There’s a new top dog in the commercial and multifamily mortgage servicer industry.

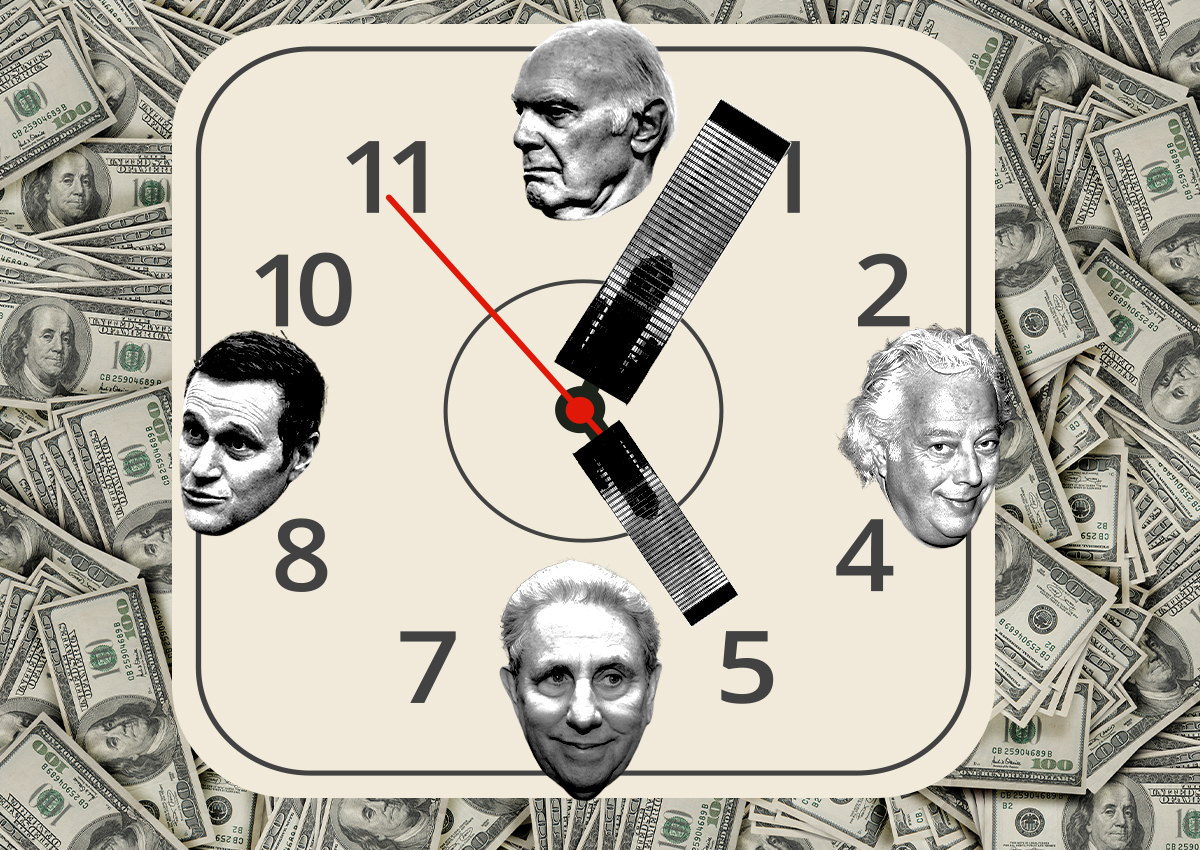

The biggest player in the industry, Wells Fargo, is selling most of its commercial mortgage servicing business to Atlanta-based Trimont, Bloomberg reported. The deal vaults Trimont from 10th in the category to first.

Trimont agreed to buy Wells Fargo’s non-agency third-party commercial mortgage servicing business. Terms were not disclosed, but the deal will allow Trimont to take over the servicing of roughly $475 billion in loans, according to Trimont chief executive officer Bill Sexton.

Trimont’s loans under management are set to triple to more than $715 billion. Many of the loans in the Wells Fargo deal are commercial mortgage-backed securities, according to Jim Dunbar, a partner of Trimont’s parent company, Varde Partners. Some of the loans are packaged into collateralized loan obligations.

“This transaction is consistent with Wells Fargo’s strategy of focusing on businesses that are core to our consumer and corporate clients,” bank executive Kara McShane said in a statement, adding that the bank remains committed to its commercial real estate business.

The bank is expected to continue servicing commercial loans on its own balance sheet, according to a company statement. The bank serviced or subserviced $543 billion in commercial mortgages for others as of June 30.

This isn’t Wells Fargo’s first retreat from the mortgage industry. Last year, the bank began backing away from residential mortgages to focus on its banking and wealth management clients. It closed its correspondent lending business that purchased loans from third-party firms and moved to reduce its mortgage-servicing portfolio through asset sales.

The Trimont announcement had little impact Tuesday on Wells Fargo’s stock price, which is up more than 14 percent year-to-date.

Loan servicing includes billing and collecting from borrowers. While it was once primarily the domain of the banking industry, which originates many of the loans, nonbank entities have recently been piling into the sector.

Read more