The tally of distressed properties in New York City grew last month along with the delinquency rate, according to data from analytics firm Trepp compiled for The Real Deal.

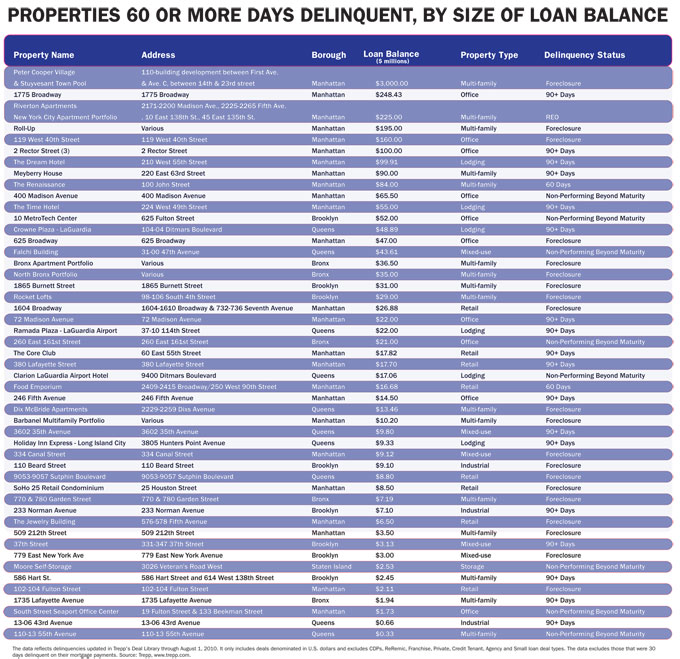

Just under $4 billion worth of delinquent loans on 49 city properties (see the full list below) made for a 5.8 percent delinquency rate in July, up from 5.6 percent, or $3.8 billion in delinquent loans citywide, the month before, Trepp data shows.

Largely due to the massive, $3 billion loan balance on the foreclosed Stuyvesant Town and Peter Cooper Village on the East Side of Manhattan, New York State ranked second in the U.S. — behind California and ahead of Florida — for delinquent loan volume, with $6.1 billion of the country’s $47.6 billion. New York City alone has a higher loan balance than 47 of the 50 states, including Texas, Nevada, and Arizona.

Of the city’s 49 distressed properties, counted because they were 60 or more days delinquent as of the end of July (Trepp’s June list was 48 items-long), newcomers included: the retail space below the New West Condominium at 250 West 90th Street, which houses a Food Emporium and has a $16.68 million loan balance; as well as a self-storage facility in Staten Island, which has a balance of $2.53 million.

The Renaissance, a Manhattan multi-family building at 100 John Street last seen on the distressed list in April, has been classified as 60 days delinquent once again after a two-month stint as just 30 days delinquent. Ranking ninth on the July list, the property still has an $84 million loan balance.

A multi-family building at 110-13 55th Avenue in Queens also made a re-entry onto Trepp’s list last month after a one-month reprieve. The Corona property, classified as non-performing beyond maturity with a $330,000 loan balance, came in last on the list for July.

Meanwhile, three properties dropped off Trepp’s list for July. The multi-family building at 405 East 77th Street, which debuted on the list in June with a $3 million loan balance that was 60 days delinquent, has since been downgraded to 30 days delinquent. The Hollis Medical Building at 190-02 Jamaica Avenue in Queens, which was more than 90 days delinquent in June with a $1.04 million loan balance, was sold at a loss July 9, according to Trepp. And the note on a retail building at 830-842 Rockaway Avenue in the Brownsville section of Brooklyn, which was in foreclosure with a $3.56 million loan balance in June, was also sold June 9, Trepp data shows.

Nationwide, the delinquency rate for commercial mortgage-backed securities also rose again last month to 8.71 percent, an all-time high for that market. But the rate of increase is moderating, helped in part by an increase in the number of loan modifications. July’s month-over-month delinquency rate increase was the smallest in a year, up just 12 basis points over June, according to the report.