Friday’s revelation that Airbnb is now worth over $25 billion was received with particular delight by a certain crop of commercial real estate tech startups.

Firms like PivotDesk, ShareDesk and LiquidSpace, which function as online marketplaces for short-term office rentals, see their residential counterpart as both a benchmark and a promise. These firms are trying to become the Airbnb of the office market, and with the firm’s new valuation, their ceiling seems to have risen substantially.

“I have no doubt that if we execute efficiently we can be as big as Airbnb is,” said David Mandell, CEO of PivotDesk. Avison Young’s CEO Mark Rose, who has invested in rival LiquidSpace, said: “We at Avison Young believe LiquidSpace could be as big as Open Table or Airbnb.” And Timothy Draper, a venture investor who is backing ShareDesk, replied “Yes!” when asked if the firm could emulate Airbnb’s success.

These entrepreneurs could be aiming even higher than Airbnb, given that the office market is far larger than temporary housing or hospitality. “We’re talking about the fifth-largest market in existence,” said Kia Rahmani, CEO and founder of ShareDesk. “And if you consider the fact at any given time the usage rate (for offices) is hovering between 45 and 50 percent, there’s a lot of value that’s locked up.”

A High Ceiling

Unlike shared office space provider WeWork , office rental marketplaces don’t lease and then sublet office space, but merely allow others to list it on their platforms. And while they benefit from the boom in coworking spaces like Regus or WeWork, which make up a chunk of their listings, they also offer landlords and companies the chance to rent out more traditional space on a short-term basis. Their ultimate goal is to eventually make all unused office and conference space available online at any time.

From left: Tod Francis and Timothy Draper

“Our ceiling is not the short-term rental market but a multiple of it,” said LiquidSpace founder Mark Gilbreath. “The appetite for flexibility, and for speed and ease of transaction go far beyond just the customers that have been transacting short-term office rentals.”

He pointed to Uber, which he said now serves three times as many customers in San Francisco as taxis traditionally have, as an example of a company that takes over a market and expands it. “You’ll see something very similar to Uber” in the office rental market, he added.

This is crunch time for players in the short-term office rental space, as many believe that the bulk of the spoils will eventually go to the alpha dog.

“I think history will tell you that consumers gravitate toward a single brand, so I think it will be dominated by a single player,” said Tod Francis, a managing director at Shasta Ventures, which invested in LiquidSpace. Generally, online marketplaces become more valuable the more users they have — people use Uber, Airbnb or Amazon because these sites offer the widest selection of cars, listings or goods. Economists call this the network effect, and its logic also applies to office marketplaces.

So which firm will muscle its way to the top? Here’s a look at the early contenders with a significant presence here in New York.

LiquidSpace

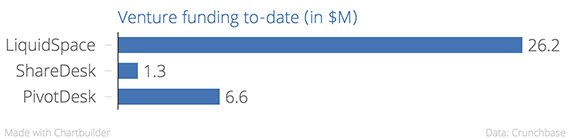

Founded in 2010 by veteran tech entrepreneur Mark Gilbreath, LiquidSpace is the most well-funded short-term office rental marketplace by far. In October, the Palo Alto-based firm raised $14 million in a Series C round, according to Crunchbase, bringing its total venture funding to $26.2 million. Its backers include Avison Young, ROTH Capital Partners and Linkedin co-founder Reid Hoffman.

LiquidSpace allows landlords and tenants to list space on an hourly, daily or monthly basis.Transactions happen online and LiquidSpace takes a 10 percent cut of monthly rents, with differing rates for daily and hourly leases. While coworking spaces feature prominently — WeWork is a partner — the firm also lists a range of more traditional offices and conference centers, with partners such as Marriott.

“There will be a point in time when LiquidSpace could compete against the traditional providers- including Avison Young,” said Avison Young’s Rose. “But we would rather be ahead of the curve and have ownership in what could be transformative change.”

Kia Rahmani

ShareDesk

This San Francisco-based startup’s business model is essentially the same as LiquidSpace’s. Founded in 2012 by Kia Rahmani and Javier Jimenez and backed by $1.3 million in seed capital, ShareDesk claims to have 3,000 current listings, compared to LiquidSpace’s 6,000. The firm charges a flat fee of 20 percent for all transactions completed on the site.

But ShareDesk has a much more global platform – with listings in 70 countries, compared to LiquidSpace’s four – and is trying to differentiate itself by focusing more on the landlords and leaseholders that list space.

“We are very focused on the experience, that’s part of the reason why Airbnb has been successful,” Rahmani said. The firm recently launched Optix, a platform that allows those listing space on the site to manage short-term leases and engage with tenants.

PivotDesk

While LiquidSpace and ShareDesk allow any user to book office space, Boulder-based PivotDesk acts more as a matchmaker bringing together small firms to share space and build a relationship.

[vision_pullquote style=”1″ align=””] “Do you want random people come into your office on a daily basis or do you want to find a company you can trust?” — PivotDesk CEO David Mandell [/vision_pullquote]A startup that has signed an office lease with future growth in mind could list excess space on PivotDesk. Other startups can then contact the company and arrange phone calls or visits. The idea is to pair firms with compatible mindsets and business models that will share space for at least a few months. All leases are monthly.

“The big difference is we approach our solution from the space holder’s perspective,” said PivotDesk’s founder David Mandell. “Do you want random people to come into your office on a daily basis or do you want to find a company you can trust?”

Because PivotDesk caters to long-term leaseholders, it has little use for the short-term coworking spaces and conference centers that make up much of ShareDesk’s and LiquidSpace’s business. Instead, it’s trying to work within the traditional office market and make it more effective. The firm has had success with investors, raising a total of $6.6 in three rounds since its 2012 launch.

“There’s no reason there should be any commercial office space transaction without someone like us involved,” Mandell said.

Room to grow

[vision_pullquote style=”1″ align=”right”] “The market is earlier in its development because consumers have just gotten used to short-term office space rentals, whereas in the home space it was already a habit that was formed.” — Shasta Ventures’ Tod Francis. [/vision_pullquote]While PivotDesk, ShareDesk and LiquidSpace currently have the largest presence in New York, there are a number of other startups in the mix. London-based Zipcube, for example, has a handful of office listings in the Big Apple, and other, similar startups are reportedly in the works around the globe. Meanwhile, the Tel Aviv-based startup Splacer, launched by architects Adi Biran and Lihi Gerstner, offers event spaces in Israel and New York on a short-term basis and just raised $1.4 million in seed funding. Breather, a firm that rents out private rooms, is often grouped in the same category and has raised $7.5 million. But it lists its own spaces, making it more similar to WeWork than to pure marketplaces like ShareDesk.

So far, short-term office rental sites are tiny compared to Airbnb, which has more than 1.4 million rooms listed, according to the Wall Street Journal – 230 times LiquidSpace’s total. Still, entrepreneurs argue that the sector is poised to grow dramatically. Because these startups don’t need to lease, renovate and build space, they can scale up far more quickly than coworking platforms like WeWork. At least in theory.

In practice, the sector still needs to overcome some cultural hurdles before it can reach its full potential, experts say. Unlike vacation rentals, short-term office rentals are still a strange proposition for many.

“The market is earlier in its development because consumers have just gotten used to short-term office space rentals, whereas in the home space it was already a habit that was formed,” said Shasta’s Tod Francis. And referring to similar startups that failed in the past, he added: “We never thought it would be easy.”