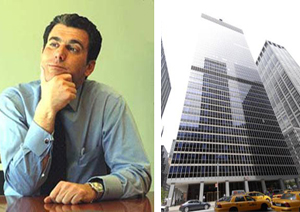

Peter Riguardi, president of the New York operations at Jones Lang LaSalle, and 1285 Sixth Avenue, where JLL co-brokered the Paul, Weiss lease (Building photo source: PropertyShark)

The dislocated commercial real estate market in Manhattan is creating unexpected opportunities for tenants and landlords, a top executive from commercial services firm Jones Lang LaSalle told clients recently.

Overleveraged properties provide leasing opportunities for bargain-hunting tenants, while in other cases landlords can collect above market rents from in-place tenants who choose to renew a lease instead of spend money building out space at a cheaper location, Peter Riguardi, president of the New York operations, said.

In 2010, “cost cutting and saving money is still going to be the highest priority [and companies are] using corporate real estate to get there,” he said.

Riguardi, along with managing director Peter Miscovich, and vice president of research Lauren Picariello, discussed national and local office leasing trends on the call open to clients and reporters earlier this week.

Riguardi said there were about 100 buildings in New York City that JLL believes are under financial stress. But instead of scaring off tenants concerned that the owners might lose the building or cannot fund improvements, he said such properties could provide an opportunity for tenants.

“If we feel there is an issue or question we will review that with the client. Some might see that as a red flag, but other clients might see that as an opportunity,” he said.

While that might benefit the tenant, there were unrelated factors in the market that appear to be helping landlords. He said in some instances tenants would pay more to sign a lease renewal instead of moving as a way to conserve precious capital during the tight lending environment.

“We worked with a law firm here in New York who recently renewed a half-a-million-square-foot lease,” he said. “They probably paid about 10 percent above the market value for space.”

He said the firm chose to stay in place — and pay slightly more than comparable deals indicate would be the current market rent — to save that cash.

“They felt it was worth it for them to stay where they are at a slight premium in order to save on capital… This is one [lease deal] that will come in about 10 percent above the market comps,” he said, referring to comparable deals.

While Riguardi did not identify the law firm, it appears to be international firm Paul, Weiss, Rifkind, Wharton & Garrison. It negotiated one of the largest lease deals in the city during a year that has seen only 13 other deals above 200,000 square feet in Manhattan, but none above 300,000, leasing records show.

Crain’s reported in November that Paul, Weiss, Rifkind, Wharton & Garrison signed a 550,000-square-foot renewal and expansion lease at 1285 Sixth Avenue between 51st and 52nd streets, a building represented by JLL.

In a conversation yesterday, Riguardi strongly denied that he was speaking about that deal, and said it was “100 percent incorrect” to link his example to the Paul, Weiss lease.

Steven Simkin, a partner and the chair of the real estate department at the law firm, said Riguardi could not have been referring to the Paul, Weiss deal.

“The parties are bound by a confidentiality agreement and [Riguardi] confirmed to me that his remarks were not about the Paul, Weiss lease,” he said.

While the parties denied it was the Paul, Weiss lease, that deal is the only law firm lease recently renewed in New York that is about 500,000 square feet, and that deal involved JLL. Furthermore, according to a brokerage firm’s private list of tenants in the market from July, no other law firm was openly looking for that quantity of space in New York.