Until now, resales have led the real estate market’s recovery in New York, with new condos trailing behind. But new development is finally starting to make up some ground, experts say.

Brokers are reporting a significant uptick in sales at new developments in the past few months, to the point where some developers are considering raising their prices.

Meanwhile, for the first time in several years, there are a number of fresh projects now hitting the market. Some have just finished construction and are starting sales for the first time, and others stalled during the downturn and are now relaunching.

Of course, the number of new projects currently hitting the market is still small compared to the boom, and prices have fallen significantly. And the current crop of new condos is very different from their late-2000s predecessors: Many are smaller, with more of a focus on price and practical amenities. However, experts say that in many ways, new development is now experiencing a rebirth of sorts.

“When the market started to recover, new development lagged behind,” said Kelly Kennedy Mack, president of Corcoran Sunshine, the new development arm of Corcoran. Now, she said, “new development as a sector is really starting to return and take hold.”

When the financial crisis struck in 2008, a number of large, pricey condo projects — like the Apthorp, Miraval Living and Manhattan House — were new to the market, some with hundreds of units to unload. As the recession tightened its grip, sales at these projects slowed to a trickle. To make matters especially difficult for new condos, mortgage giant Fannie Mae announced that it would stop backing loans in developments that had sold less than 70 percent of their units, making it next to impossible for buyers to get mortgages in new buildings. Meanwhile, many developers couldn’t drop their prices because of “release prices” previously agreed upon with their lenders.

So as the economy began its slow recovery, resale activity improved, but many new condos were still flailing.

In the second quarter of 2006, new development condos made up some 58 percent of sales in Manhattan, according to appraisal firm Miller Samuel. By the first quarter of 2010, that figure had dropped to only 16.4 percent.

Some, like the Apthorp, warded off foreclosure with new ownership. Others faced construction delays, or stalled completely as their lenders stopped funding them. Still others, like Linden78 on the Upper West Side, were nearly sold out in presales, but ran into trouble when buyers rebelled, refusing to close on their units.

With all the turmoil, very few new projects came on the market in 2009 or early 2010. But that has finally started to change. For the first time since the financial crisis, there are a clutch of new and relaunched projects all hitting the market at the same time. And they are doing surprisingly well, Mack said.

Busy sales offices

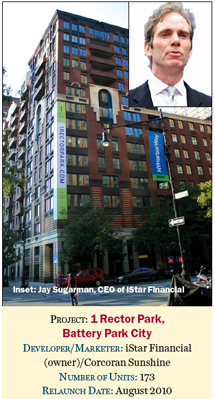

Battery Park City condo conversion 1 Rector Park started sales amid the downturn in early 2009, but then went back to its lender, iStar Financial. The bank hired Corcoran Sunshine as the exclusive agent, revised the pricing and marketing campaign, and quietly started sales in early August while gearing up for the official opening this fall.

“It was a soft opening — there was no real advertising,” Mack said.

Mack said she was surprised when the sales team received over 500 inquiries about the building. Since then, 23 contracts have been signed there.

Corcoran Sunshine is also marketing Extell’s condo, the Aldyn at 60 Riverside Boulevard, which is slated to start sales this fall, as well as 47-unit 123 Third, located in Union Square. While 123 Third didn’t officially open until after Labor Day, Mack said, her team started making sales over the summer to passersby who saw the building’s sign.

“It’s amazing to me — we [weren’t] even open, and we’d done 13 deals there,” Mack said. “It’s a return to there really being a demand from buyers for new product.”

There are now 15 signed contracts at the building, said Andrew Bradfield, principal of Orange Management and a development partner in 123 Third. “It’s been frankly astonishing,” he said, noting that the sales team has had over 300 appointments with potential buyers.

That’s especially impressive given that Bradfield’s track record is somewhat marred by his recent involvement with 22 Renwick, a condo that went bust during the downturn, leading to a number of lawsuits (see “What does it take to make a comeback?”).

Stephen Kliegerman, executive director of Halstead Property Development Marketing, said he too was surprised by the amount of new condo activity.

Halstead is currently marketing +Art at 540 West 28th Street in Chelsea, which stopped sales during the downturn and came back on the market in May, he said. A new 12-story condo overlooking Morningside Park in Harlem, 88 Morningside, also started sales around that time.

The fact that a number of projects are coming on the market at once isn’t a coincidence: Developers are starting — or restarting — sales now because they feel that market conditions have improved.

“We’re hitting the market now, at a time when more stability has come back,” said Richard Gorsky, who leads the RCG Longview Team, which is developing the Apex Condominiums in Harlem.

The 44-unit Apex started sales last month, said Gorsky. RCG — like many other developers across the city — wanted to wait until the Apex was entirely complete before starting sales, in deference to buyers’ current dislike of buying off floor plans.

Almost all of the new developments coming on the market now are completed, Mack said. Developers who otherwise would have started presales last year are instead waiting to market their projects until construction is finished, so buyers can close on their units right away.

During the second quarter of 2010, new development market share had climbed to 22.6 percent, said Jonathan Miller, president and CEO of Miller Samuel. Statistics for the third quarter weren’t yet available at press time, but Miller said contract signings at new developments have been steadily increasing.

There’s so much activity that some developers — most of whom had to work with banks to lower their prices before they hit the market — are now considering raising their prices, though few are actually doing it yet.

“We have developers talking about whether they’re going to raise prices,” Mack said. “That’s something no one’s talked about for two years.”

No more Alice in Wonderland

What’s behind the uptick in new development activity?

In addition to the general market improvement in the last year, Kliegerman noted that buyers now seem less fearful about losing their jobs. And since prices for new development condos in Manhattan have fallen around 20 percent, buyers feel like they can get a good deal, especially since interest rates are “outrageously low,” he said.

Plus, concessions like landlord-paid broker fees are disappearing from the rental market, helping to push some renters toward the sales market, he added.

Most important, while prices are down from the peak, they have remained relatively stable for some time now. Between January and August of 2010, the average sale price of a new development condo in Manhattan was $1.88 million, Miller said, up 16 percent from $1.61 million in the same period of last year. He said the price increase is due almost entirely to the current demand for larger units, not an increase in value.

Still, potential buyers are taking note of the relative stability.

“Last November, the market was free-falling,” said Victoria Shtainer, a senior vice president at Prudential Douglas Elliman. “Like Alice in Wonderland, you didn’t know when it was going to end. Now, you don’t have that free-fall feeling — you know what you’re getting into.”

Shtainer is currently marketing a sponsor-owned penthouse at Highline 519 on West 23rd Street, which the developer had originally put on the market along with the rest of the building several years ago. Disappointed by the soft market, he rented it instead of selling. But now he feels the market is “ready for him to sell it,” Shtainer said.

The end of the free fall in prices means buyers who have been biding their time, waiting for the market to improve, are now willing to take a chance.

“A lot of people were just waiting on the sidelines for a really long time,” Mack said. “They needed to get a level of confidence back. They’ve been waiting and watching, and pricing has now been stable for over a year.”

Leaving the sidelines

At projects that have been on the market for some time, sales agents are noticing offers from buyers who first visited their sales office months or even years ago, said Jacqueline Urgo, president of the Marketing Directors.

“We’re seeing the same people from a year ago actually buying a home,” she said. “They loved the building when they first saw it, but their confidence got shaken. Now they … are ready to pull the trigger.”

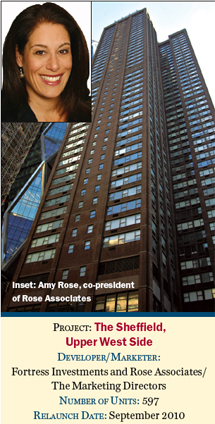

One of the major relaunches of the fall is the Sheffield on West 57th Street, which had a soft opening this summer and officially started sales late last month. The Marketing Directors, which is handling sales at the project, is selling an average of eight units a month, Urgo said. The Marketing Directors will also be handling Linden78 when it relaunches this fall, she said.

The 63-unit Isabella condo in Clinton Hill, Brooklyn, was also slated to start sales late last month. The project stalled during the downturn when the lender, HSBC, discontinued funding, explained Alec Ornstein, principal of Ornstein Leyton Company, the Isabella’s developer. But it recently got fresh financing from Canyon-Johnson Urban Fund, a partnership between basketball legend Magic Johnson and Canyon Capital Realty Advisors.

In the middle of last month, Ornstein said he already had a list of around 50 potential buyers — before sales officially started.

Thrown for a loop

When Fannie Mae first began changing its requirements at the beginning of the downturn, developers were thrown for a loop. Many found themselves playing catch-up, rushing to fulfill the new requirements while sales languished. But projects starting sales now have an advantage: They are fully aware of what Fannie requires. “We understand the rules of the game,” Ornstein said.

The Isabella has found three lenders who have approved the building and are willing to do mortgages for the building’s first buyers, he said.

Meanwhile, the team has nearly completed the complex process of getting the building approved by both Fannie Mae and the Federal Housing Administration (which allows qualified buyers to make down payments of less than 10 percent through mortgages insured by the federal government).

Getting these approvals is a lengthy process that most New York developers didn’t bother with before the downturn. “Developers [now] understand what the financial markets need,” Ornstein said. “We’ve done that homework already.”

Buying a new condo still isn’t as easy. Lenders are still requiring larger down payments, and the mortgage process takes longer than it did in the past.

However, the recession has in some ways actually helped create more qualified buyers, Kliegerman said. “A lot of those people didn’t know if they would have jobs,” he said. “They started to cut back on expenses and squirrel away money. Then, when they found out their job was secure, all of a sudden they have a significant amount of money they’ve been sitting on that they can use as a down payment.”

Brokers noted that the new condos now hitting the market are quite different from the amenity-loaded towers of the boom. First, they’re much less expensive, and many are much smaller than the mega-projects of recent years. For example, boutique condo 208 West 96th Street, which Halstead is marketing, contains just nine units. Kliegerman said the 76-unit Laureate, under construction at 2150 Broadway at 76th Street, is likely the largest project to be hitting the Upper West Side in the coming months. That’s a far cry from behemoths like Manhattan House, Miraval Living and Williamsburg’s the Edge and Northside Piers.

Meanwhile, the condos coming online today tend to emphasize quality and value. “The really high-end, ultra-luxury product that was being developed three years ago … nothing of that category is really opening,” Mack said. (But there are a number of very high-end new rental projects, perhaps as a reaction to the dearth of über-luxury in the condo market.)

RCG’s Gorsky said prices of around $600 per square foot at the Apex are significantly lower than expected when the project was originally conceived, but “our hope is that we’ll be able to raise prices,” he said.

And while a number of new projects are finally hitting the market, there are still far fewer than the onslaught that was coming on during the boom, Kliegerman emphasized. “It’s not very many units, when you think about how many units were coming on the market two years ago,” he said.

That’s helpful, he noted, since projects opening up have less competition, especially now that units at the older, larger projects are finally being absorbed. “In any submarket, there’s maybe one or two, but not multiple developments, particularly south of 96th Street,” Kliegerman said.

Things are likely to improve even more in the next few months, as more of the available inventory is sold, he said.

“Especially for the next 12 to 24 months, you’re still going to see a relatively small amount of supply as demand continues to increase.”