Trending

What to expect

Foreign buyers paying cash, super-luxe condos and other trends to watch in 2015

New York City’s real estate market didn’t miss a beat last year. Even if its pace showed signs of stabilizing, prices reached new, record-breaking heights — notably, last fall, when billionaire Leonard Blavatnik dropped $80 million for a unit at 834 Fifth Avenue owned by New York Jets owner Woody Johnson, the most ever paid for a co-op apartment in the city.

So it’s no surprise that there’s more luxury housing coming as developers race to complete towers on 57th Street, which has come to be known as “Billionaire’s Row.” Meanwhile, other developments across the city are reaching for the sky, in both price and height. Read on for more of what to expect in 2015.

Year of the premiere

Year of the premiere

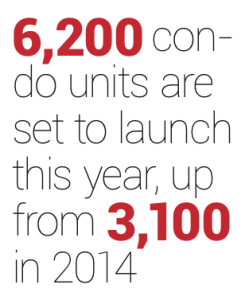

Some 6,200 new condo apartments are set to hit the market this year — compared with 3,100 in 2014, according to data obtained from Corcoran Sunshine Marketing Group. Because of the high cost of land and rising construction prices, developers have been mostly focused on building pricey luxury apartments to make the projects pencil out.

In recent months, concerns about a potential glut of homes for sale at the top of the market has been causing concern. But not everyone agrees. “I still feel very bullish on the market,” said Susan De França, president and CEO of Douglas Elliman New Development Marketing. “We still see a real, real strong, deep-rooted demand internationally to purchase in New York City.”

Boutique boom

Condo developers are bringing a crop of boutique buildings to the market, each crafted with a level of attention aimed at drawing discerning buyers. The trend has already started to take hold: According to Corcoran Sunshine, 91 properties were set to hit the Manhattan market in 2014, with an average of 37 units each. That compares with 18 properties launched in 2010, with an average of 84 units per property.

The boutique projects include the 12-unit 515 West 29th Street and an eight-unit building at 559 West 23rd Street. “I think the new luxury is boutique buildings,” said Douglas Elliman’s Frances Katzen, the exclusive broker for 60 White Street, a boutique building that launched late last year.

The boutique projects include the 12-unit 515 West 29th Street and an eight-unit building at 559 West 23rd Street. “I think the new luxury is boutique buildings,” said Douglas Elliman’s Frances Katzen, the exclusive broker for 60 White Street, a boutique building that launched late last year.

And then there are bespoke residences. At 45 East 22nd Street, for instance, would-be buyers of the 83 condo units can choose from three wood finishes for the kitchen flooring and cabinetry. “Choice in the past has been a complete no-no,” said Leonard Steinberg, president of Urban Compass. “People like the idea of having their own personal choices.”

“I see a more competitive market in the $10 million and up” category, said Wendy Maitland, director of sales at Town Residential. “There’s going to be a lot of attention paid to the architecture and design and the quality.”

Price pop?

The average sale price in Manhattan jumped to $1.68 million in the third quarter of 2014, an 18 percent increase from the third quarter of 2013. Price appreciation in the luxury market during the same period was even steeper: The average sale price increased 34 percent to $7.25 million, according to data from real estate appraisal firm

Miller Samuel.

Whether price appreciation will continue at the same clip is a source of debate. “New development condo prices have risen 60 percent in the last two years,” said Diane Ramirez, president of Halstead Property, said at a recent real estate industry luncheon. “You can’t sustain those kind of price increases without leveling off.”

Whether price appreciation will continue at the same clip is a source of debate. “New development condo prices have risen 60 percent in the last two years,” said Diane Ramirez, president of Halstead Property, said at a recent real estate industry luncheon. “You can’t sustain those kind of price increases without leveling off.”

Still, Maitland said she expects prices in the luxury market to continue their upward trajectory, because “there’s a larger demographic of buyers who are looking in that range and spending in that range than ever before.” (The luxury market is generally defined as the top 10 percent of the market in terms of price.)

Kathy Braddock, managing director of brokerage William Raveis NYC, noted that buyers from Russia, China and Brazil are still looking to move their money out of those countries. Among those buyers, there’s a continued appetite for trophy apartments. “There’s an underlying reason why these trophy apartments will sell,” she said. Investors “are trying to diversify their assets because of the global picture.”

Interest rate increase

Interest rates are still at record lows, but it’s widely believed an increase is coming. And while Federal Reserve Chairwoman Janet Yellen hasn’t indicated when, economists point to sometime in mid-June.

That prediction means the next six months are likely to be busy. “People are doing deals now as opposed to six months from now, because there’s more certainty,” said Jay Neveloff, a partner at the law firm Kramer Levin Naftalis & Frankel. “No one has a crystal ball,” he said, but everyone realizes rates are at record lows.

That prediction means the next six months are likely to be busy. “People are doing deals now as opposed to six months from now, because there’s more certainty,” said Jay Neveloff, a partner at the law firm Kramer Levin Naftalis & Frankel. “No one has a crystal ball,” he said, but everyone realizes rates are at record lows.

De França said an interest rate change would mainly impact first-time buyers, rather than the luxury market. That’s because in New York City, many luxury sales are all-cash, or a significant amount of cash. Many of these sales involve foreign investors, who are expected to continue parking their money in New York real estate.

“The financial-crisis hangover is still with us,” said Miller Samuel’s Jonathan Miller. “Investors are wary of financial market investing. They’ve shifted to hard assets.”

#div-gpt-ad-1528731140084-0{display:none;}