Consumer-focused Internet firms like Google and Amazon that have a limited retail presence might be the next type of company to take retail space in the bustling Times Square area which in recent years has seen growth of apparel tenants like American Eagle and Forever 21.

“Theoretically, at some point, I envision brands like Google, like Amazon — large brands that don’t necessarily have a brick and mortar presence,” opening stores in Times Square, David LaPierre, an executive vice president at CBRE, said. “There are a lot of groups out there that predominantly survive on a wholesale business and at some point are going to get it together and figure out how to [sell] retail.”

LaPierre was speaking along with retail brokerage colleagues Susan Kurland and Andrew Goldberg, also executive vice presidents at the commercial brokerage, at a third-quarter media briefing at CBRE’s Midtown office this morning.

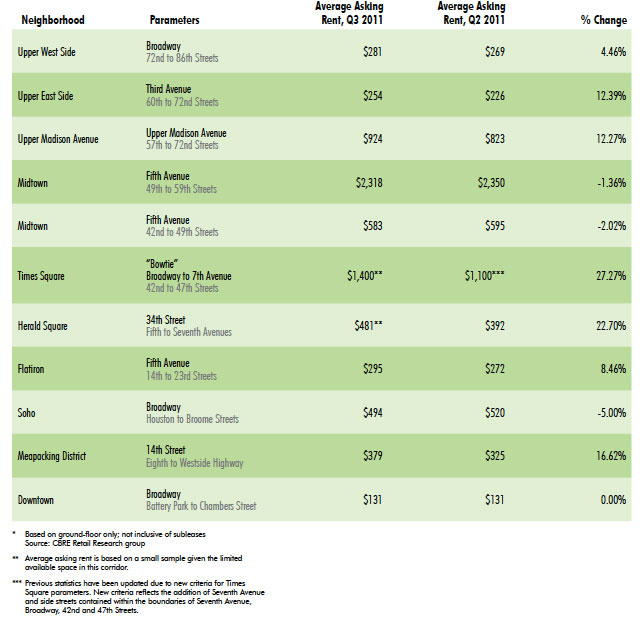

The Times Square asking rent, based on a small sample of available space in the core of the market, is $1,400 per foot for ground floor space in the third quarter, up from about $1,100 per foot in the prior quarter, CBRE figures show.

Asking rents in seven of the 11 major retail districts rose in the third quarter. Times Square was the steepest rise. The second largest percentage increase was on 34th Street between Fifth and Seventh avenues, which rose by 22 percent to $481 per foot from $392 per foot.

The biggest drop was in Soho, on Broadway from Houston to Broome streets, which fell 5 percent, to $494 per foot from $520 per square foot.

Fifth Avenue from 49th to 59th streets remained the most expensive, but declined by 1.36 percent to $2,318 per foot from $2,350 per foot, the CBRE statistics show.

Major Retail Corridors’ Average Asking Rent Per Sq. Ft (North to South)

Source: CBRE