An uptick in sales activity has slowed the once-rapid decline in the Manhattan real estate market, according to fourth-quarter 2009 market reports released by the city’s major brokerages today, though experts still fear a double-dip in prices.

Sales activity jumped and inventory shrank in the fourth quarter, the reports show, though prices were still far below 2008 levels. Experts attributed the positive signs to low interest rates, pent-up demand from a slow winter, and falling prices.

“This surge in activity and sharp drop in inventory has stopped prices from essentially hemorrhaging,” said appraiser Jonathan Miller, president and CEO of Miller Samuel and the preparer of Prudential Douglas Elliman’s fourth-quarter report. “We’re looking at a much more modest decline.”

While prices in the Manhattan market have declined an average of 25 percent from the peak of the market, Miller said, fourth-quarter reports released by Elliman (see full report here or below), the Corcoran Group (see full report here or below), and sister companies Brown Harris Stevens and Halstead Property (see Halstead-BHS full report here or below) show that average apartment prices dropped between 9 and 19 percent from the same period last year.

The average sales price of a Manhattan apartment was $1.296 million, falling 12.7 percent from $1.485 million in the fourth quarter of 2008, and slipping 2.1 percent from the third quarter of 2009, according to the report by Elliman, the city’s largest brokerage. Corcoran pegged the average sale price at $1.335 million, down 19 percent from $1.649 million in the prior-year quarter and 5.1 percent less than the third quarter.

All of the brokerages reported a significant uptick in activity both from 2008 and the third quarter. There were 2,473 closed sales in the fourth quarter of 2009, Elliman found, up 8.4 percent from 2,282 in the prior-year quarter and 10.9 percent from 2,230 in the third quarter. BHS and Halstead (the two companies, both subsidiaries of Terra Holdings, use the same data) reported 2,519 sales in the fourth quarter, 9 percent more than the same period of 2008.

“We’re seeing a tremendous increase in volume,” said Hall Willkie, president of BHS. “We are in much better shape than we ever thought we would be.”

Corcoran, which issues its reports in conjunction with PropertyShark.com, estimated that there were roughly 3,400 closed sales in fourth-quarter 2009, an increase of 48 percent from the same quarter in 2008. Corcoran explained the discrepancy by saying that it used slightly different methodology than other brokerages, using mathematical models to estimate the value of sales that took place in the fourth quarter but haven’t yet been recorded in public records.

The listings Web site Streeteasy.com recorded over 3,800 real estate closings in the fourth quarter of 2009, an increase of 28.6 percent from 2,990 closings in the fourth quarter of 2008 and 17.6 percent more than the third quarter. The site found that the average price of an apartment in Manhattan was $1.327 million, down 7.8 percent from the prior-year quarter but up 2 percent from the third quarter. (For a closer look at Streeteasy.com’s Manhattan market report for the fourth quarter of 2009, click here.)

“The rate of descent in prices has slowed down,” said Sofia Song (formerly Sofia Kim), vice president of research at Streeteasy and the author of the report. “The numbers are less drastic this quarter.”

The reports also showed fewer apartments available for sale. There were 6,851 listings for available homes in the fourth quarter, Elliman found, some 24.6 percent less than 9,081 in the prior-year quarter.

Low interest rates, pent-up demand from a slow winter, and falling prices buoyed the market, real estate pros said.

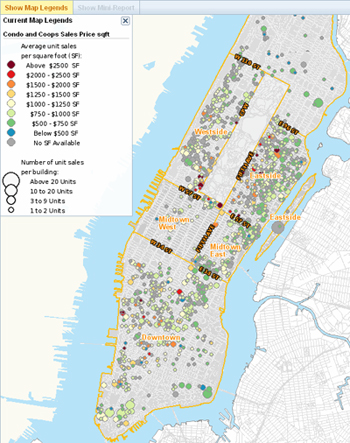

“New York became a lot more affordable in 2009,” said Pamela Liebman, the CEO of Corcoran. “That was great for buyers who had been priced out of the market. We had more sales below $500,000 than we had seen in years.”

Streeteasy.com’s report found that 65.2 percent of all closings in the fourth quarter were under $1 million.

Smaller, less expensive homes were more likely to trade hands and hold their value in the fourth quarter, the reports show. Fifty-eight percent of the closed sales in the fourth quarter were studios or one-bedrooms, compared to 53 percent from the prior-year quarter, according to Elliman’s report.

Meanwhile, the median price of a Manhattan studio fell 10.7 percent to $375,000 year-over-year and one-bedroom prices fell 7.6 percent to $661,000, while prices for two- to four-bedroom apartments plummeted between 23 and 42 percent, Elliman’s report shows.

Experts attributed the activity at the lower end of the market to the current difficulty of getting a jumbo mortgage as well as the availability of the federal first-time homebuyer tax credit.

“You’re seeing more demand for the studio and one-bedroom units,” Miller said. “It’s pretty pronounced. That’s financing — conforming versus jumbo.”

The credit crunch has also caused new developments to plummet in popularity, the reports show, since many buyers have trouble getting mortgages in new condos.

In the fourth quarter, only 19 percent of closed sales were in new developments, according to the Elliman report, down from 38.3 percent in the fourth quarter of 2008. At the peak of the market in 2006, Miller said, some 57.9 percent of closed sales were in new developments.

“That’s really changed, and it’s a function of credit, pure and simple,” Miller said. “Resales have become the dominant form of sales activity.

Though experts took the reports as a sign of a healthier real estate market, they cautioned that a double-dip in prices may be on its way, especially with interest rates expected to rise and the first-time homebuyer tax credit slated to expire in the second half of 2010.

“My sense is that we may have an uptick in prices in the first half of the year, and a declining trend in the second half,” Miller said, noting that unemployment is expected to continue rising through much of 2010, bringing with it more foreclosures.

“I think that the double-dip is a very large possibility, and the reason is the lack of credit,” Streeteasy’s Song said. “If credit doesn’t loosen up, you’ll have buyers who are unable to close on these deals. That’s when we’ll see another decline in prices.

At the very least, “it’s going to be a slow recovery,” Willkie of BHS said.